When I first started this blog, one of my most common questions I got from readers was “How do I get started in investing?“

Choices were limited back then. I would painstakingly explain the process of 1) Why passive investing is the best strategy for most people, 2) How to set up your own portfolio using ETFs, 3) How to dollar-cost average into them, etc. It got so complex that I created and sold an entire online course about it.

And then robo-advisors arrived in Singapore. While I was initially critical of them, they’ve improved tremendously over the years. Now, companies like Endowus, StashAway and Syfe can help anyone set up a portfolio, automate a monthly investment, and move on with their life within an evening. I no longer need to write about passive investing because robo-advisors have made it so easy to do. I love them so much that I invest the majority of my portfolio in them.

While I think that robo-advisors (they prefer the term “digital wealth managers”) have generally been a fantastic innovation for Singapore investors, I’ve been a little disappointed with how they’ve developed recently.

The Under-Appreciated Value of Robo-Advisors

To understand why, let’s first talk about why robo-advisors are valuable in the first place.

When robo-advisors first started in Singapore, they didn’t offer users a lot of choice. They offered you one portfolio with the same underlying funds. The only choice you had to make was to decide what percentage you would allocate to stocks vs. bonds. That’s it.

This was actually a GOOD thing. Minimizing choice prevented analysis paralysis among new investors, encouraging them to stop overthinking and start investing. Investors could get started quickly, get comfortable, and build that habit of investing consistently over time. And since they were offering legit, sensible investments like equity and bond funds (As opposed to those sketchy exchanges at the height of the crypto boom), it helped ease more people into investing.

There was also another more subtle benefit of robo-advisors: Some of them – like Endowus – are advocates of a passive investing approach. And as I’ve advocated many times, passive investing is the best investing strategy for 90% of people, including myself. There’s simply no other strategy that helps grow your returns over the long run, as long as you have the patience to stick with it.

By making it easy to invest, robo-advisors have effectively championed the passive investing cause in Singapore and helped huge swaths of people get started (let’s hope that most of them stuck through with it, despite the crazy volatility over the past year!).

The Dark Side of Choice

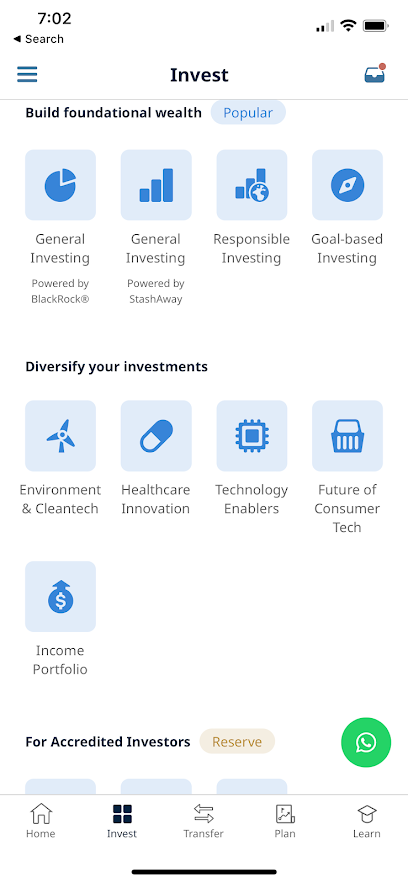

But now, things have changed. A quick glance at the Endowus fund page shows 190 funds for retail investors alone. You can pick funds in niche areas like mining, Shariah equities, or climate change. You can customize your own portfolios or pick from thematic ones. Stashaway is similar: They offer investments along the lines of Environment & Cleantech, Healthcare, or Responsible Investing.

I would hate to be a new investor onboarding onto Endowus or Stashaway today. I’d get so overwhelmed that I’d probably give up. Consumers may say that they want more choice, but it turns out that having more choices also tends to lower our overall happiness:

As the number of choices grows even further, we become less satisfied with the options we’re given, and the negatives escalate until we become overloaded.

From a business perspective, I get why robo-advisors have expanded their offerings. They earn razor-thin margins – as low as 0.3% in some cases – so they need scale in order to be profitable. Someone with a $100K portfolio, who might have paid $2K in annual fees to a financial advisor, would pay just $300 a year to Endowus. So robo-advisors can’t stick with just passive investors, they’re trying to appeal to all investors by increasing their offerings.

But as we outlined above, giving investors more choices could sometimes make them worse of. Beyond analysis paralysis, it also exposes newbie investors to the danger of dabbling in the whatever the latest hot fad is, like Gen AI or cleantech. Which as we know, almost never works out well for them.

Choice Architecture

Thankfully, not all is lost. In the book “Nudge“, Richard Thaler talks about how choice architecture can be used to influence users towards a particular outcome, without forcing them to do it. For example, Google famously nudges employees towards healthier habits by making it harder to access unhealthy snacks. In the microkitchen near my desk, fruits and nuts are placed prominently on the counter, while I need to stoop down to the lowest drawer to access the chips and chocolate.

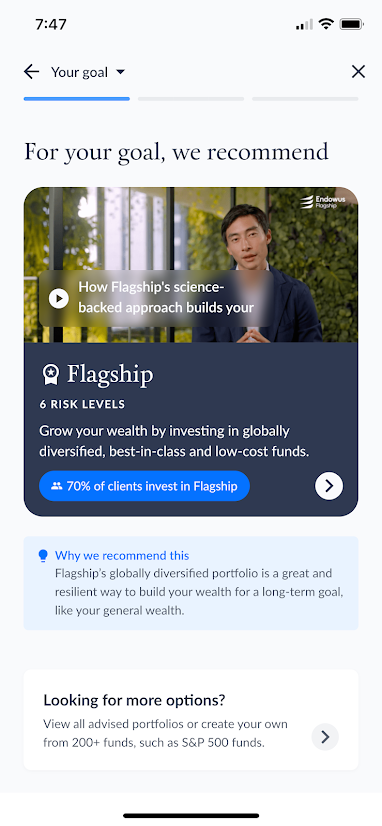

In the same way, I can see how Endowus nudges investors towards their “Flagship” Portfolio, comprising low-cost funds with a passive investing approach. Its placed prominently as the first option when you’re setting up your investment, and there’s a banner indicating that 70% of their clients investing in it, providing strong social proof.

(They didn’t sponsor this post, I’m just a really big fan)

I get it: robo-advisors need to run a business too. But I hope that more of them take this approach and nudge users towards what’s actually the best for them, from both an investing strategy and a behavioural science perspective.

Because if investors win, they win too.

Hi Lionel, Completely agree! And they are cost effective under certain channel. E.g cpf and SRS.

My perspective is that if I am in the cost efficient camp, I would definitely know what I am looking for and to slide track is to play with performance.