This is a sponsored post done in collaboration with DBS. I very rarely accept sponsored posts, and only do so when I already use or like the product. All opinions are my own.

You get the best insights over whiskey and KFC.

I had some time to kill yesterday, so I hung out with Alvin and Jon from Dr Wealth at their office, kicking back over some excellent Hibiki whiskey and a KFC Dip ’N Share Bucket. Nothing gets the brain going faster than single-malt whiskey and greasy food.

About 3 hours in, a slightly inebriated Jon started drawing a Venn diagram on our KFC box, while explaining a concept he heard on a TED talk:

“You see Lionel, organizations generally use 3 approaches to solve problems: By using economics, technology, or psychology.”

The very inebriated me was mindlessly doodling and not listening to him, but he continued anyway.

“Almost every organization solves problems by using economics and/or technology. Governments use incentives (economics), and Uber uses an app (technology) to solve some of the world’s biggest problems. But almost no one uses psychology to solve issues. The opportunity there is HUGE.”

I contemplated Jon’s point while chewing a greasy nugget. He was right. There aren’t that many examples of companies using psychology to solve problems, but if done right, it can be a very effective, low-cost way of getting the job done.

For example, research from Yale suggests that simply publishing the average electricity consumption can help “nudge” people to reduce their electricity usage. The mere comparison with your neighbours makes you VOLUNTARILY reduce your consumption. This approach doesn’t cost the utility company a lot of money, but it’s massively effective in reducing electricity consumption. In fact, our very own SP Services and PUB have redesigned their bill since 2016 to take advantage of this psychological behaviour.

Can we also apply that approach to personal finance? I’ve long argued that improving your personal finances is primarily a psychological problem, not an economic or technological one. We have all the right incentives and the tech we need, yet most people I know can’t bring themselves to “figure out this finance thing.”

Why is that the case? And what tools can we use to solve this problem?

The Psychology of Your Financial GPS

Enter DBS NAV and Your Financial GPS, a “digital financial advisor at your fingertips that works with you to reach your desired goals.”

I know, I know, it sounds like yet another fintech product to take advantage of unsuspecting millennials. I know you might be skeptical (I was too), but hear me out for a second.

Most tech solutions to personal finance are pretty crappy. They’re either over-automated (i.e. the app lets you set a budget, but doesn’t take into account how variable your expenses are), or waaayyyyy too complicated (i.e. you need to fill in 23 different fields just to calculate your assets). But I agreed to do this sponsored post because I saw some promising features in the DBS platform.

Take the concept of a health checkup. When you go for your annual checkup, your doctor measures various metrics like your blood pressure, your BMI, your cholesterol, etc, and compares them against established benchmarks. The checkup itself doesn’t do anything, but it sheds light on areas that might be worth paying a little more attention to.

When it comes to money, the trick to getting these “checkups” just right is that it has to balance between 1) being flexible enough to meet your unique situation, 2) being simple that it doesn’t take 20 hours to complete.

Your Financial GPS does a great job of doing both. That’s not to say that the product is perfect – there are shortcomings – but it’s a step in the right direction. The “digital financial advisor” encompasses several elements, but I’ll just focus on one aspect – the “SAIL” concept – and my thoughts on how well it can drive behaviour change.

Wait – What The Heck Is SAIL?

SAIL stands for Savings, Assurance, Investments, and Life Goals, which is 1) A corny-but-memorable mnemonic, and 2) the four “coordinates” of your financial journey.

Despite the corny name, I like the approach. Most people get intimidated by the topic of “MONEY MANAGEMENT” because it seems like a seething, complicated, and boring topic. Breaking it down into four “Big Wins” helps you focus on one task at a time.

Today, I’ll talk about each aspect of SAIL, how they’re displayed as features within Your Financial GPS, and what I like/don’t like about them.

A couple of caveats:

- I don’t actively use DBS (I self-manage my money and investments on different platforms) so my insights may not be 100% accurate

- Like any tech product, nothing is static. The current version is likely an MVP and will probably see improvements over time

- This is a sponsored post so it’s not 100% unbiased, but I’ve tried to be as objective as possible

Ooookay, now that we’ve got that out of the way, let’s delve into the nitty-gritty:

S – Savings

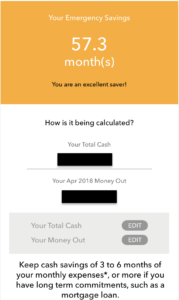

The ’S’ in SAIL refers to “Savings’, or more specifically, your emergency fund.

Most people already understand why they need an emergency fund and how to calculate it (3-6 months of your expenses). But Your Financial GPS excels here for two reasons:

- It compares your savings against your actual spending data; and

- It accounts for non-DBS savings and expenses

First, it takes the ACTUAL amount you spent (from your credit card and ATM transactions), and compares it against the amount of savings you have. That gives you an indication of how large your emergency fund is, from a “monthly expenses” perspective.

I like their concept of taking actual spending data and using it to compute how much emergency funds you need. We often fool ourselves thinking that we only spend like $583.70 per month, when the reality is often much higher. So taking your actual credit card data is a great idea, although it may be uncomfortable for some people.

But the really smart feature here is that Your Financial GPS lets you incorporate non-DBS savings and expenses. For example, if you have a credit card with say, Citibank, you can manually input those figures into the platform so that you have a holistic sense of your total expenses across DBS and Citibank. This is unlike a closed ecosystem that only accounts for the expenditure for that bank’s credit card.

My only beef with this feature is that it only takes the previous month’s expenses into account, rather than an average of say, the past 6-12 months. Most people’s expenses vary from month to month (i.e. I might spend $500 on average, but I might incur $2,000 this month for a holiday), so it’s much better to take an average figure over time.

A – Assurance

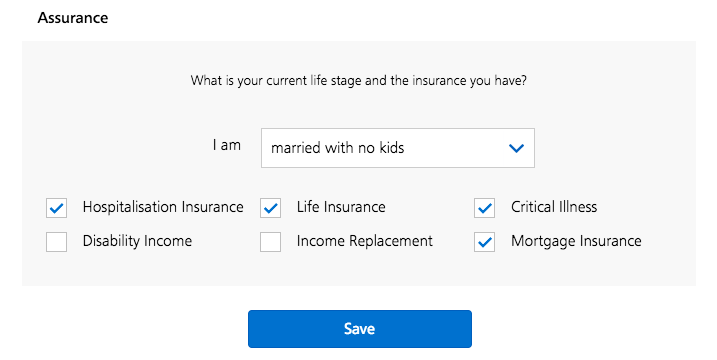

‘A’ stands for Assurance, aka a less threatening way of saying that dirty word “insurance”.

This feature is pretty simple – it asks you to select your life stage (Single, Married with no kids, Married with kids, etc), and then recommends the TYPE of insurance coverage you need for your life stage. You can check the insurance plans you already have, and the remaining ones are presented to you as options to consider.

This is consistent with DIYInsurance’s philosophy of Life Stage Planning – namely, only get the insurance you need for your life stage. (Aka, The “Don’t Be Kiasee” Strategy) For example, if you’re a student with no dependents, your highest priority is to get a hospitalisation plan, not a pricy life insurance plan.

Here, Your Financial GPS aims to surface the various insurance types you can consider for your life stage, without you having to talk to an insurance agent financial advisor (which, to some people, is scarier than fighting Thanos).

Of course, DBS is hoping that discovering these gaps will lead you to purchase more insurance plans from them, but they do a good job of not being too sales-y on the cross-sell.

For future iterations, I’d really like to see a feature to calculate the amount of insurance coverage you need for each type. For example, I might discover that I need Critical Illness cover, but how much exactly? $100,000? $50,000? Having a simple questionnaire (like DIYInsurance’s excellent Selfcheck tool) could help make this feature a little more robust.

I – Investments

Most investment dashboards present some sort of pie chart detailing your asset allocation (i.e. What percentage of your money is invested in stocks vs REITs vs bonds, etc). Your Financial GPS, however, takes a slightly different approach. Rather than delving into the details of WHAT to invest in, it keeps it high-level by asking HOW MUCH you have invested so far.

This is a much better starting point for beginners. Most beginners aren’t asking, “Hey, what’s the mean-variance efficient allocation of stocks vs bonds?”. Instead, they’re asking, “I just started work. How much of my money should I be investing vs saving?”

To answer that question, Your Financial GPS calculates a metric called the “invested assets to net worth” ratio. In other words, dividing how much you’ve invested by the difference between your assets and your liabilities.

What this figure basically means is: What percentage of your net worth is working hard for you through your investments, vs sitting idly in your savings account?

According to the Financial Planning Association of Singapore, the recommended level is 50%. That means that if your total net worth is $300,000, at least $150,000 of that should be invested. Personally, I think that percentage should be a lot higher, especially if you’re young. But 50% is a good figure to start with, given how under-invested most millennials are.

This figure gives you a kick in the pants that politely says, “STOP BEING SUCH A WUSS AND INVEST ALREADY, DUMBASS.”

It’s an interesting metric, but personally I don’t find it super inspiring. I would have preferred something like a Financial Independence Calculator, like this one. In other words, something that calculates how close you are to financial independence, and how much faster you can get there by investing just 5% more every month.

Here, DBS is probably trying to encourage their users to invest in their Unit Trust, Regular Savings Plan, Equities and Singapore Govt Securities products. Again, the cross-sell is more informational rather than salesy, which is good.

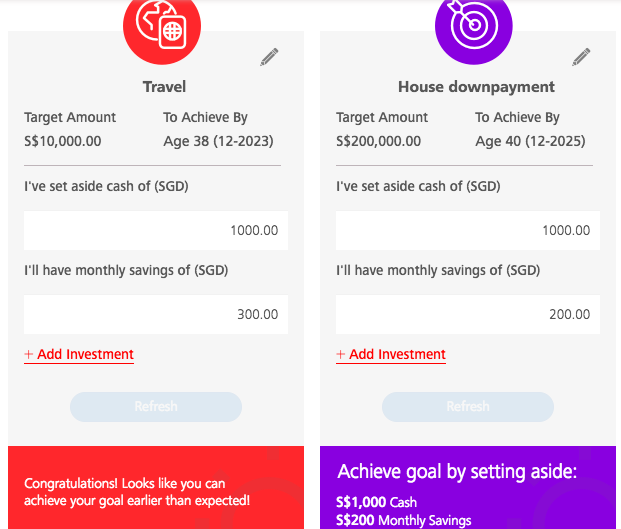

L – Life Goals

Of all the features, I felt this one could do with a little more integration.

I assumed that Life Goals would be like a sub-savings account to help you segregate your money into different “buckets”, similar to OCBC’s MoneyIn$ights or Maybank’s iSAVvy sub-accounts. To me, sub-savings accounts are one of the most useful tools for saving automatically, so I was excited to see something similar for DBS.

However, from playing around with the tool, I gather that Life Goals is basically a savings calculator which helps you 1) Set savings milestones, and 2) Calculate how much you need to save every month to achieve them. There doesn’t appear to be any functionality to actually segregate your savings from your spending money, and track your progress against those goals. (though to be fair, I understand from DBS is looking into this currently)

Still, setting those goals is a useful exercise, since most people dont even think about their future savings needs until some sort of trigger happens. For example, most couples don’t start saving for a wedding until they get engaged. Assuming their wedding is 12 months away, they’ll need to set aside $2,500 a month for a $30,000 wedding, which is pretty hefty for most young couples.

So the Life Goals features does a good job in encouraging users to at least think about these upcoming big expenses and put a number to them earlier. That way, folks can start saving for milestones earlier and reduce unpleasant surprises later in the game.

Your Financial GPS – Yay Or Nay?

Overall, I like the premise Your Financial GPS. In developing the product, DBS got a couple of things right:

Taking a behavioural approach: Rather than rolling out some complex AI-based solution which no one will use, Your Financial GPS simply highlights where you stand against some basic financial metrics. Psychologically, this helps to 1) spur action by highlighting areas of improvement, 2) focus your thinking on the next step – just like a health checkup.

Making it user-friendly: I’m glad they didn’t adopt the notion of “hey let’s use our money to build the world’s best financial planning platform”. Instead, they stuck to a very simple, non-intimidating framework which you can set up in a couple of minutes

Making it flexible: Even if most of your investments/expenses/savings are outside the DBS ecosystem (like me), you can still manually input them into the platform, crunch the numbers, and get some insights. Realistically, I don’t know if they’ll get many non-DBS users to use it regularly, but it’s a valiant effort to make the product robust and flexible

The product isn’t perfect, and specifically I’d love to see more integration especially around the Life Goals feature. Even better if they can import transactions and credit cards from other banks, which would then make them REALLY robust.

Still, Your Financial GPS is probably one of the better “financial healthcheck” platforms I’ve seen, staying very simple and high-level without getting bogged down with the minutia. It’s great for beginners who are feeling intimidated and want to figure out how to take the next step.

Now, if the DBS folks want to brainstorm on how to use psychology to help people get better at personal finance, just remember this timeless piece of advice:

Nothing gets the brain going faster than single-malt whiskey and greasy food.

PS: Like I said, I rarely accept sponsored posts unless I like whatever I’m writing about. Your Financial GPS is just one of the many resources in NAV – a collection of useful resources to help you in financial planning. I think it’s a great, free resource that is genuinely helpful and isn’t overly sales-y. Check out NAV here.

Rarely do people use psychology to solve a problem? Ask Trump and Kim Jong Un. These two are experts in using psychology to solve problems. Same as property agents in Spore. They use psychology all the time.