Sometimes, I wish I were a 4th-century king in medieval England.

Sometimes, I wish I were a 4th-century king in medieval England.

I would spend all day sitting on my throne, deep in thought, slowly sharpening my broadsword and staring out into the abyss. My subjects, fearful of breaking my concentration, would whisper amongst themselves. “Perhaps His Majesty is coming up with a way to reduce taxes? Maybe he’s planning an invasion of France?”

And then I would suddenly stand up, skewer an unsuspecting roast pig, and roar, “YES! IT TOTALLY MAKES SENSE TO PREPAY YOUR HOME LOAN!!!!”

Then I would sit back, smile, and tuck into my meal. Peace would return to the kingdom. No longer will my people be subject to the yoke of interest rate slavery ever again.

(Sorry – it’s been a long week and I had to let off some steam)

The Conventional Advice And Why I Think It’s Misguided

Maybe you’re like me: You met your soulmate, got married, settled down, and before you knew it, found yourself servicing a (ugh) home loan. Getting a home loan is like a fast track into adulting – you realise that you actually have to be responsible for stuff. Who would’ve known?

Most people simply pay their home loan over the standard 20-30 years and don’t think much about it. But weirdos like me often spend our Sunday afternoons pondering deep philosophical questions like, “Does it make sense to prepay your home loan?” (I actually DID spend a Sunday afternoon pondering over this question – I really need to get a life).

Prepaying simply means that instead of faithfully making your mortgage payments every month, you pay some of it upfront. So if you owe the bank $300,000, you could pay say, $10,000 right now and reduce your liabilities to $290,000.

Conventional advice says this is stupid. I Googled “Should you prepay your mortgage”, read the first 5 articles, and they all basically said: Instead of reducing your home loan which has a measly interest rate, you could take that $10,000 and invest it at a higher return. Then you’ll become rich and spend your days swimming in a jacuzzi and playing with beautiful (airplane) models”

However, I have a different view. Today, I wanted to share why it might make sense to make partial repayments of your home loan, if you fulfil 2 conditions:

- You service all or most of your home loan using CPF

- You have some spare cash every month to invest

Let’s math this shizz out!

Prepaying Your Home Loan Is Like An Investment

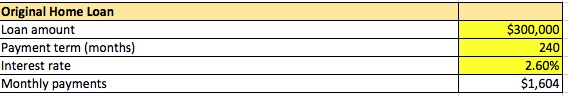

Let’s say that you took out a 20-year home loan of $300,000 at a 2.6% interest rate*. Using a mortgage calculator like this one, you calculate that you’ll need to pay $1,604 every month for the next 20 years. Like most Singaporeans, you decide to service your mortgage from your CPF account.

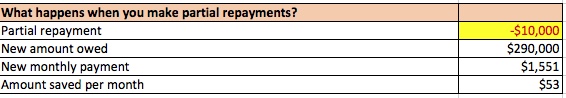

Now, let’s say that your boss was feeling especially generous this Chinese New Year, and decided to give you a $10,000 cash bonus. HUAT AHHHHHHH! Now let’s say that you used that $10,000 to make a partial repayment of your home loan, reducing your liability from $300,000 to $290,000.

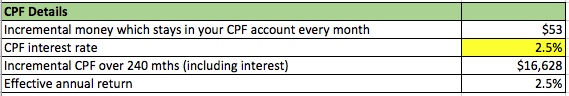

Assuming you keep the same payment term of 20 years, your monthly payment has now been cut down from $1604 to $1,551, saving you $53 per month which you get to keep your CPF account (use the mortgage calculator again to get these figures). That means that you now have an additional $53 per month that will keep on earning that delicious 2.5% annual interest rate from CPF.

Over 20 years, you’ll end up with $16,628 more in your CPF account, compared to if you didn’t pre-pay your home loan.

Money saved is the same as money earned. Imagine 2 twin brothers who park their car illegally to buy some tauhuay:

- Tim strolls back to his car, only to discover that the saman aunty has fined him $400

- Tom gets back to his car in time, driving off as the saman aunty stares murderously at his departing car

Tom is now $400 ahead of Tim, simply because Tom avoided paying the fine. In the same way, saving $16,628 was the same as earning $16,628 on your $10,000 “investment”. Working backwards, that’s a return of 2.5% per year. Not bad, and definitely better than your savings account.

But as they say in those strangely addictive infomercials: But wait! There’s more!

Use Your Home Loan To Diversify Your Portfolio

At this point, some smart aleck will say, “This is stupid. If I had spare cash, I will invest it at 7% and become a gazillionaire while you losers are busy paying off your home loan.”

Okay, wise guy. Let’s examine this.

If you had say, $2,000 in spare cash every month, you could plonk it all down in stocks. But only overconfident amateurs do that. Smart investors understand the importance of diversification. Why? Because investing ALL your money in stocks is risky. You can’t predict the future, so it’s always a good idea to split your investible funds into a mix of high risk/high return and low risk/low return assets.

For example, you could split out your $2,000 in cash into:

- $1,200 in stocks yielding 7%

- $800 in bonds yielding 2%

Not bad, but can you improve this even further? Of course. The more asset types you have, the more diversified you are. Remember what we’ve learnt so far: 1) Prepaying your mortgage is like an investment, and 2) it earns you a guaranteed return of 2.5%*.

So here’s one possible way of diversifying your cash even further:

- $1,200 in stocks yielding 7%

- $400 to prepay your home loan “yielding” 2.5%

- $400 in bonds yielding 2%

Boom! You’ve now diversified the conservative part of your portfolio into two parts: Bonds yielding 2% and your home loan payment yielding 2.5%. In this case, the difference isn’t that large, but I could see some savvy investors employing this as an investing tactic when interest rates are low.

Now, you’ve improved your overall returns, and have the added psychological advantage of reducing your debt, which makes you less fragile. Nassim Taleb would approve.

Optional: The Accrued Interest Benefit

There IS one less obvious benefit of prepaying your home loan. This will only apply if you sell your house before you turn 55, so if your brain hurts from all those numbers, feel free to skip ahead to the next section.

Still here? Okay, the subtle benefit of prepaying your mortgage is that you can convert some of your accrued interest into cash. Let me explain.

CPF has an accrued interest rule where 1) If you use CPF to pay for your house, and 2) you sell your house before you turn 55, you have to “refund” your own CPF account with what you would have earned if you left that money in CPF. This is easier to explain in numbers, so let’s go back to our original example.

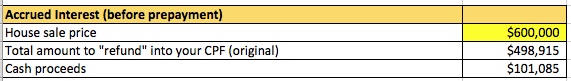

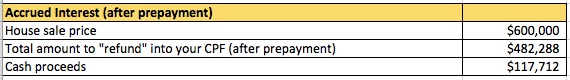

In our original example, you took out $1,604 per month from your CPF to service your home loan. Had you kept this money in your CPF account, it would have compounded into $498,915 over 20 years. Now, suppose that you sold your house for say, $600,000 after 20 years. You now have to “pay back” that $498,915 into your CPF account, so you only get to keep $101,085 in cash.

This isn’t as bad as it sounds, since you’re paying it back into your own CPF account. However it DOES mean that you will have less cash proceeds from the sale of your house.

HOWEVER, if you prepaid your mortgage using your $10K bonus, you now only have to withdraw $1,551 from your CPF each month to pay for your home loan. Compounded over 20 years, that leads to $482,288 that you “owe” your CPF account. If you sell your house for $600,000, that means that you get to keep $117,712 – a difference of $16,628 – in cash.

In short, you sacrifice $10K in the short term for $16K in cash in the long term. Whether this is a suitable trade-off or not differs from person to person, but it’s a benefit to keep in mind.

Don’t Get Lost In The Numbers

Okay, this post became a lot more number-y than I intended. My bad! If you’re lost, don’t worry too much about the numbers. Here’s the key message:

Pre-paying your home loan might make sense because:

- It’s like making an investment

- It helps diversify your investible funds

- It frees up part of your accrued interest if you sell your house

And let’s not forget the main benefit of prepaying your loan: It just feels good to reduce your debt. It might make quantitative sense to simply invest the additional cash, but personal finance isn’t just about the numbers. It’s also about how you feel. And personally, I prefer to balance my cash between 1) Investing for the future and 2) paying down my debt.

My wife and I set aside some money each month and use it to prepay our mortgage once a year. By doing so, we’re hoping to clear our debt in less than half the time of our original mortgage. That puts us on a path towards early financial freedom, plus it’s just a super shiok feeling to see your debt shrink faster and faster each year.

If you’re on a HDB loan, it’s pretty easy to make partial repayments: Log into MyHDBPage, go to My Flat > Purchased Flat > Financial Info > Other Related Services. From there, you can make a payment via Nets, and boom – it takes away a chunk of your home loan.

Here’s A Joke Because I Feel Like It

Okay, because you’ve been so good at following this post all the way through, here’s a random joke I heard from the play Mama White Snake, which still gives me the chuckles sometimes:

A guy gets on a boat to cross the river. The boatman asks, “Do you have cash?”

The guy, checking his wallet, says, “Yep.”

The boatman, “Okay good. The other day some fisherman got into my boat and tried to pay me by giving me his net.

I had to tell him, ‘Cash only. No Nets.”

(Like I said – It’s been a long week)

—–

*PS: Of course, not everyone has a 2.6% interest rate on their home loan. Some of you might be on a lower interest rate of say, 1.8%. In that scenario, your effective “investment returns” might be lower. However, it might still make sense to do cash prepayments if you normally use CPF to service your loan, since you’re essentially sacrificing a 2.5% CPF interest rate to service a loan with a lower interest rate.

PPS: You can also download my Prepayment calculator in Excel to see how I came up with these calculations. Also, I just learnt how to use the FV, PV, and RATE functions in Excel so I just wanted to share my little piece of geeky joy.

Thanks for crunching the numbers! Apart from sense, pre-paying your home, in this case plowing your spare cash into the loan, can also free up your attachment towards it (especially when your children are young) and it becomes one less thing to think about. The caveat for this is if you are in Singapore’s system, if you believe in diversification and if you don’t have an alternative that so-called guarantees a 2.5% per year. Insightful post, thank you.

But is there a “penalty fee” when when one pre-pays mortgage loans from banks?

Does it make sense to prepay the home loan using extra $ in CPF OA account vs transferring the extra $ to Special Account to earn the 4% interest? Hmmm… What is your opinion?

I read this from “The Automatic Millionaire”. To reduce the no. of years of loan repayment – by repaying half of the monthly loan once every two weeks. Say the monthly instalment is $1500, so you pay $750 every two weeks. In a year, you are repaying a total of 13 months’ of loan instead of 12 months. By using this repayment method for a 30-year loan, it will cut down to 25 years.

Thanks Lionel, finally good to know someone who agrees with my opinion.

But I have a few differences

1) About using CPF for paying home loan –

There is no doubt that CPF OA provides a good facility especially for downpayment.

But I really think this is a bad idea for a variety of reasons.

When CPF monies are used for any house, then they need to be paid back with Interest, which is an expensive proposition.

If the house is sold then CPF monies need to be returned with interest back.

If the house is never sold, then upon death, beneficiaries will get after subtracting CPF Interest.

So better not use CPF monies at all

But if really CPF monies are used then, better to do downpayment of that first, else the CPF interest will accrue over the years.

And in case, 2.5% rate of CPF is seen as measly then people always have the option to invest that in ETFs or bonds, of course with known risks. Other option for the risk averse is to transfer to SA.

2) Next about extent of prepaying itself –

Before coming to that, first it is better that the owner have insurance to cover the value of house in case he were loose his/her life during the loan period. So that will free his/her dependents.

Once that is in place, then it is better to have an investment amount that covers the value of the house, a rough yardstick is that if X amount is obtained in a year then invest X/2 and use X/2 to do prepayment of the loan.

I think done that way, is best of all the worlds – it is risk free, achieving investment value and finally prepaying the house before time.

Interesting article. For the portion on accrued interest I think its important when deriving the $16,628, we take into account the $10K if not used to redeem his loan. Assuming he just kept the $10K, then the difference would only be $6628. He would need a return higher than 2.55% to justify not redeeming the loan.