Oh, UOB. You are such a hard-to-understand entity. (That’s about the extent of my rhyming prowess. I’m a blogger, not a poet).

Oh, UOB. You are such a hard-to-understand entity. (That’s about the extent of my rhyming prowess. I’m a blogger, not a poet).

On one hand, you provide such fantastic credit cards to earn miles, like your UOB PRVI Miles World Mastercard, and the UOB Preferred Platinum Visa card. On the other hand, you resort to such sneaky little tactics to try and pull one over on your cardmembers.

Case in point: Here is a screenshot of my credit card statement on my UOB Mighty app:

Nothing much to see here, just a couple of transactions and a GIRO payment.

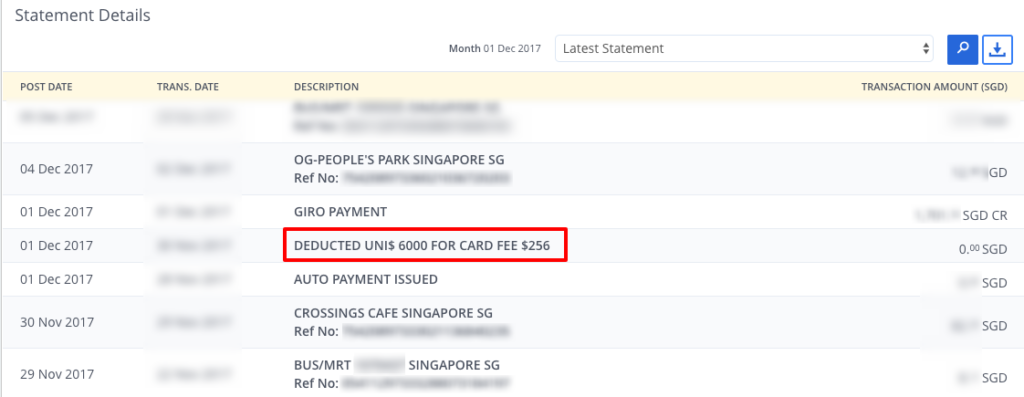

But wait! Clicking over to the desktop version of my credit card statement, I spy an entry that wasn’t reflected on my mobile app:

Ah hah! It’s the dreaded credit card annual fee in the form of 6,000 UNI$, which UOB had quietly deducted from my account without reflecting it on my mobile app.

6,000 UNI$ isn’t a trivial amount – that’s the equivalent of 12,000 miles if I convert it to KrisFlyer miles.

To give you some context, a one-way Economy Class SQ ticket to Hong Kong costs 15,000 miles, while a Business Class ticket costs 27,500 miles (see here). The difference between Business Class and Economy Class is 12,500 miles, just a touch over the amount UOB sneakily deducted for my annual fee.

Not cool, UOB, not cool.

Why did UOB do this? It’s likely because:

- It reduces their UNI$ liabilities in a way that doesn’t cost them anything. If I had redeemed those same UNI$ for a flight, that would’ve been way more expensive for them

- Since the annual fee is charged in points instead of cash, it’s less likely to raise alarm bells among cardholders, who would have otherwise called in to request a fee waiver. To cover up their tracks even further, they found a way to make non-cash transactions not show up on their app

Reversing the annual charge was easy – all it took was a quick phone call, and the automated system reversed the charge and reinstated my UNI$.

BUT if you’re a UOB cardholder, I wanted to let you know about this sneaky little tactic in case you weren’t already aware. To guard yourself against it, I’d recommend doing the following:

- Set up an automated calendar reminder to check for annual fees on your statement. These are usually charged on the month following your card anniversary date

- Log into your UOB online account on desktop to view your statement and look for the annual fee

- Request for a fee waiver by calling their hotline – as long as you’ve spent a decent amount on the card, this should be done automatically and immediately

Ugh, annual fees: The most useless charges in the world. They waste everyone’s time, annoy the heck outta you, and are just a way for banks to make money from people who’re too busy/lazy to check their statements.

Make sure you’re not one of ’em!

Citibank is worse. The staff verbally promise to make the waiver request, and didn’t do it. when I realised it and call in, their call agents say it’s past the deadline to do the waiver. Yet for my 2 credit cards, they waive off the one which I did not even activate to use. They said I had to pay the annual fee before requesting to cancel! On pressing the by going down to the branch, they give another hotline to call again. This time it’s forcing me to pay $192 annual fee and they give you $100 back in rebate requirng you to spend further.

I was so angry when they did that! it was totally under the radar- if not for the fact that i check my uni$ statement every month i would so totally have missed that!

UOB, you are such a bad boy. Be good n dun do it again, understand?

My experience is even worse. UoB continued to charge me annual dees even after I have cancelled my card. The outstanding amount was tjen passed to credit management to initiate collection process. And this was not all. Suddenly my sms and whatsapp were flooded with loan advert. I am thinking of sueing UoB for harassment and breach of personal privacy acts.

I had the same issue…what happen to the data protection act ?mine involves other banks including UOB dont know who is the culprit????

The Mighty overall user experience is really sloppy and buggy, they need to up their game. The home page design looks like kindergarden doodle.