Okay, quick poll: How many of you hate being called a “millennial”?

Okay, quick poll: How many of you hate being called a “millennial”?

I know I do. A little part of me dies every time I see a millennial commercial showing beautiful young people laughing, taking selfies and drinking hipster coffee.

You see, I don’t think I fit into the typical millennial stereotypes. I hate WhatsApping, I prefer reading books over checking my Facebook feed, and I run away from stores that sell anything with the word “artisanal” in it. I recently read an article titled “Don’t Call Me A Millennial” and I was like, “YES! FINALLY someone understands me!”

Some of you might know what I’m talking about. Maybe you’ve been working for a few years, maybe you’re married, and maybe you’ve taken on some responsibilities like paying for a house and supporting your retired parents.

If you’re in your late 20s or 30s, you might still be officially considered a millennial. However, like me, maybe you’re starting to realise that you don’t fit into the usual millennial stereotypes.

What Do Millennials and CPF Have In Common?

You know what else has a stereotype? The Singapore CPF System.

For many of us, our CPF savings are like K-drama celebrities: Something you can see but never touch, and pretty much impossible to understand.

We all know the usual CPF stereotypes: That the gahmen takes away 20% of our salary, they lock it up till we’re 55, and make it as complicated as possible for us to withdraw.

But if we just took 30 minutes to read about it, we might realise that 1) It’s a lot more flexible than we give it credit for, and 2) it could actually be beneficial for us.

Now, I get that no one wakes up in the morning and goes, “YES! I REALLY NEED TO UNDERSTAND THE CPF SYSTEM TODAY!” Which is why I decided to write this post to introduce a few ways on how unconventional millennials like us can use the CPF system to our advantage.

Yes, this is a sponsored post by the CPF Board. But if you’ve been reading my blog, you’ll know that I rarely accept sponsored posts. And when I do, it’s because I already believe in what I’m writing about. There ARE ways for us to make the most out of our CPF – we just have to take the time to understand it.

As unconventional millennials, we already do certain things that break the usual millennial stereotypes. How can we apply that same mindset to win at CPF?

Grab a piece of avocado toast, cause we’re about to begin:

We Go Above & Beyond The Minimum

Stereotype: Millennials are entitled. We want a trophy just for showing up to work. #thestruggleisreal

Reality: The truth is, many of us are proud of what we do. We’re willing to work hard and go beyond what’s expected of us. If our boss asks us to “explore how we can improve productivity”, we over-deliver by providing a detailed analysis of 3 options, and a proposed 30, 60, 90-day implementation plan.

How to apply this to your CPF savings:

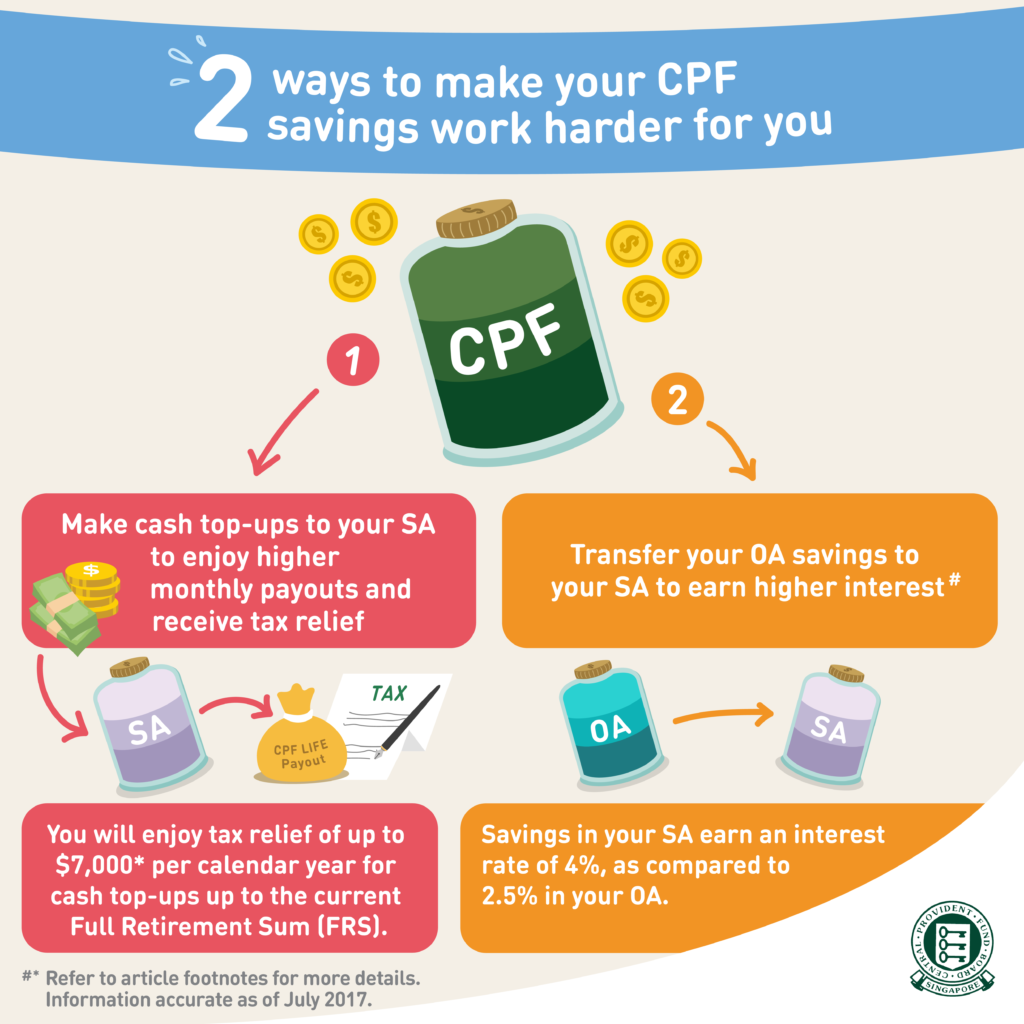

Most people are pretty passive about what they do with their CPF savings. They let it sit in their Ordinary Account (OA), which earns a return of 2.5%. But as unconventional millennials, we want more than the bare minimum. One option to consider: Put more savings into your CPF Special Account (SA) to earn a higher interest.

You can do this in 2 ways:

- Doing a cash top-up to your SA, which has the added benefit of reducing your tax*

- Transferring your OA savings to your SA (applicable if you’re below 55 – which you totally are, because you’re a millennial, right?)

Quick caveat: Transferring money and/or making cash top-ups to your SA is a commitment. The transfer and/or top up is irreversible, so only commit your money if you’re sure you won’t be using it for other things like housing. Your SA is meant for retirement, which is why you get a higher interest rate for keeping it there for the long-term. If you think about it, money is kind of like marriage: The more you commit, the more you’ll get out of it.

We Play The Long Game

Stereotype: Millennials want instant gratification. We want to travel the world, become CEO, and get perfect abs NOW. #showmethemoney

Reality: We know that real results take time, and we don’t believe in get-rich-quick schemes. In fact, some of us have even started setting aside money for investments so we can attain financial freedom.

How to apply this to your CPF savings:

Building serious wealth is about committing for the long-term. And no, this doesn’t mean putting your money in a “hot stock” and praying that it goes up over 5 years. For me, long-term investing means investing in a solid portfolio, leaving it alone, and letting it grow for 20, 30, 40 years.

As John Bogle, the founder of investment giant Vanguard, used to say, “Don’t do something, just stand there!”

Now, your CPF account isn’t just a savings account with a good interest rate. You can also invest your CPF OA savings (above the first $20,000) or SA savings (above the first $40,000) through the CPF Investment Scheme (CPFIS) to get potentially higher returns.

But here’s where the structure of CPF works beautifully in our favour: CPF, by definition, is a long-term thing. It’s meant for retirement! So any proceeds earned from our CPFIS investments will go back to our CPF account to beef up our retirement savings.

Personally, I choose to invest my CPF savings in a passive investment like the Straits Times Index ETF, but there’s also a whole bunch of other investments to choose from.

I’m not sure whether the sentence can be mis-interpreted as CPF “forcing” members to stay invested in their investment product until retirement. This is not true as CPFIS does not set any restriction on when the member can sell his investment.

We’re More Generous Than People Think

Stereotype: Millennials are ungrateful and leech off our parents. Time magazine called us the “Me Me Me Generation” since we only care about ourselves.

Reality: Many of us are exceptionally grateful to our parents. We support them financially, help them out with errands, and make it a point to spend quality time with them.

How to apply this to your CPF savings:

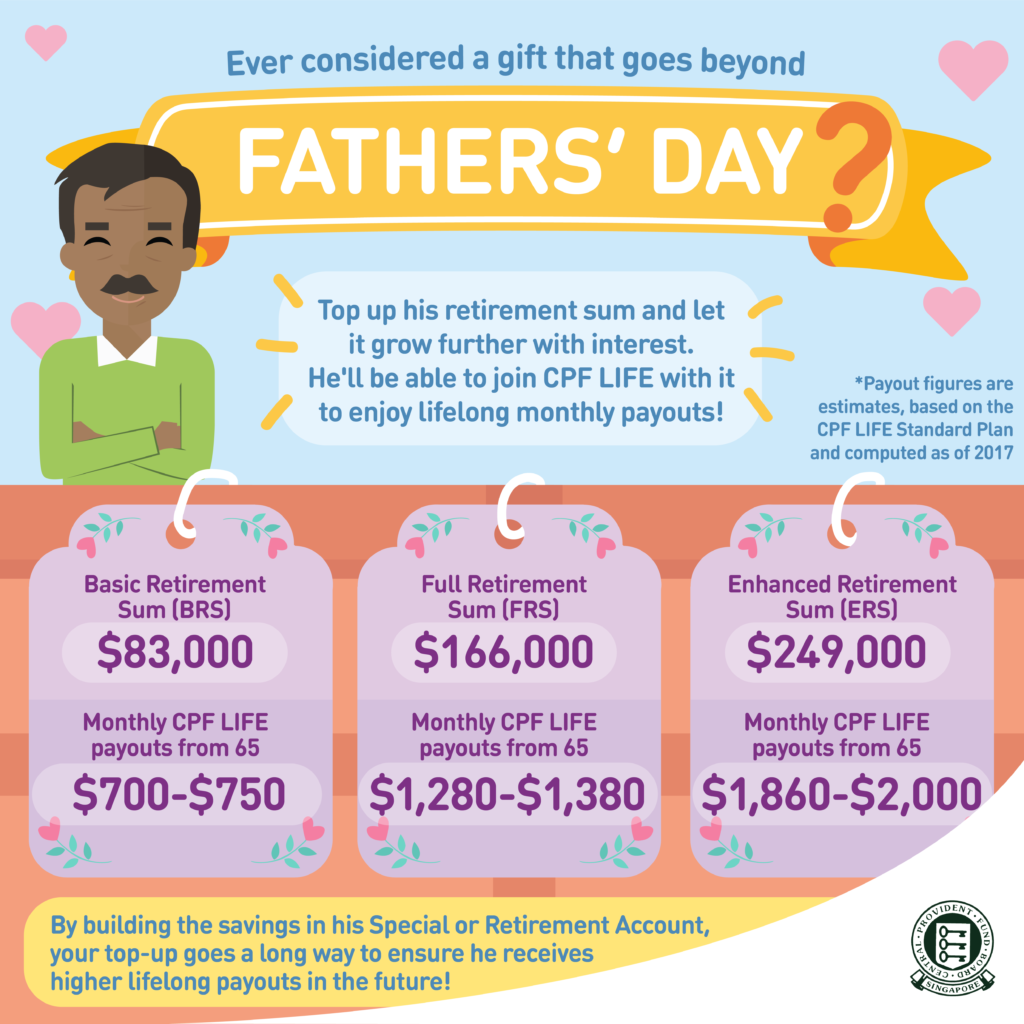

Although money isn’t everything, many of us intuitively understand the importance of providing for our parents financially. But beyond just giving them a cash allowance, you can also top up their CPF accounts via cash or your own CPF savings.

If you have excess cash or CPF savings while your parents’ CPF balance is on the low side, it makes sense to top up their CPF accounts. Why? Because you’ll be helping them grow their retirement savings by taking advantage of CPF’s extra and additional interest:

- An extra 1% interest is paid on the first $60K of combined balances (of which $20K comes from the OA)

- For members aged 55 and above, an additional 1% interest is paid on the first $30K of combined balances (of which $20K comes from the OA)

As a side benefit, you’ll also enjoy a dollar-for-dollar tax relief of up to $7,000 per year for cash top-ups.*

The combined effect of your top ups + the higher interest will help your parents grow their retirement savings, and enjoy higher lifelong monthly payouts if/when they join CPF LIFE.

Sure, that reduces your cash or CPF balance in the short-term, but remember that you also have a lifetime of growing your money ahead of you. In fact, the Straits Times reported that we’re seeing more people topping up their own or loved ones’ CPF accounts, which is awesome.

We Think About Our Legacy

Stereotype: We often live like we’re immortal. We don’t want to deal with depressing topics like death.

Reality: Many of us do think about our legacy: What will we leave behind when we die? Even though we’re young(ish), we know that anything can happen to us. So we want to make sure that the people we love will be taken care of when we’re gone.

How to apply this to your CPF savings:

What happens to your CPF savings after you die?

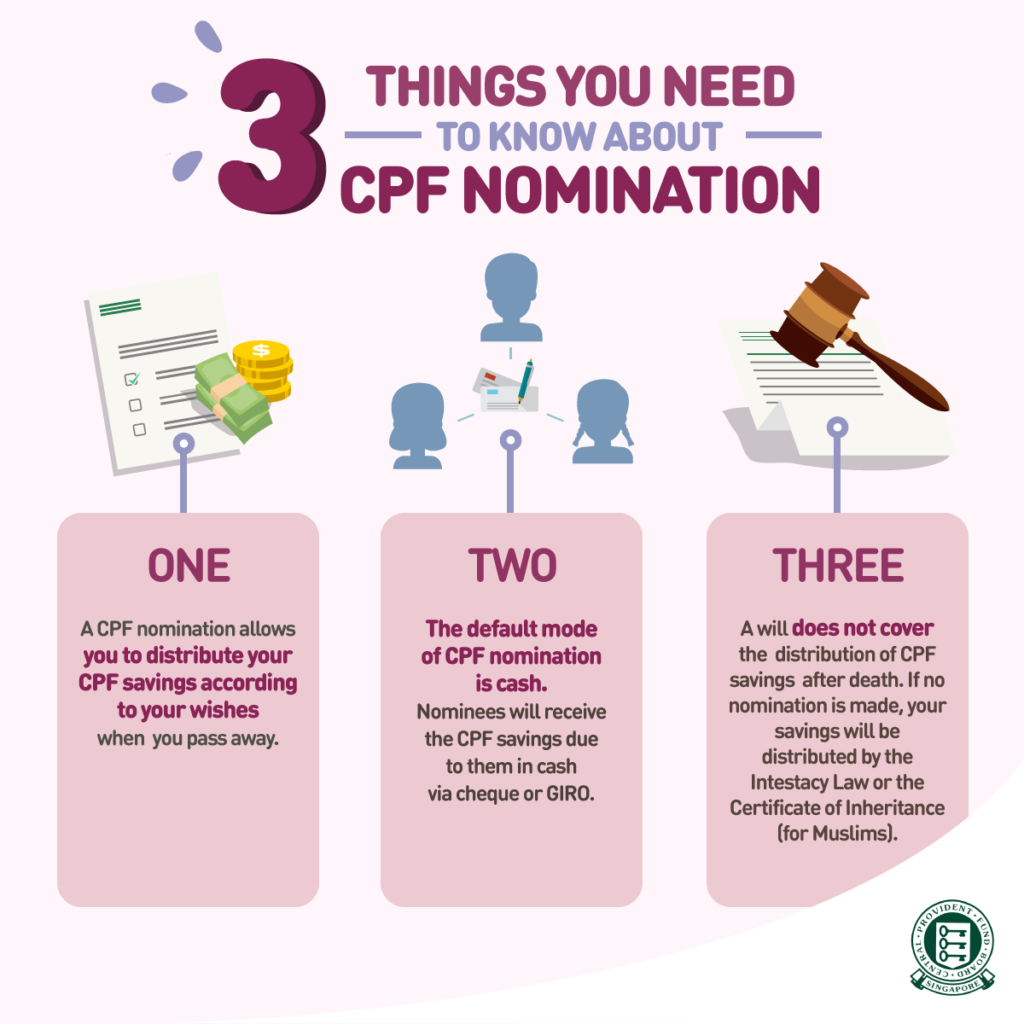

Not many people know this, but you can actually decide how your CPF savings will be distributed to your loved ones after your death. If you’d like your CPF savings to be passed on to your parents or equally among your 3 kids, you can make sure that happens.

How? By making a CPF Nomination which allows you to specify 1) who your nominees are, 2) how much CPF savings each nominee should receive after your death. You can also review and change these instructions as circumstances change (marriage, children, etc).

I get it – making a CPF nomination sounds like one of those annoying administrative tasks we “should” do, but don’t. After all, death isn’t something we like to think about.

But what happens if you don’t make a CPF nomination, and you kick the bucket? Well, your CPF savings will then be transferred to the Public Trustee’s Office (PTO) for distribution to your family members under the Intestate Succession Act or the Inheritance Certificate (for Muslims).

That sounds like a loooot of legal jargon, but here’s the bottom line: It just takes a couple of minutes to ensure that your CPF savings are distributed according to your wishes. You’ll also be saving your family some money, as the PTO charges beneficiaries an admin fee for distributing your CPF savings.

Making a CPF nomination is about ensuring that your family is taken care of because you love them. And unlike life insurance, there’s no cost to it – just a simple, straightforward statement of love.

Let’s Break Them Stereotypes

One of my favourite things to do is to take a typical stereotype, and then slowly and systematically destroy the assumptions around it. Then I’ll sit back with a whiskey, puff a cigar, and look smugly at everyone else while they comprehend my amazing genius.

Just kidding. What I’m trying to say here is that the world has stereotypes and assumptions. Instead of getting worked up about them, we can defy those assumptions in our lives and prove them wrong.

As unconventional millennials, we already do this every day. We’ve proved that we’re not the lazy, entitled, narcissistic kids that the world expects us to be. We’ve proved that we’ve got what it takes to get more out of life.

Now, it’s about taking that stereotype-breaking spunk and applying it to other domains – like our money, our careers… and our CPF.

===

Full disclosure: This is a sponsored post done in collaboration with the CPF Board.

Footnotes:

*Up to $7,000 per calendar year and capped at the current Full Retirement Sum (FRS). Cash top-ups beyond the current FRS will not be eligible for tax relief. In total, you can enjoy tax relief of up to $14,000 per calendar year if you make cash top-ups for yourself and your loved ones. The overall personal income tax relief cap of $80,000 applies for cash top-ups to CPF accounts. Terms and conditions apply.

Image credits: Terence l.s.m, CPF Board