A couple of years ago, an Army friend asked me:

A couple of years ago, an Army friend asked me:

Index investing sounds great and all, but when you buy the index, you’re just settling for average returns. Why would you settle for average when you can get above-average returns by picking stocks?

On the surface, that seems to make sense. Why would you settle for a boring 5-7% return when you can get 10-12% through value investing / forex trading / tactical asset allocation?

Getting a great return is awesome. But how important are they to your overall wealth?

Let’s Math This Problem Out

When I was in Primary 4, I fell asleep during my math test and failed it. My teacher scribbled “Lionel is not interested in math” and made me take it to my parents and sign it.

To prove my Primary 4 teacher wrong (and because there’s nothing more motivating than my childhood insecurities), I’m going to use math to answer this question.

So! Here’s our math question for today: Xiao Ming invests $12,000 every year at a return of 5% a year. How much will Xiao Ming end up with after 20 years? (I bet there are Primary 2 math questions out there today that are way harder than this one)

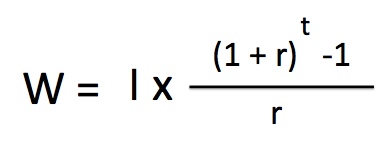

We can use a single formula to answer this question (take that, Mrs Lau!) Don’t worry, it isn’t as complicated as it looks:

Don’t worry, it isn’t as complicated as it looks:

- W is your wealth

- I is how much you invest every year

- r is the returns you get from your investments

- t is the time horizon you invest for

So all we gotta do is plug in Xiao Ming’s numbers:

As my French colleague likes to say, Wa-la! We find that Xiao Ming ends up with a nice stash of $396,791. Not too shabby.

Let’s Flip The Numbers And See What Happens

Now, let’s do a Missy Elliot and put that thang down, flip it, and reverse it. Is it better to get 5% a year for 20 years, or 20% a year for 5 years?

Let’s take Xiao Hua, who isn’t satisfied with 5% a year and now trades forex. Let’s assume that he’s really good at what he does and gets 20% a year for 5 consecutive years.

(By the way, if you can get 20% a year for 5 consecutive years, you’ll soon have rich people knocking on your door asking you to invest for them).

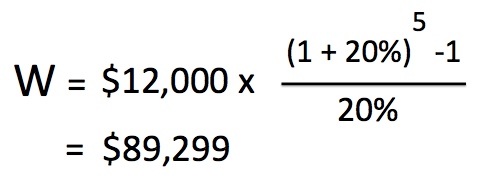

Let’e see what happens when we plug Xiao Hua’s numbers into our formula:

Booya! Xiao Hua’s amazing 20% per annum strategy yields just a little over $89,000 over five years. Getting 20% returns per year might SOUND sexy, but unless it’s sustainable, it doesn’t amount to very much.

The truth is, getting these sky-high returns isn’t very sustainable at all. At those levels, you’re likely 1) Taking on a huge amount of risk, 2) In a Ponzi scheme, 3) all of the above. And unless you’re Warren Buffett, it’s unlikely that you’ll get returns that will beat the market over the long run.

Pick A Sustainable Strategy, Not A Sexy One

Which brings me to my point: Lots of people are obsessed with finding the sexiest investing strategy that will bump up their returns by a couple of percentage points: Smart beta! Momentum! Tactical asset allocation! Forex trading!

But instead of asking, “Which strategy will give me the highest returns?”, it’s much better to ask, “Which strategy can I stick with for the longest time?”

As the numbers show, your time horizon – not your returns – is the key differentiating factor. The longer you can stay invested, the greater the compounding effect, and the greater your wealth.

[…] By Lionel Yeo […]