Soooooo a bunch of robo-advisors have launched this month in Singapore.

Soooooo a bunch of robo-advisors have launched this month in Singapore.

When I first heard about them, I got REALLY EXCITED. I tried sharing my excitement with my friends, which is probably why no one invites me to parties anymore.

Now that I have nothing better to do on Friday nights, I did a little bit of digging on these Singapore robo-advisors. Annnnd here are my findings.

A quick caveat: I’m haven’t actually invested using any of these robo-advisors yet. All observations I make here are purely from tinkering around with their signup pages. If you spot any inaccuracies, feel free to let me know in the comments below.

What The Heck Are Robo-Advisors?

Wait – You haven’t heard? It’s a new movie starring Nicholas Cage about a Certified Financial Planner who dies in an accident. Then the insurance company PruManuEastern gives him a new lease of life, outfits him with cyborg parts and programs him to sell more policies…. Okay not really.

(That would be SUCH a terrible movie.)

Robo-advisors are digital platforms which provide algorithmic ways for you to invest. You answer a couple of online questions, they crunch the numbers, and ta-daaaaaaahhh they recommend a suitable portfolio for you. You can send money to them, and they’ll automatically invest it for you in your chosen portfolio every month.

The main ones I keep hearing about in Singapore are AutoWealth, Smartly, and StashAway.

What Makes Me Go YAY!

As a concept, robo-advisors are awesome. Most of them passively invest in index-based ETFs which I’ve been advocating on this blog for years.

It’s great that they’re championing the passive investing mantra: That it’s better to invest in the entire market instead of picking individual stocks (picking individual stocks doesn’t work, despite what those scammy Facebook ads say).

Robo-advisors give you an easy way to get started. You set up an online account, send money to them, and voila! it gets automatically invested into multiple passive ETFs. They handle all the asset allocation, rebalancing, and all the icky stuff that folks don’t want to deal with.

This is a FANTASTIC way for beginner investors to start. There’s no research to be done, no Excel files to tinker with, nothing. You can put in say, a hundred buckaroos a month and have it instantly diversified into thousands of stocks and bonds worldwide.

Literally set-it-and-forget-it investing.

If you’re prepared to stick with them for the long-term, robo-advisors can offer a much better alternative compared to investing in overpriced unit trusts or ILPs (Why do these things still exist?).

What Makes Me Go Hmmm

Not everything is hunky-dory though. There are a couple of areas which I have mixed feelings about.

The Wrong Messaging?

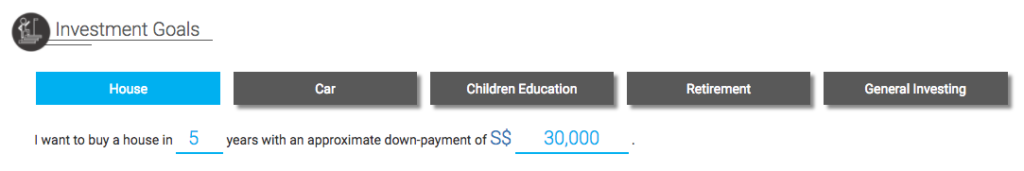

It feels like robo advisors aren’t emphasising enough on the importance of investing for the long-term. For example, here’s the first question in Autowealth’s online questionnaire:

I like “Retirement” and “Children Education” (never mind the grammatical error) – since these are primarily long-term goals.

But “House” and “Car”? Anyone who’s read the passive investing literature (okay, anyone who’s a weirdo like me) knows that index investing only works if you do it for the long-term. And by “long-term”, I mean at least 20-30 years.

And if you’re investing for a house and your investments take a nosedive, does that mean you’re forced to stay with mummy and daddy for another 5 years?

There are some things you should invest for, and others that you should SAVE for. Personally, I wouldn’t subject my house downpayment to the whims and fancies of the stock market – especially if I’m planning on buying a house soon.

But okay, maybe these goals help to appeal to itchy-backside, instant-gratification millennials like me (dammit, millennials!). Maybe once we get them through the door, they’ll understand the importance of investing for the long-term, so we’ll let this one slide.

You Don’t Get To Choose Your ETFs

Robo-advisors get economies of scale by getting everyone to invest in the same ETFs. So while you can select your allocation between each ETF, you can’t include or exclude ETFs.

This is fine if you’re in the “Just help me invest my money, I don’t give a sh**” group, but not so great for us who want to dive a little deeper. For example, here’s the portfolio that Smartly recommended for me:

Here are a couple of questions I had off the top of my head:

- Why is the equity component 100% invested in US stocks? What about international stocks?

- What if I don’t want to invest in Gold?

- Why are we invested in emerging market bonds (which are riskier)?

My point isn’t to tear this portfolio apart. Instead, it’s to urge you to UNDERSTAND what you’re investing in first. Are these the best ETFs for you? Are you convicted enough that you’ll stick with them when times get rough (and it WILL get rough)?

However, I can understand why robo-advisors want to approach it this way. Some people might get turned off when presented with too much information. And maybe this is the right amount of info that makes it as easy as possible to get started.

But my point still stands: If you’re going to invest in something, make sure you look beyond the shiny dashboards to REALLY understand it first.

Your Dividends Get Taxed

Along the same lines, all 3 robo-advisors invest in US-listed ETFs, which are subject to a 30% dividend withholding tax. This is a boring, technical topic, but Kevin from Turtle Investor wrote a great explanation of it here. The bottom line: The dividends from US-listed ETFs are taxed by 30%, so you essentially get less money compared to ETFs listed on non-US exchanges.

Robos probably picked US ETFs because they have better liquidity and a tighter spread, which is good when you’re making lots of transactions on behalf of investors. However, less active investors like me might be better off investing in ETFs outside of the US which aren’t subject to that same tax.

On the flip side, StashAway wrote a nice rebuttal of the withholding tax issue here saying that it doesn’t really affect returns. However, I’m not entirely convinced and I’d like to see that analysis applied across more ETFs and asset classes. For example, bond ETFs tend to be more affected by the tax given that their dividends comprise a bigger proportion of their returns.

What Makes Me Go NAY

Rising Costs As Your Portfolio Gets Bigger

The biggest nay I have with robo-advisors are the costs. You see, robo-advisors charge a percentage fee of your total portfolio. This won’t matter so much when you’re just starting out, but it matters as your portfolio grows.

For example, an investor with a $10,000 portfolio using AutoWealth will pay only $85 a year (or $7 a month) in fees. However, as her portfolio grows, she’ll start paying more and more. For example, a $300,000 portfolio will end up costing her over $1,500 a year, or $125 a month in fees.

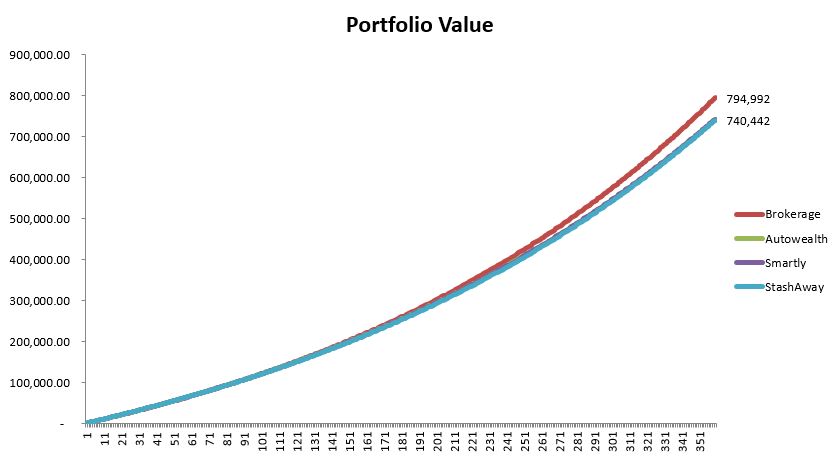

Compare this with paying say, $25 a month in commissions to a brokerage (I pay much, much less than that). Over time, the difference starts to add up. Here’s a chart comparing the hypothetical 30-year performance of someone investing $1,000 a month at 5% returns a year, using a brokerage vs. robo-advisors.

Calculations in this Excel file: DIY investing vs roboadvisors_14082017

While the costs look similar in the first few years, robo-advisor costs accelerate pretty quickly as the portfolio grows. By the 30th year of investing, an investor using StashAway could see a $84,700 difference in their portfolio value compared to an investor using a regular brokerage.

Now, maybe paying an additional $2,800 per year is a worthwhile price for having everything fully automated for you. But for a DIY investor like myself, I’d rather take 1 hour every quarter to invest myself and save paying those fees.

Tactical Asset Allocation

StashAway charges the highest fees for a reason: They use a proprietary investment strategy called the Economic Regime-based Asset Allocation (ERAA), which is described in this intelligent-sounding article describing it (which I spent my Saturday night geeking out on because I have no life).

ERAA is essentially a tactical asset allocation strategy, which might pose some problems:

- Tactical asset allocation is notoriously tricky, and many smarter hedge funds have tried and failed

- Determining which “economic regime” you are in is often based on lagged data (though StashAway says that they use forward-looking indicators)

- Tactical asset allocation is usually only obvious in hindsight, along with other forms of bias like data mining

I have no doubts that StashAway is run by very smart people who have carefully backtested their strategies, but at the end of the day, ERAA can no longer be classified as passive investing.

The same goes for Smartly. According to their website:

Dozens of algorithms monitor your investments daily. If market conditions change, we rebalance/reorganise your portfolio accordingly. All this to give you the best return.

I can’t tell if this is simple rebalancing, or if they’re engaging in other forms of tactical asset allocation.

I’m not saying that robo-advisors have bad strategies. On the contrary, investors in these platforms might end up with a better performance than a passive buy-hold-rebalance strategy.

However, nobody can predict the future. How do you know that a fancy-schmancy strategy will beat a simple buy-and-hold strategy? You don’t. If it starts underperforming, you’ll be left with a dilemma: Is this just a temporary dip in performance, or something more permanent? Did you make the right decision?

We all know how extremely difficult it is to beat the market, given than more than 90% of active funds failed to do so over a 15-year period. Many of them probably had intelligent-sounding strategies with fantastic backtest results too.

As a passive investor, I’d rather forget trying to beat the market and simply match the market return. That way, I can sleep well at night knowing that my strategy is always working.

Sooooo… Yay Or Nay?

I did’t mean to sound so critical about robo-advisors in this post. On the contrary, I think they’re a great boon to Singapore investors. They make it much easier to invest, and most of them are championing the forget-stock-picking-just-invest-in-the-market message, which is the right approach.

If you’re a beginner investor with very little money to invest, then robo-advisors might be a great way to start investing. Just as long as you:

- Understand the investments you’re investing in

- Are able to commit to investing in it for the long-term– meaning 10 years or more (preferably 20-30!)

- Are comfortable with investing via a black box asset allocation strategy

So far, I haven’t found a compelling reason to invest in robo-advisors yet. The fees are just too prohibitive at this point, and I’m not entirely convinced that their portfolios are necessarily the most optimised for passive investors. (If any of them are reading this though, I’d love to understand more about their portfolio construction and asset allocation strategies!)

Have you invested or are you planning to invest in any of these Singapore robo-advisors? What are your thoughts on them?

Epilogue

I had a good follow-up chat with Michele Ferrario, the founder of StashAway in response to this post. He pointed out some errors in my previous Excel calculations, which have been fixed in the file above. (Thanks Michele!)

Some of his counter-arguments:

- For a short-term investing goal like housing, StashAway recommends lower-risk portfolios which are more conservative and weighted more towards bonds

- It’s not fair to compare brokerage costs of $25 a month, since it would cost much more than that for individual investors to invest in 7-8 ETFs themselves, which is the typical size of a StashAway portfolio

- Their strategy isn’t a black box, since they try to make their strategy as transparent as possible for their investors. (Lionel: The black box label in this post has been amended)

And my counter-counter arguments (haha):

- A low-risk portfolio is still subject to risk. Even if a portfolio has 80% bonds, you can still lose money. Personally, I believe that any goals less than 5 years out should be SAVED for, not invested. There’s simply no guarantee that you will see investing gains in that short of a timeframe, even with a “safe” portfolio. You don’t want to lose your ability to buy a house because of a dip in the market.

- I acknowledge this isn’t an exact apples-to-apples comparison, since robos invest every month into 7-8 ETFs, while individual investors would realistically invest less regularly into say, 2-4 ETFs. HOWEVER, this isn’t necessarily a bad thing – for example, there’s a strong case that you only need one ETF to track the global stock market (remember that the whole point of index investing is that we can’t beat the market, therefore we should own the whole market without a bias toward any particular slice of it). Couple that with a local bond ETF and you have a solid, diversified portfolio. IMO, the diversification benefit of adding more ETFs to that mix is doubtful at best. Individual investors can build robust, diversified portfolios with just 2-4 ETFs, which wouldn’t incur high brokerage costs if we invest say, once a quarter or once every 6 months.

- It’s great that StashAway is as transparent as possible, however at its heart, ERAA remains a tactical asset allocation strategy. Applying a successful tactical asset allocation strategy requires a rigorous methodology, while many very smart hedge funds have tried and failed. It might even lead to poorer risk-adjusted returns and higher costs (see here and here) than a traditionally passive portfolio.

Again, these are just my personal views – I’m not saying that a DIY method of investing is necessarily a better approach than investing through robos. No one can predict the future, although I’d argue there’s a strong case to be made on 1) Forming a simple, robust portfolio and 2) Investing it it yourself to reduce the cost. But I totally get that this isn’t for everybody!

Ultimately, robo-advisors are helping investors to ditch scammy, pricey investment schemes and choose index investing, which is definitely a plus in my book.

I was very seriously considering Stashaway because whatever strategy they’re employing is probably better than mine (or lack of). Plus, they investing into a lot of ETFs I don’t have easy access to especially when I don’t have that kind of purchasing power. I do think the fees are quite high (and realised the fee only reduces for each tier of $25k invested, not as a whole), but maybe if I was serious about investing in US ETFs, it might be a better option than buying direct.

Interesting thoughts. I’ve got portfolios with both Smartly and StashAway so will see how they both get on! I previously took advice from my bank on which ETFs to invest in.

Same point stands about their motivations not being transparent.

So I think they are a good alternative to private banking, but no substitute if you prefer doing your own research.

Yeah … the no-cap fees turned me off. If I put the bulk of my assets into these robo-advisories, I’ll be paying a few K per year in fees.

Those in US have started to put in caps, e.g. max USD5K per year for anything over USD2M in investment.

Maybe I’ll just start with a tiny amount with tiny monthly DCA. I suspect those robo-advisories based their business plans around such type of customers i.e. millennials starting to build up their investments.

That ERAA sounds pretty much like sector-rotation strategies based on real-world factors such in inflation, interest rates, PMIs, capex, commodities, business cycles, etc. Practitioners started using it in the 1990s with the start of quantitative investing and investors using computers to backtest strategies and methods.

The major problem with quants & backtesting is data-fitting, where you tweak the algorithm, factors, parameters such that your strategy gives the best result for the past 20 years or past 50 years of data. The problem is if the future or some future crisis is novel and not experienced and captured in the past e.g. 50 years of data. Then you have to hope & pray that your algo & strategy can still maneuver the new situation.

Another problem, but lesser, is if the backtest data used is not fine-grained enough such that there are gaps. E.g. using month-end data, but missing out some previous intra-month volatility that could have blown up some asset classes. If such volatility happens only infrequently once-off in the future, then the overall portfolio still can take it. But if the future changes and it occurs frequently, say over a prolonged 3-6 month period, then it may deal a mortal blow to the portfolio.

Interesting article.

I actually like my spreadsheet, so wont be using a robo advisor. But, if they can take some business away from expensive commission based ‘financial advisors’ then I’ll be a huge supporter.

Gee, i’ve stupidly decided to give stashaway a try, but aint planning to put much. like you’ve said, at 0.8 % , stashaway is pretty expensive compared to the rest (which i didnt know about D: ). My plan would probably really be putting a very tiny bit of my monies inside (less than 2000, yeah, feels pointless eh?) and just take that I’ve bought a lesson or something (although, frankly, with that amount i could easily take up better lessons, like a list of adventure related courses for example).

Not sure if you’d be able to see their breakdown of stocks that they’re buying, but tada, here’s the link : https://app.stashaway.com/support/etf-details#AAXJ