Before we start: I’m experimenting with short, tactical and specific posts like these with nuggets of practical tips. They’re easier to write than my longer strategic (rambling?) posts, but may not necessarily apply to everyone. I’ll likely end up doing a mix of both, but let me know what you think!

Before we start: I’m experimenting with short, tactical and specific posts like these with nuggets of practical tips. They’re easier to write than my longer strategic (rambling?) posts, but may not necessarily apply to everyone. I’ll likely end up doing a mix of both, but let me know what you think!

===

Everyone knows that if you want to fly on Suites or Business Class without shelling out thousands of dollars, you need to earn miles. And to earn miles, you need an airmiles credit card… right?

I’ve talked previously about how airmiles cards like the Citibank Premiermiles card or the UOB PRVI miles card are great ways to accumulate miles, especially if you travel. But lots of people don’t want to sign up for a new credit card, so they automatically assume that they’re out of the miles game.

But here’s the deal: You don’t actually need an airmiles card to earn miles. Here’s why.

Case Study: The Citibank Rewards Card For Shopaholics

One of my friends recently cancelled his Citibank Rewards card. He was hoping to replace it with a mileage credit card and accumulate enough miles for a Business Class flight with his wife. However, I didn’t think it was a great idea.

You see, my friend and his wife REALLY LOVE shopping – that’s why he got the Citibank Rewards card in the first place. They shop at Amazon, Lazada and ASOS all the time, chalking up Reward points which they’d redeem for small rewards like movie tickets and spa vouchers.

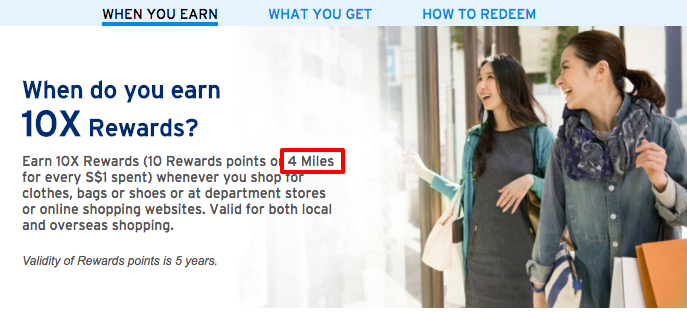

But waaaaaitaminute. They could also redeem their points for free flights. Here’s a screenshot from the Citibank Rewards card website:

Citibank Rewards cardholders can earn 4 freakin’ miles for every dollar spent on shoes, clothes and bags. There’s even a nifty crowdsourced spreadsheet to help you identify which merchants are eligible for the accelerated miles.

Given that my friend and his wife spend hundreds of dollars a month on shopping, they would have been better off keeping their Rewards card instead of going for an airmiles card.

Rewards Cards Are Airmiles Cards In Disguise (or vice versa)

But what if you hate shopping (like me)? There are plenty of cards that let you earn miles in other categories:

- The UOB Preferred Platinum Card gives you 10X UNI$ (or 4 miles) per dollar spent on Visa payWave transactions

- The DBS Woman’s World MasterCard (which – as I learnt from Shutterwhale – men are eligible for as well!) gives you 4 miles per dollar on eligible online transactions

- Even the Citibank Clear Platinum Card – yes, the card you had as a fresh grad because it gave you free entry into Zouk – earns 2 miles per dollar on dining & online shopping

Contrast this with say, a typical airmiles card like the Citibank Premiermiles card which only gives you 1.2 miles per dollar for most categories besides flights and hotels

The Spend By Categories Strategy

The obvious strategy here is to get Rewards cards for categories which you spend the most money on. Shocking, I know.

- If you do lots of online shopping, get something like the DBS Woman’s World MasterCard that rewards you for online transactions

- If, like me, you spend a lot on random items like ToastBox breakfasts, grocery shopping, etc, get one that rewards you for Visa payWave transactions like the UOB Preferred Platinum card

- If you travel for work or do lots of staycations, get something like the DBS Altitude cards which could get you 9 miles per dollar for OTA spends.

Caveat: This strategy doesn’t work with cashback cards, where the benefit goes straight back into your account to offset your bill. I prefer mileage/rewards cards compared to cashback because I get a lot more value out of them, although I acknowledge that everyone’s spending patterns are different.

What are your thoughts on using rewards cards for miles? Is that something you’d do?

[…] By Lionel Yeo […]