What are some of your most deep-seated assumptions?

What are some of your most deep-seated assumptions?

You know, stuff that you’d never even think about questioning. Like:

- “You need a college degree to be successful”

- “Investing is about how well you pick stocks”

- “Donald Trump will never win the election”

How about this one: “Credit card fees are a waste of money”

Are they really?

Let’s think about this for a sec. Sure, no one likes paying annual fees, but what if I told you that it could help you travel on First and Business Class at a fraction of what other people are paying?

In this post, I’ll show you how to do exactly that, using a strategy you can start implementing today.

The Miles For Fees Strategy

When I got my first credit card, all my friends said that I should NEVER pay the annual fee.

“Just call the bank and ask them to waive the fee! It’s just a way for those rich douchebags to eat up even MORE of our money!!!”

And so I followed their advice. For the first few years, I’d faithfully call up Citibank to ask them to waive the fee. (I was using the Citibank Clear Card back then, with the sole reason that it gave me free entry to Zouk. Because I totally had my priorities right.).

I thought I was pretty smart, until I discovered mileage cards.

Let’s put aside the fact that mileage cards earn you miles when you spend on them. Everyone knows that. Here’s what lots of people don’t know: You can earn miles at a crazy accelerated rate when you pay your annual fee.

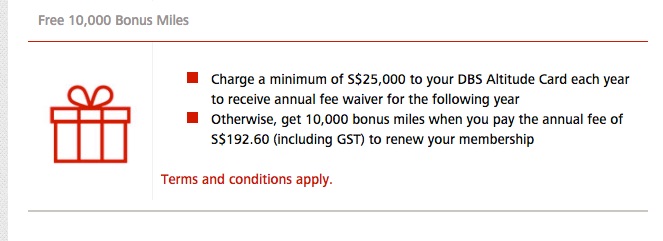

Let’s take the example of the DBS Altitude Visa Signature Card. When you pay their annual fee of $192.60, you’ll receive 10,000 bonus miles as their way of saying, “Thanks for not quitting on us!”

Let’s dig into why this works in your favour. Most mileage cards have an earn rate of 1.2 miles per dollar spent. Which means that to earn 10,000 miles, you’ll need to spend approximately $8,333. Not easy.

Conversely, an annual fee which costs than $200 gives you 10,000 miles. That’s equivalent to an earn rate of 50 miles per dollar spent. Nothing else even comes close.

10K miles is great. But you can multiply the impact by applying the same strategy towards more cards.

Here are some eligible cards which currently give you 10,000 miles when you pay your annual fee:

- The DBS Altitude Visa Signature Card(annual fee $192.60)

- The Citibank PremierMiles Visa Card (annual fee $192.60)

- The DBS Altitude American Express Card (annual fee $192.60)

- The ANZ Travel Visa Signature Credit Card (annual fee $200)

So what happens if we apply for ALL FOUR CARDS and pay the membership fee for 2 years?

Well, we’d be paying $1,555.60, but in return, we’d get a nice stash of 80,000 miles (10,000 miles per card x 4 cards x 2 years).

Let’s see what goodies we can exchange them for.

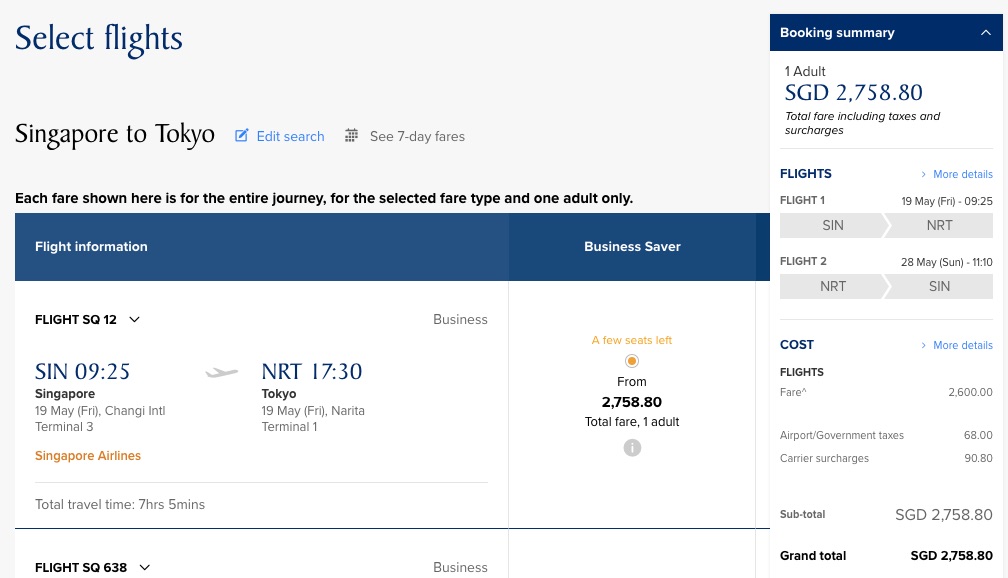

Business Class To Tokyo

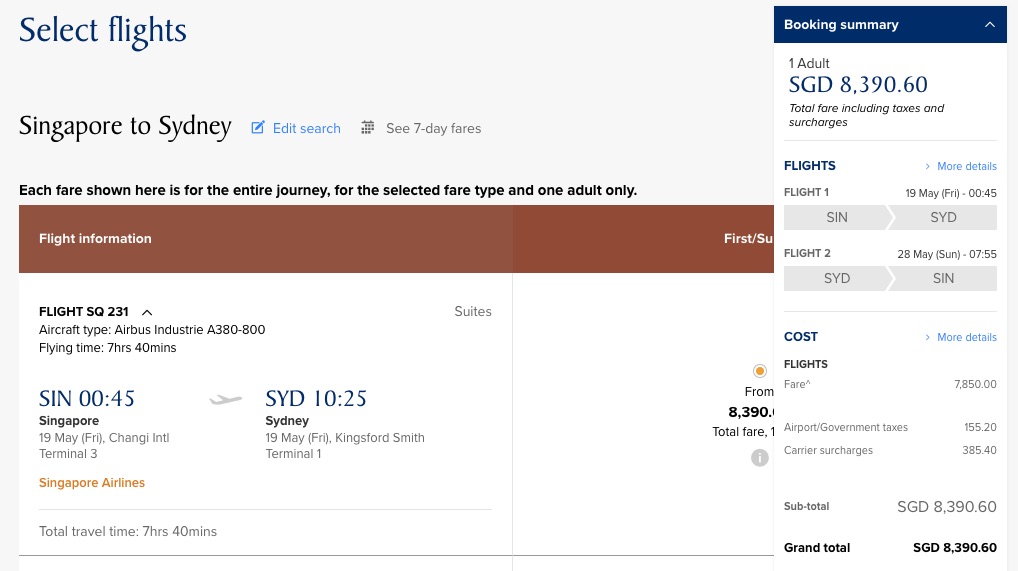

According to the Singapore Airlines Award chart, 80,000 miles gets you a round-trip Business Class ticket to Tokyo worth $2,758.80. (Or up to $4,084.50 if you book it at the last minute)

So essentially, you’d be paying $1555.60 (annual fees) + $68 (airport tax) + $90.80 (fuel surcharge) = $1,714.40*. That’s a 37% discount off the cheapest publicly-available Business Class fare.

Sure, $1,714 isn’t cheap, but you’re getting a round-trip Business Class ticket to Tokyo on a Singapore Airlines B777-300ER. That’s seven hours each way of lounging on their handcrafted Scottish leather seats, which also transforms into a fully-flat 78-inch bed complete with linen, duvet and pillows.

You’ll get to sip champagne, watch Krisworld on an 18-inch screen with a noise-cancelling headset, and dine on a gourmet 3-course meal served on real cutlery (try the satay – it’s delicious). Oh, and you get cool perks like dedicated check-in counters, priority baggage, and lounge access in both Singapore and Tokyo.

Does $1,714 sound expensive to you now? You probably spent that much – if not more – on your Economy Class ticket for your December vacation.

(If you’re impatient, you can also settle for a one-way Business Class ticket for 40,000 miles, achievable after paying one year’s worth of annual fees for the above 4 cards.)

Let’s Get Even More Extravagant

But why stop there? Why not go all the way to Singapore Airlines’ fabled Suites at less than half the price?

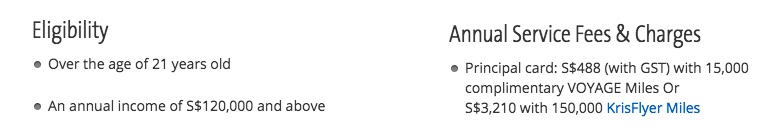

- Step 1: Apply for the OCBC Voyage Visa Infinite Card.

- Step 2: Choose option 2 of their annual fee, which requires you to pay $3,210 for a whopping 150,000 KrisFlyer miles. (Option 1, where you pay $488 in exchange for 15,000 miles, is a terrible deal on a cost-per-mile basis)

Granted, this isn’t for everyone. You need to be an OCBC Premier Banking customer ($200K in assets) with an annual income requirement of $120,000, which isn’t achievable for most people. But if you’re a top performer, a $10K/month salary is entirely within your reach within a few years.

For an easier alternative, follow the Miles For Fees Strategy for 4 years, spending $3,111.20 to get 160,000 KrisFlyer miles. Use a combination of sign-up bonuses and smart spending to shorten the timeframe to 2-3 years.

150,000 miles is enough to buy you a round-rip Suite ticket to Sydney, which is a whole new level of luxury.

At Changi Airport’s First Class Check-In Lounge, you’ll be shown to your seat and served refreshments while someone handles your documentation. You’ll then get access to The Private Room, probably one of the most exclusive lounges in the world.

Onboard, you’ll get your own individual cabin with a sliding door and window blinds for greater privacy. You can combine two Suites to make a massive double bed if you’re travelling with a partner. Savour a multi-course gourmet meal from SIA’s International Culinary Panel, served on specially-designed bone china together with premium, top-notch wines.

How much would that cost you?

A well-heeled board member of a Fortune 500 company would pay $8,390.60 for the privilege.

With the tactics above, you’d spend $3,210 (annual fee) + $155 (airport tax) + $385.40 (fuel surcharge) = $3,750.40 for a lifetime experience that most people would only dream about. That’s a 55% discount off the price paid by the stressed out tech magnate sitting next to you.

Get Ultra-Specific To Destroy Your Assumptions

Now, maybe flying First or Business Class isn’t your idea of fun. Many people would prefer to use that $1,714 in other ways.

No problem. No matter what your dreams are, I’d like you to consider this today: What assumptions are holding you back?

Before this, I thought I’d never be able to afford a Suites ticket. I also assumed that credit card annual fees should be waived at all costs. But by getting ultra-specific, I was able to destroy those assumptions and actually afford an experience of a lifetime.

So today, think about an experience – a luxury, an adventure, a fear to conquer – anything you’ve always dreamed of. Think about the possible reasons WHY you thought it was impossible.

And then systematically attack them one-by-one by doing research and talking to others who’ve done it.

What you find might surprise you.

*There are some fees for transferring the miles over to your KrisFlyer account, but they shouldn’t amount to more than $100 total for all 4 cards.

Image credits: s.yume

I think the annoying thing is that for SQ at least (AKA the most stingy miles program), the saver redemptions are very limited. since this miles strategy is not really a secret, everyone is trying to redeem them and very often end up on waitlist for a particular route even trying to book them months in advance. you end up making further compromises such as flying to a different airport, changing your route or destination entirely.