Last week, I wrote a post about how my wife and I redeemed Singapore Airlines Suites tickets with our KrisFlyer miles. The next thing I knew, I was receiving tonnes of queries asking, “EH WHICH CARD YOU USE AH? I ALSO WANT TO FLY SUITES LEH.”

Last week, I wrote a post about how my wife and I redeemed Singapore Airlines Suites tickets with our KrisFlyer miles. The next thing I knew, I was receiving tonnes of queries asking, “EH WHICH CARD YOU USE AH? I ALSO WANT TO FLY SUITES LEH.”

Okay, okay. Ruh-lax. First of all, assuming that you can redeem a Suites ticket with just one credit card is like saying you can marry someone with a single pick-up line. It’s not that simple.

Sadly, there’s simply no magic bullet that will give you a lifetime of free First Class travel without any work. The travel hacking game takes time and effort to master (I still have a looong way to go), and the strategy goes a lot deeper than simply using the right credit card.

I can’t cover all of it in a single blogpost, but today I wanted to introduce one aspect of it, which I call the Carousell Miles Strategy. You can use it to evaluate any deal where you’re getting miles in exchange for cash.

The Carousell Dealer

I have a friend who buys and sells stuff on Carousell. He’s turned it into a nice side business: Buying items cheap from Taobao, and then selling them for a higher price on Carousell. (I would totally do it too, except that my level of Mandarin prohibits me from doing anything on Taobao)

In the same way, the mileage game is all about buying and selling miles: You “buy” air miles at a low cost, and “sell” them at a higher value.

Whenever you redeem your miles for an air ticket, you’re actually “selling” them back to the airline. Except that instead of selling them for cash, you’re getting a free flight. Last week, we talked about how it’s important to exchange your miles for as high of a value as possible using the Value Per Mile metric.

In case you forgot (d’oh!), here are the approximate Value Per Mile rates for the different travel classes on Singapore Airlines:

- Economy Class: 1-2 cents per mile

- Business Class: 4-6 cents per mile

- First Class/Suites: 6-9 cents per mile

That’s the selling part. This week, we’ll cover the “buying” part of the equation.

In other words, how do you tell which deals will help you earn miles at the lowest possible cost?

How To Evaluate If You’re Getting A Good Deal

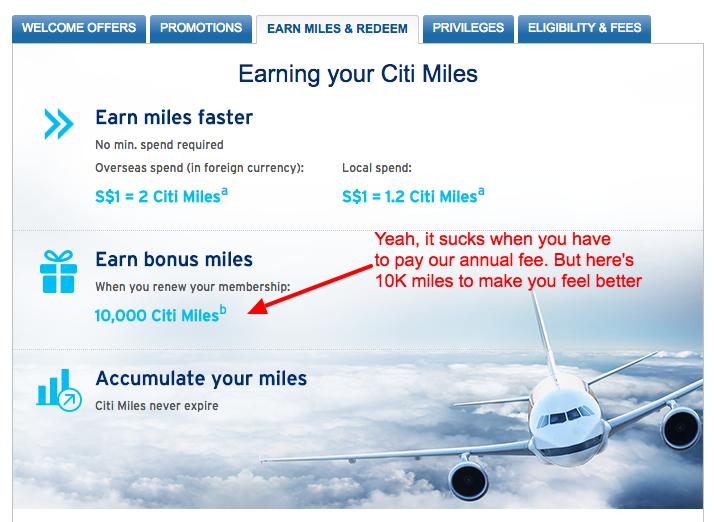

Let’s say you see deal like this: Renew your membership (and pay the $192.60 fee) and get 10,000 Citi Miles.

How do you tell if it’s a good deal?

Citibank wants you to think that you’re getting those miles as a “bonus”. But in reality, you’re actually buying them from Citibank.

At what price? Well, it’s $192.60 divided by 10,000 miles, which works out to 1.9 cents per mile.

This is a pretty alright deal, because you “buy” miles at a cost per mile of 1.9 cents, and then “sell” them to the airline for a Business Class ticket worth 4-6 cents per mile.

Do you see how this can be a profitable hobby if you do this right?

The catch, of course, is to figure out how to “buy” them at as low of a price as possible. Let’s check out a few more examples:

“Okay” Deal: SCB Miles Time Deposit

Standard Chartered Bank (SCB) recently ran a promotion where you could earn 10,000 miles for every $27,000 of fresh funds deposited in a 6-month time deposit with them. (The campaign has since ended)

Basically, it works like a Time Deposit, but instead of getting your interest in cash, you’re getting it paid in miles instead. Gotta give them credit for coming up with an innovative campaign like this (at least for Singapore). But is it a worthwhile promotion?

Well, assuming you parked that same $27,000 in a 6-month SGD time deposit earning 1.5% per annum, that money could have gotten you around $202.50 in interest. (Hat tip: MileLion for doing the comparison on his excellent blog)

So in reality, you’re actually “buying” those 10,000 miles for $202.50, at a cost of 2.0 cents per mile. That’s an okay deal, considering it’s pretty much the same rate as renewing your credit card membership.

“Not Bad” Deal: TapForMore Points

The PAssion card has an unfortunate reputation as an aunty-uncle card, because of its association with Community Clubs, POSB, NLB, and all the good ol’ Singaporean institutions our parents dragged us to when we were kids. But not many people know that it also provides a pretty decent conversion rate for KrisFlyer miles.

Whenever you buy stuff at Cold Storage/Giant/Guardian, you can earn TapForMore points for every dollar you spend. Most aunties and uncles will cash those out for rebates (I don’t know what’s up with Singaporeans and our obsession with rebates), at a rate of 150 TapForMore points for a $1 rebate.

However, instead of converting them into cash, you can also convert your TapForMore points into KrisFlyer miles. I logged into my TapForMore account and did a quick check on how many miles I had:

I currently have 56.25 TapForMore points, which can be converted into 24 KrisFlyer miles. That’s an approximate rate of 1 mile = 2.3 TapFormore points

How much is 2.3 TapForMore points worth? Well, let’s see:

- 150 TapForMore points = $1 rebate

- 1 TapForMore point = $1 divided by 150 points = 0.6 cents

- 3 TapForMore points = 0.6 cents x 2.3 points = 1.5 cents

In other words, you can “buy” KrisFlyer miles using your TapForMore points at a rate of around 1.5 cents per mile. (Still with me here?)

That’s a pretty good deal – it’s tough to find a rate of below 2 cents a mile these days.

But – and you might have noticed this already – you’re gonna have to spend a loooooot of money at Guardian/Giant/Cold Storage in order to earn enough miles to redeem a flight. That’s a lot of toilet paper.

Still, the lesson is that if you have a bunch of TapForMore points lying around (and let’s face it – we all do, because deep down inside, we’re all aunties and uncles), you’d be much better off converting them into KrisFlyer miles.

Better Deal: Kaligo DBS Altitude Promotion

Hotel booking platform Kaligo has a pretty awesome promotion where you can earn up to 10 miles per dollar spent on hotel bookings with your DBS Altitude card, from now till 31 Dec 2016. So if I book a staycation for $200, I get 2,000 KrisFlyer miles as a bonus.

But hold up. Smart readers out there might notice that it works out to a seemingly crappy rate of 10 cents per mile ($200 divided by 2000 miles = 10 cents per mile). Isn’t that a terrible rate?

Yes, but let’s not forget that unlike the credit card annual fee example, you’re not spending that $200 for nothing. Instead, you’re getting a staycation AND 2,000 miles on top of that, which is a pretty sweet deal.

In general, anything above 6 miles per dollar spent can be considered a good deal, provided you were gonna spend on that item anyway.

In Short…

The Carousell Miles Strategy is just one of the many frameworks I use to evaluate mileage deals. It’s about reducing all the complicated T&Cs into just two metrics: 1) Value per mile (which we covered last week), and 2) Cost per mile.

Assuming you can earn miles at the lowest cost and redeem them for the highest value, you’re on your way towards getting that Suites ticket.

Image credits: Matt@PEK, memegenerator (doncha just love this site?)

[…] – cheerful.egg: The Carousell Miles Strategy: How To Evaluate Mileage Deals […]