Imagine this scenario: You’re rummaging through your kitchen drawer, and realise that you’re out of plasters. You know, the sticky thing you put on your knee when you cut yourself against the coffee table (speaking from experience here).

So you head to NTUC and look for plasters. Now, if you’re like me, you probably hate running errands – especially something as mundane as buying plasters.

You arrive at the plaster section, only to be faced with a gazillion varieties. Who has time to compare the intricacies of each type? You just want to grab your plasters, check it off your to-do list, and go back to watching Daredevil. (Just started watching it on Netflix. Goodbye, productivity!)

Who has time for plasters?

Making Sucky Situations Less Sucky

I know it sounds weird, but stay with me here:

- Its sole purpose is to make a sucky situation less sucky

- You only need it temporarily

- You hope you never have to use it

For a plaster, it makes your wound a lot less painful (and if you get those with the cool animal prints, it makes for a great conversation-starter). And after a couple of days, you tear it off – you don’t need it anymore.

For insurance, it pays off when some crappy thing happens to you, like when a piano drops on you and you die. It makes life less sucky for your family, because they get lots of money to pay off your mortgage, send your kids to school, etc.

But you don’t need it FOREVER – at some point, when you’re say, 50 years old, your mortgage will be paid off, your kids would have started working, and you’ll have a nice stash of savings. At that point, you don’t need insurance anymore – you’re essentially “self-insured” since you have enough to pass on to your loved ones.

For both plasters and insurance, their sole purpose is coverage. You hope you never have to use them, but it’s nice to know that they’re there.

Therefore, when it comes to buying insurance (or plasters), you should be asking yourself: Which is the one that gives me the best coverage, at the lowest possible price?

Here Comes The Value Pack!

Now, let’s go back to NTUC, specifically the NTUC boardroom where all the smart NTUC executives meet every week. The chairman asks, “How can we make more money for NTUC?”

Some Smart Alec raises his hand: “From our research, people who buy plasters tend to want to buy Milo too. Heyyyyyyyyy – why don’t we create a value pack that bundles both plasters and Milo together? Then we can charge a looooot of money for it.”

*In case it wasn’t clear already, this is a HYPOTHETICAL example. NTUC isn’t that lame.

I know, it’s totally insane. What the heck do plasters have to do with Milo?

The thing is, it works. Especially on lazy people like me. I know that 1) I need to buy plasters, 2) I need to buy Milo. So I’ll just buy the value pack that has both! Duuuh.

But I might not realise that I’m also paying a loooooot more for the value pack instead of buying the items individually.

So when we apply this to the world of insurance,

- Term insurance is like a plaster: It only has one purpose – To give you coverage

- Whole-life insurance is like the value pack: It bundles together plasters (coverage) and Milo (investments)

The latter is fantastic for lazy millennials. We see insurance and investments as things to check off from our to-do lists. We know we gotta buy them at some point, but man are they boring to research!

So when a financial comes along and tells us that we can have BOTH packaged up into a single product, we’re super happy. We gladly take out our wallets and pay for it.

But what if I told you:

- That you were actually overpaying – sometimes by thousands of dollars every year– for the same coverage?

- That you could have used the money you saved to earn a much better return?

- That your financial planner was getting thousands of dollars in additional commissions, using your money to fund his new Audi? (Check out the Appendices in this excerpt – fascinating read if you’re a weirdo like me)

Would that change your mind?

Personal finance bloggers have been advocating term plans over whole-life and investment-linked plans for many years now. For example, check out articles from BigFatPurse, Dollars And Sense, Tree of Prosperity, and yours truly.

It’s no secret that I’m a big fan of term insurance. It’s like a nice, solid plaster: It’s cheap, it does ONE thing (give me coverage), and it does it well.

The Plaster Retailers

It’s a generalised statement, but I get the sense that financial planners like to promote insurance “value packs”, even if it may not be the best fit for the clients’ needs. I’m not saying that ALL financial planners do this; just that the system incentivises that sort of behaviour.

It’s a generalised statement, but I get the sense that financial planners like to promote insurance “value packs”, even if it may not be the best fit for the clients’ needs. I’m not saying that ALL financial planners do this; just that the system incentivises that sort of behaviour.

So I was pleased when a young upstart named DIYInsurance jumped on the scene in 2014, wanting to bring term insurance to the masses. They wanted to “create a transparent platform where people with insurance needs can come to a safe environment, to get advice, without feeling pressured to buy and knowing that whatever they are getting is best for them, and not because (DIYInsurance) earns the most from it.”

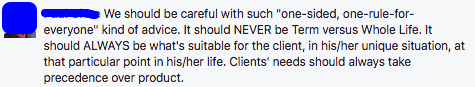

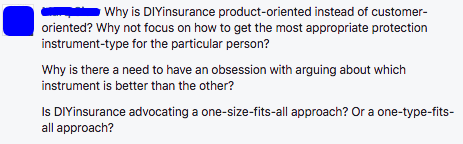

They started publishing content on term insurance. Naturally, this really pissed off the financial planners out there. Personal finance bloggers were one thing, but to have one of their own dissing their favourite product?

For example, check out their comments on DIYInsurance’s Facebook page:

Rawr! Them fangs are coming out.

At first glance, these comments seem to make sense. Shouldn’t insurance be customised to fit clients’ needs? Shouldn’t we avoid a one-size-fits-all approach?

We’re More Similar Than We Think

But if you dig just a little deeper, you’ll realise how hollow this argument is. It’s like criticising Apple for only promoting the iPhone, because it’s not “customised” to each unique individual’s needs.

Yes, we’re all unique individuals. But many of us have surprisingly similar needs:

- We all want to make sucky situations less sucky (for ourselves, and for our loved ones)

- We all have limited budgets

- Most of us only need insurance up to a certain point – not forever

For the purpose of insuring ourselves in the event of death and TPD (total permanent disability), I believe that term insurance meets the above needs for the vast majority of people. The customisation comes in when you tweak the parameters, for example the provider, the coverage period, the sum assured, etc.

In response to the (surprisingly entertaining) conversations on their Facebook page, DIYInsurance came up with a holistic consumer guide: The Case of Term vs Whole Life Insurance.

Read it – it’s surprisingly clear and insightful. It’s the ebook I wish I had 10 years ago, when I stupidly bought a whole life insurance policy and subsequently terminated it, costing me thousands of dollars.

Yes, it’s written by a company that sells term insurance, and yes, the guide advocates their cause. But I’ll challenge you to find a convincing opposing viewpoint that applies to most people. You’ll be hard-pressed to find one.

In short, when it comes to insurance – most people would be better off if they save their money and go for the plasters. The “value pack” just ain’t worth it.

And if you’ve had enough of my warped supermarket analogies, check out DIYInsurance’s guide. Here’s the link again.

===

P.S: I’m not saying that whole-life insurance is irrevocably bad. In some cases – e.g. when you have children with special needs and want to provide for them long after your death – it might make sense. But the argument here is that for most people, term insurance would meet their needs much better AND save them money.

Full disclosure: This is a sponsored post from DIYInsurance, and I purchased a term plan from them over a year ago as a normal customer. However, this doesn’t change my opinion – I’ve been advocating term insurance since 2012, way before DIYInsurance was formed. Ultimately, I only write articles on topics/companies that I support – and this is one of them.