Psst. I’m gonna teach you how to get free food at McDonald’s. You ready?

Psst. I’m gonna teach you how to get free food at McDonald’s. You ready?

You see, I visit McDonald’s at least twice a week to blog. Some people work at Starbucks, others do better at the library, but I get my creative juices flowin at Mickey Ds.

They’ve got free wifi, cheap coffee ($2.60 for their premium roast black coffee + unlimited refills is Singapore’s best kept secret), and just enough background noise to work in. I also have a hack that I’ve been using for years to score free or discounted food and drinks at McDonald’s.

I’ve used it to get free Ribena chills and Cokes, 1-for-1 chicken mcnuggets, free cheeseburgers, 1-for-1 McSpicy burgers… and loads more.

Free food is nice, but you can also use that same principle to earn airline miles to score every traveller’s dream: Free flights. If that sounds good to you, read on.

Here’s How It Works

First, download the McDonald’s Surprise Alarm app.

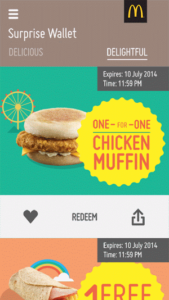

Here’s how it normally works: Once a day, it triggers an alarm on your phone and randomly gives you one of two surprises:

- A lame motivational message like “Reach For The Skies” or “Have A Great Day”. This is basically McDonald’s nice way of telling you “awww you didn’t win a prize, but try again!!“

- FREE OR DISCOUNTED MCDONALDS FOOD

Anyone who’s studied Marketing will see the genius of this app. By making you crave for goodies every day, Macs is hoping to entice you to spend more on them than you normally would.

But here’s what most people don’t know: You can manually set the alarm to go off at any time you want. As long as you’re only doing this once a day (defined as 12am – 11.59pm), you can choose to receive your surprise only when it’s convenient. This is how I do it:

- Most of the time, my alarm remains inactive

- Whenever I’m about to head into a McDonald’s, I launch the app and set the alarm to one minute after the current time. So if it’s now 3pm and I’m right outside a Macs, I’ll set the alarm for 3.01pm.

- Once I stroll in, I’ll have a 50% chance of getting some great deals on food I’m already buying

The Psychology Behind The App Hack

In short, I only launch the app when I’m about to head into a McDonald’s. This way, I use what I would have spent on anyway to potentially get more benefits out of it.

In short, I only launch the app when I’m about to head into a McDonald’s. This way, I use what I would have spent on anyway to potentially get more benefits out of it.

Worst-case scenario, I get a terribly corny motivational quote. But more often than not, I score a free Coke or a free pack of fries I can munch on while writing my blogpost.

But the McDonald’s App Strategy applies to more than just fast food – it works for anything you spend money on.

Think about how much you spend in a year. Add up your phone bills, family dinners, groceries, dining out, watching movies, vacations, taxis, entertaining, etc. What do you get? Ten thousand dollars? Thirty thousand dollars?

It boggles me that so many people still use debit cards or cash for their everyday spending. When you use cash, money goes out of your wallet and into someone else’s account, giving you exactly zero benefit.

Now, for some people who have problems with credit card debt, it might make sense to use debit cards or cash. But for most of us, it’s a lot smarter to use a credit card.

Think about it: Dozens of banks and card issuers are all fighting to get you to spend through their cards. They’re practically throwing freebies in your face to spend like how you’re normally spending. By using cash, you’re practically leaving money on the table.

Personally, I used to be a fan of rebate cards. But in the past few months, I’ve switched over to mileage credit cards because the value of the “prizes” – free flights – are a lot better than cash rebates.

How I Optimise My Spending Around Credit Cards

Here’s my strategy to maximise miles for my spending:

First, I completely automate all my regular bills, such as my S&CC charges, phone bills, and income tax, by having my credit cards pay them automatically every month. Then I pay off my credit cards automatically using GIRO.

These are basic necessities that I’ll spend on anyway, so I might as well earn some miles from them. Right off the bat, this translates to hundreds of free miles every month.

Next, I use mileage cards for every single transaction – whether it’s a $12,000 wedding dinner or a $1.20 bottle of water. I use cash only when I absolutely have to – usually less than $150 a month.

Here are some cards you could use for specific expenses

- For online or Visa Paywave transactions: The UOB Preferred Platinum Visa Card. Gives you 4 miles per dollar spent. Every day, I wave this little baby like Harry Potter doing a Patronus charm.

- For travel-related expenses: The DBS Altitude Visa Signature Card. Gives you 3 miles per dollar spent on flights/hotels/airbnb/OTAs.

- For everyday expenses: The UOB PRVI Miles Card or the Citibank Premiermiles card. Both have their pros and cons: The PRVI Miles card has a better earn rate, but the Premiermiles is a lot more flexible – It has no minimum spending or miles transfer thresholds.

There are also other cards that help you earn loads of miles on categories like dining, shopping, travel, etc. Different cards work for different people – maybe you don’t like miles and you prefer getting cash rebates or points instead.

However, the basic premise remains the same: Get a benefit out of every transaction you make.

Remember that the next time you walk into a McDonald’s. Launch your Surprise App, get your bonus, and use your credit card to pay for it.

Free food + free miles = awesomeness.

Image credits: siarkowski, Sean MacEntee

[…] In practice, I usually only earn about 1.75% in interest because I don’t buy any insurance or Unit Trusts from OCBC, or spend $500 on their credit cards every month. (I spend on other banks’ cards now ever since I switched my focus from rebates to miles) […]