One of my favourite movies last year was X-Men: Days of Future Past.

To save the X-Men from the Sentinels who want to fry them into goreng pisang, Wolverine travels back to 1973 to create an alternate future, forever altering the fate of the X-Men.

Which really got me thinking: What if I could travel back in time and talk to my 20-year old self?

What would I tell my younger self about money that would forever change my entire future for the better?

Here’s what I would’ve said:

1. Pay Yourself First

I get it – it’s really, really hard to save money when you’re 20.

Your tiny allowance is barely enough for meals, movies, and the occasional overpriced coffee and organic ice cream at some hipster cafe.

Here’s a tiny hack that’ll help you save with less effort: Pay yourself first. Every month, take $200 from your allowance and deposit it into a separate savings account.

It’s a lot easier to save money that you can’t see.

In all likelihood, that money would have been spent on random, forgettable things like snacks, coffee and cab rides anyway. So you probably wouldn’t even notice that it’s gone.

I only started doing this when I was 25. If I started at 20, I would’ve ended up with $12,000 just 5 years later – enough to pay for half of a modest wedding.

Can’t afford to save $200? Well, what about $100? Or $50?

The actual amount isn’t that important. What’s important is that you start as early as possible, and let your savings accumulate over time.

So you’ve taken care of your savings. What do you do with the rest of your money?

2. Figure Out Where Your Money Is Going

If you want to throw an epic party or take a spontaneous trip with your buddies, it’s totally cool. Really.

As author Ramit Sethi said, “It’s ok to spend on the things you love, as long as you cut costs mercilessly on the things you don’t.”

So do yourself a favor: First, figure out where you’re spending your money. Then, decide which things you care and don’t care about.

For example, I hate shopping. I find it boring. So I literally dress like a slob and spend zero dollars on clothes. But I splurge on overseas trips and hanging out with my buddies.

If you spend your money consciously, you get to control it. You get to move it to where it matters most. And you’re not feeling a single ounce of guilt while you’re doing it.

Need help figuring out where your money is going every month? Try implementing my Automatic Money Jar System, or pick up some budgeting tips from a free ebook published by the Institute for Financial Literacy (IFL).

You’ve optimised your saving and spending. Now let’s see whether we can make our money pie even bigger.

3. Build A Side Income

There’s a limit to how much you can save, but no limit to how much you can earn. Think that saving $200 is a big deal? Wait till you start earning money on the side.

As a 20-year old, you may not have a lot of money, but you’ve got a lot of TIME. So try using your skills to generate a side income.

Think you don’t have any skills that people would pay for? You’d be surprised.

- If you’re studying, parents will gladly pay you to tutor their kids.

- Good with computers? Frustrated laptop owners will gladly pay you to troubleshoot their software problems

- Do you know Photoshop? SMEs and blogshop owners will gladly pay you to design a logo for them.

- Spend all day surfing Pinterest? There’s plenty of demand for consultants in wedding, design, branding, and hundreds of other fields.

Even if you earn just $250 a month in side income (and many people earn way, way, way more than that), that’s $15,000 in 5 years. That puts you way ahead of your friends who’re just starting out broke.

You’re such a baller!

With all that extra cash, it’s time to turn to the Big Daddy of growing your wealth: Investing. But first, a quick warning:

4. Understand That Trading Is Really, Really Hard

It’s easy to feel invincible in your twenties. All your life, you’ve been told that as long as you work hard, you can achieve anything you want. I call this the financial Reality Distortion Field (RDF).

When you’re in the RDF, anything – including your ability to get rich quick – is possible.

In your quest to become super rich, you may come across some questionable “gurus” who’ll convince you that you can make $10K a month trading from home.

Be very, very, careful.

It’s tempting to listen to a convincing sales pitch and think that this is the once-in-a-lifetime opportunity you’ve been waiting for.

Step out of the RDF and look at the facts:

- The vast majority of professionals cannot beat the market

- Retail investors have an even more dismal performance

- If these trading strategies are so valuable, why are these “gurus” sharing it with you? Why not just trade it themselves?

Do your homework. Read reviews. Check out MoneySENSE’s advice on unregulated investment entities and schemes before you commit a single cent.

History is littered with the carcasses of 99% of hopeful traders who couldn’t see past their RDF. Don’t be one of them.

It’s really hard to get rich quick. What’s a better way?

5. Get Rich Slowly

When you’re 20, you have 40-50 years of investing ahead of you. That’s a LOOOOOOT of time for your money to grow.

Put your money in proven investments – like stocks and bonds – and stick with them for the long-term. This doesn’t get anyone excited at parties, but it works: The Motley Fool found that anyone who stayed invested in the market for 20 years or more always beat inflation.

Above all, start early. By starting to invest when you’re young, you’re giving yourself a HUGE advantage.

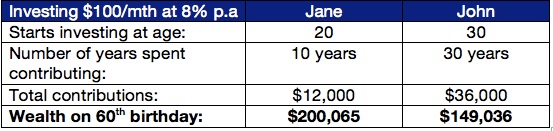

For example, let’s take 2 twins: Jane and John. Jane invests $100 a month in the stock market when she’s 20, does this for 10 years. And then she STOPS – she doesn’t invest another cent, but leaves her money in the market until she’s 60.

John only starts investing when he’s 30, contributing $100 a month for the next THIRTY years. Assuming the both of them get returns of 8% per year, who has more on their 60th birthday?

The answer: Jane! In fact, Jane has 34% more even though she invested less. And if she continued faithfully investing $100 a month until she was 60? She’d end up with $349,101 – more than TWICE of John’s wealth.

THAT’S the power of compounding interest. Never underestimate the power of starting early.

Take Action (And Maybe Win An iPhone!)

Lots of people will read this and say “Oh, that’s interesting!” and then go back to their lives without changing a thing.

But if you’re truly serious about growing your wealth, it’s time to take action. Today.

It doesn’t matter if you’re 20, 30, or 50. Just ask yourself: What would your future self wish you did today?

Pick ONE thing – and then commit to it.

How do you make sure that you commit? Research shows that when you write down your goals, you’re more likely to achieve them. Even better, making your goals public is one of the best ways to guarantee that you’ll take action.

And here’s the perfect opportunity for you to do so: The Institute for Financial Literacy is running a contest where they want you to tell them how you’ll be sensible with your money. And to sweeten the deal, they’re giving out an iPhone 6s 64GB to one lucky person.

Here’s how you can do take part:

- Step 1: Follow IFL on Instagram (@finlit.sg) or “Like” them on Facebook.

- Step 2: Leave a comment or post to tell them how you can be MoneySensible. (You can totally use the ideas I talked about in this post).

- Step 3: Hastag #BeMoneySensible #FinLitSG

For more details, check out http://finlit.sg/be-money-sensible/

Annnnnnndddd that’s it! It literally takes 5 mins, and you have nothing to lose.

But if you win that iPhone, remember which friendly personal finance blogger helped you out 😉

Quick note: This is a sponsored post for the Institute for Financial Literacy (IFL). Longtime readers of this blog will know that I’m VERY selective about sponsorship requests – in fact, I reject over 99% of such requests. But I love IFL’s mission of bringing financial literacy to more Singaporeans, so I was super happy to help. They’ve got some great free resources like ebooks, videos and talks, so definitely check them out.

Image credits: Bob Owen, bradipo, miguelavg, Mauro Luna, micheleart

1 and 2 are extremely important. Most people tend to miss that point. They are critical to growing financially.

And 4 is very true.

Yep! I’ve always believed that once you get your saving and spending right, everything else will follow 🙂