Poor Greece. Everyone is sees it as that irresponsible, bratty kid who borrowed money from the big boys, then stuck his middle finger at them and told them to go shove it.

Poor Greece. Everyone is sees it as that irresponsible, bratty kid who borrowed money from the big boys, then stuck his middle finger at them and told them to go shove it.

This week, I read this Quora answer on explaining the Greek crisis in layman terms. Check it out – It’s way better than watching a Channel 8 drama.

The story talks about how Greece took on some “credit card debt” [National Debt] to help out his family members who were too old to work. [Pensions]. Then Greece lost his job [Economic Downturn], took on more “credit cards” to pay off his debt [Issuing Debt to Make Debt Payments], is now faced with high interest rates, and has a pretty dismal chance of paying them off.

And it all started because of debt.

Debt is a funny thing, isn’t it? It could make you richer beyond your wildest dreams, or it could rip you to shreds and drive you out of your home.

It’s easy to point fingers and make fun of Greece for taking on more debt than it could handle.

But wait a minute – won’t the vast majority of us be in debt at some point? In the next couple of years, most of you reading this will probably take on the greatest debt of your life: A housing mortgage.

Sure, a housing mortgage isn’t like “normal” debt like credit cards or a car loan. It’s for a house that you’ll live in. And houses are investments… right?

But debt is debt. Even with the best intentions, we could easily make the same mistakes as Greece did.

This post isn’t for the 1% of you who can afford to pay off your entire house in cash. (Lucky you!)

For the rest of us who’re about to take on a housing loan, we first need to ask ourselves: How much should we borrow?

My Housing Debt Decision

So my fiancee and I recently paid our Option Fee for a resale flat we’ve been eyeing for a while now. It’s our first house, so we chose an affordable flat that was well within our means.

As I was going through the sums, I was faced with a choice: Should I take on MORE debt, or LESS debt?

I’m aware that having this choice in the first place is a luxury. I get the sense that many people these days tend to purchase houses they can barely afford, so they have little choice but to take on as much debt as possible.

But since you’re reading cheerfulegg, I’m gonna assume that you’re a sensible, financially responsible person who’s gonna buy a house you can afford. You probably have a nice stash of cash saved up, so the question is about your prior beliefs.

Most people fall into two schools of thought:

- The “Debt Is Awesome” camp: Take on MORE debt and use your cash to invest

- The “Debt Is An Evil Monster” camp: Take on LESS debt and use your cash to pay down a larger downpayment

Let’s delve a little deeper, shall we?

The “Debt Is Awesome” Camp

The people who fall into the “Debt Is Awesome” camp tend to be weirdos who attend personal finance talks and hang out at the investing section of Kinokuniya. (I’m generalising here, but yes that’s generally true)

They often take a cold, calculated look at debt vs investing:

- Take on more debt at a low interest rate

- Invest your cash at a high rate of return

- Everything is awesome

People in this camp believe that you should take on more debt when you’re young and then invest your savings in stocks. That way, the return from your investments will exceed the interest rate on your debt.

Over the long run, your portfolio will grow while your debt gets eroded by inflation. Even if you encounter an emergency (like losing your job), you can always sell your investments and use the proceeds to pay off your mortgage.

Besides, that nerdy financial blogger from cheerfulegg keeps saying that you should invest early, right?

The “Debt Is An Evil Monster” Camp

But wait a minute. The Greek crisis also taught us that there’s always a flip side of having too much debt.

First, being in debt sucks, psychologically speaking. No matter what happens, you’ll have to service it every month. For most people, that means:

- No quitting their jobs

- No risky-but-potentially-profitable business ventures

And since there aren’t any truly fixed interest rate loans in Singapore (no, not even HDB loans – they’re pegged to the CPF rate which can fluctuate!) – that also means a constant fear that interest rates might rise.

Nassim Taleb, author of the book Antifragile (aff) would tell you that debt makes you fragile: extremely vulnerable to sudden, scary shocks. For example, in a financial crisis, you’re not only at risk of being laid off, but it’s also precisely the worst time to sell your stocks if you need to cover your mortgage. People with less debt aren’t as worried about these scenarios because they have fewer liabilities.

To Debt Or Not To Debt? A Tool To Help You Decide

So – which option is better? Should we:

- Take on more debt and invest more?

- Take on less debt and invest less?

To me, the (boring) answer is what your doctor tells you about dieting: Everything in moderation.

In other words, taking on too much or too little debt is obviously unhealthy. Borrowing too much makes you too fragile. Borrowing too little makes you too conservative. We need to find a healthy middle ground.

Does it sound like a cop-out answer? Yes.

Is it sensible advice to follow? Definitely.

That “sweet spot” of housing debt will differ from person to person. For me, it might mean taking out a 70% housing loan. For someone else, maybe it’s something closer to 20%.

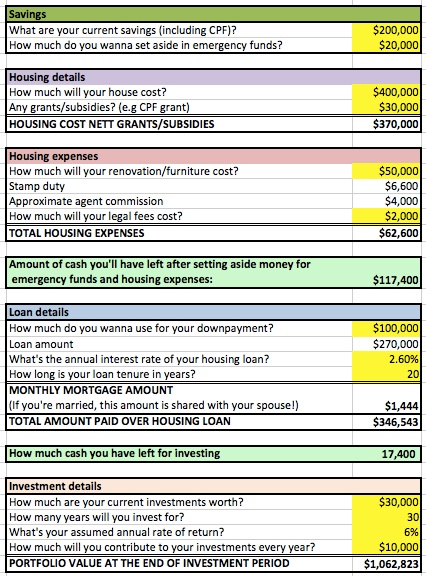

But it’s important to sit down, look through the numbers, and ask yourself important questions like:

- How much should you set aside in emergency funds?

- How much can you afford to pay every month for your mortgage?

- How much do you want your portfolio to be worth by the time you retire?

These questions will help you determine how much you should allocate to your housing loan vs your investment portfolio.

From my experience, the best way to figure this out is to take a look at a good ol’ spreadsheet. Numbers have an awesome way of giving you clarity.

I know, I know, the numbers can get a little hairy sometimes.

Which is why I created this nifty little Excel calculator to help you work them out:

Just plonk in the numbers in yellow, and presto! It calculates the essential figures for you.

It’s absolutely free – no strings attached.

If you want to receive more free tools like these and get my best content delivered straight to your inbox, sign up for my VIP list. You’ll also get my free ebook on how to save an additional $300 every month – and grow your wealth even further.

As always, I’d love to hear from you on whether you found this useful. Leave a comment below, or send me an email – I read every one.

Image credit: linkway88

Awesome post.

Although I am a bit old for taking on a new housing loan I find your thoughts and your spreadsheet very helpful.

Talking to my younger colleagues at work I often got the impression that they prefer to max out everything. And this includes buying a condo instead of a more affordable housing option.

Well, at least they do get a security guard (which they hardly need here in safe Singapore), a swimming pool (which they hardly use after initial euphoria), smaller rooms (less cleaning, right?) and the bragging rights of having a private Condo-address. And all this is worth at least twice the price of an HDB.

Ok, enough of that rant.

Planning ones housing loan is most valuable invested time. What I did many years back was to:

1) Make sure that the loan is manageable with one income to keep the option open that one of us could stay at home and take care of the kids (they will arrive sooner or later).

2) Do a prudent computation of the loan with 5% interest to compare, as sooner or later the interest rates will go back to the historic mean.

3) Keep the loan tenure as short as feasible, because here the magic of compounding interest clearly works against you.

In general a housing loan is one of the few good debt categories around. After all DEBT is not a bad 4 letter word if structured correctly.

I love this! Reminds me of the phrase on how people tend to “work too hard at jobs we hate, to buy things we don’t need, to impress people we don’t like.” I also like the idea of using a higher interest rate to compute your loan, although when I looked at the data it was hard to find a suitable average figure.

judging from the spreedsheet. i reckon taking a appropriate debt is better than taking low debt. since with investment of around 3% to 6% will win in a long run? so i assume the “person standing at the investing section” is right after all? correct me if i am wrong. But i appreciate and find your post super useful. lucky i am your vip member liao!

Well, yes and no. There’s often a psychological cost to debt that most people dont account for. So for some people, it might be better to simply pay off as much debt as possible, whereas for others, they might be able to live with more debt.

after doing the spreadsheet – what was your conclusion?

Like what I said in the post – a moderate level of debt, and a moderate level of investment

Thanks for this! I find it very helpful

1. The expenses for housing expenses can be reduced for to-be-married individuals (since the partner should be able to contribute half of these expenses) leaving more for investment.

2. The item”current savings” can be split to 2 components – CPF (OA) and cash or cash equivalents to better reflect the ‘usability’ of these savings. CPF savings cannot be used for housing expenses (I stand corrected) and some types of investments.

In general, your spreadsheet is very helpful and it gives a great overview of how one can plan for the future financially.