If you’ve been checking out the Singapore personal finance blogosphere, you might know Alvin Chow, who writes at BigFatPurse.com.

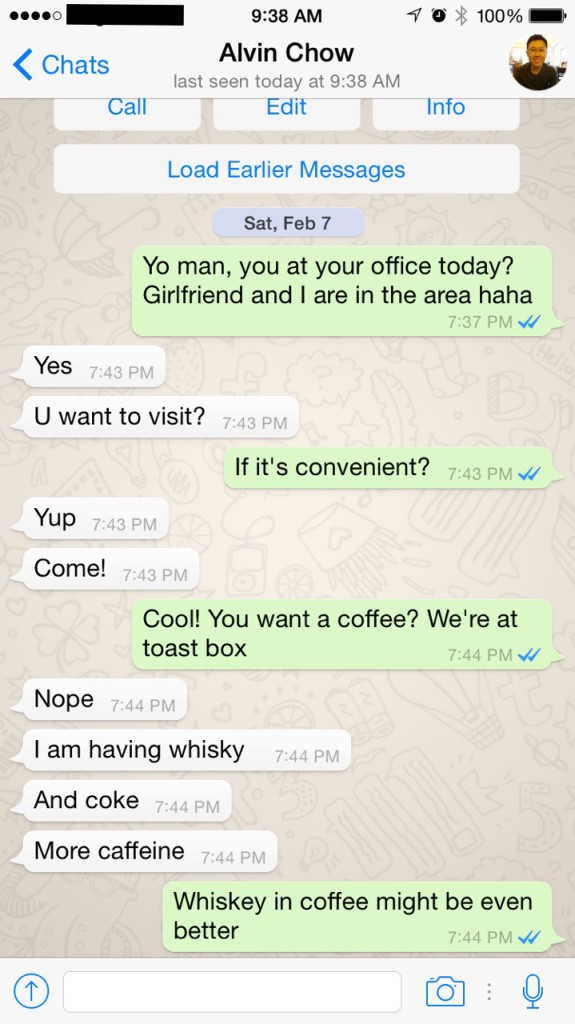

Alvin and I spoke at a couple of events together, and we’ve hung out a couple of times drinking beer/coffee and chatting about psychology and investing. So when I was in Dhoby Gaut last month, I texted him and asked if I could drop by his new office:

The dude was drinking whiskey. Before 8pm. That’s when I knew this was a guy I could be great friends with.

Friends help friends when they write books, so this post is all about his new book: The Singapore Permanent Portfolio.

First of all, I don’t normally promote other people’s stuff on this blog unless I think they’re really, really good. Sometimes, companies contact me wanting to advertise their website, app, book, investment scam opportunity and I usually ignore them.

But Alvin’s different. He quit his high-flying Air Force job to teach investing full-time, and he’s one of the rare people in the industry who teaches investing without all the annoying get-rich-quick-believe-in-yourself rah rah. Instead, he conveys his material in a straightforward, rational, no B.S way, which I really like.

So when he wrote his new book The Singapore Permanent Portfolio, I was super psyched to check it out:

The Permanent Portfolio Philosophy

First of all, the Permanent Portfolio has nothing to do with hair products even though it has the word “perm” in it. (Sorry, bad joke. Couldn’t resist).

Instead, it’s a passive investing strategy, similar to the index investing strategy I advocate on this blog. You can read more about the Permanent Portfolio philosophy here, so I won’t delve too much into it.

In summary, a investor in the Permanent Portfolio splits her capital equally between stocks, bonds, gold and cash. The concept is that at least one asset will perform well during the economic cycles of growth, deflation, inflation and recession.

I don’t practice Permanent Portfolio investing myself, but I agree with the general principles behind it. As Alvin writes:

- Most people are overconfident (I would say “delusional”) about their ability to pick stocks, so they’d be better off diversifying into a stock market index

- Most people overestimate to ability to hold on for the long term, so they’d be better off minimising volatility through asset allocation

- Most people spend a lot of time and effort actively investing with poor results, so they’d be better off following a passive strategy instead

Outline of the Book

The book is short – only about 70 pages – and I finished it easily within a day. It follows a succinct, no B.S structure:

- The Reality of Investing

- The Permanent Portfolio Concept

- The Permanent Portfolio Performance

- Implementing the Singapore Permanent Portfolio

- Maintaining the Singapore Permanent Portfolio

- Frequently Asked Questions

You’re not gonna find long, flowery stories of filler content to beef up the pages here. Instead, it’s a short, practical guide for people who’re looking to implement the Permanent Portfolio in Singapore.

What I really liked were the clear explanations of the underlying concepts, and the practical, succinct steps on how to implement it in Singapore. He lays it out in an unbiased, here-are-the-pros-and-cons-of-each-option manner.

Different, But Same Same

I completely agree with the underlying principles of the Permanent Portfolio:

- Diversify instead of picking stocks

- Hold on for the long-term

- Invest passively

- Rebalance regularly

Most people are delusional about their ability to pick stocks successfully. 90% of people reading this (including me) cannot beat the market, so we’re better off with a passive, long-term strategy instead.

However, the Permanent Portfolio executes it slightly differently compared to index investing which I advocate on this blog. I prefer to limit my portfolio to just equities and bonds, while the Permanent Portfolio adds gold and cash into the mix. Personally, I’m not a huge fan of gold as an asset class for a couple of reasons (it’s negative-yielding, and primarily a speculative “asset” instead of a productive one).

My approach to executing index investing also differs slightly from the Permanent Portfolio. For example, the Singapore Permanent Portfolio includes SGS bonds while I prefer investing in bond indexes. Or some Permanent Portfolio investors may invest solely in the STI while I advocate a more global approach.

Still, these differences are just nuances of the same overall strategy: Invest passively for the long-term.

Even among the passive investing community, different investors vary in their portfolio approach, and the Permanent Portfolio is just one of them. But as a study from Meb Faber Research shows, most of these portfolios performed pretty similarly over the long-run anyway.

So it’s not about whether the an index investing strategy is “better” than the Permanent Portfolio or vice-versa. The mark of a good investor is to be able to study different strategies, understand their advantages/disadvantages, and pick the one(s) that suit them the best.

Get Yo Copy!

From that perspective, the Singapore Permanent Portfolio is a great book for those who want to understand the characteristics and practicalities of implementing the Permanent Portfolio in Singapore. It’s a much better use of your money than some scammy active trading course.

Check it out, read it, and if you like it, you should buy Alvin a beer. (You’re welcome, Alvin).

The Singapore Permanent Portfolio will soon be available at major bookstores, but if you can’t wait, you can also order it online here.

Bought the book yo!

Terrific, I will be checking this book out. =)

Bought!