Warning: This post contains expletives. I hardly swear, but there are some situations where “gosh darn it” just doesn’t quite cut it. If you’re the kind of person who gets easily offended, don’t read this. No hard feelings

Warning: This post contains expletives. I hardly swear, but there are some situations where “gosh darn it” just doesn’t quite cut it. If you’re the kind of person who gets easily offended, don’t read this. No hard feelings

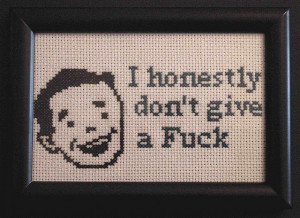

Mark Manson wrote an awesome article recently, titled The Subtle Art of Not Giving A Fuck. It’s full of f-bombs, but I loved the points he raised. Definitely recommended for the people who’re taking up pitchforks over the 5-10 cent transport fare hike announced this week.

So today, I wanna apply the philosophy of “not giving a fuck” to investing.

Some people might think that this is an odd perspective for me to take. Isn’t investing important? Isn’t this a personal finance blog? Aren’t I a hardcore advocate of index investing?

Yes, yes, and yes. Which is precisely why you shouldn’t give a fuck about investing. Or at least, give less of a fuck about it.

Here’s why:

Subtlety #1: Giving more fucks won’t make you a better investor

90% of investors give too many fucks when it comes to their investments. Here are just three out of the hundreds of lame issues that investors gave a fuck about these past 2 weeks:

- Falling oil prices

- Europe’s stimulus package

- The Swiss Franc going crazy

- Singtel’s horrifying new logo and grammar apocalypse

Here’s the dirty little secret that CNBC doesn’t want you to know. For 99% of you, exactly NONE of this matters to your investments. Zero. Zilch. Nada.

Think about it: The vast majority of the world has their panties up in a bunch about “the economy” and “when is the best time to buy stocks”. And the vast majority of the world is terrible at investing. Doesn’t that tell you something?

So, giving more fucks doesn’t make you a better investor.

It’s just like corporate life – just because you stay in the office till 10pm every day doesn’t necessarily make you a top performer. In fact, it’s often counterproductive: There’s a clear negative correlation between productivity and number of hours worked.

It’s the same when it comes to investing. Bloomberg, investment columns and $8,888 investing courses exist to try to convince you to exert more effort in your investments: Study this chart! Use this pattern! Watch out for the US unemployment figures!

As Mark Manson said, “We all have a limited number of fucks to give.” Don’t waste them on the inane details that the financial industry wants you to believe or buy. Save them for the couple of important things that will truly help you invest successfully.

Subtlety #2: Just because you give less fucks doesn’t mean that it’s not important

A lot of people assume that not giving a fuck about investing means not caring at all. That’s not true.

Many young people don’t care about investing. They’ll say things like, “It’s too complicated. I’ll figure this stuff out later”. And then they’ll wake up 20 years later and realize their savings are worth about 2 rolls of toilet paper. Not good.

Instead, I think you SHOULD care about investing. You SHOULD care about:

- Starting to invest early

- Investing over the long-term

- Diversifying

- Keeping your costs low

- Not being a dumbass

What you shouldn’t waste your time on are the lame short-term tactics that we talked about in Subtlety #1. That’s what I mean by giving less fucks.

Just like when it comes to your career: You SHOULD care about making genuine contributions and creating great products and making your customers happy. These are all important things.

What you shouldn’t give a fuck about is the fact that Sally from Accounting is giving you a hard time because you submitted your cover page in font size 11 instead of 12. In the grand scheme of things, things like that don’t matter. Fuck Sally.

Investing is important. A lot of the details aren’t.

Subtlety #3: Not giving a fuck is a luxury

I blog a lot about hatching a rich life – in more ways than just about money. Sometimes, hatching a rich life means spending on the things you love. Sometimes, it means creating something amazing and sharing it with the world.

But sometimes, it means having the luxury to just not give a fuck.

The world wants you to believe that this piece of news, this chart, or this tactic is The Most Important Thing Ever.

But once you know you have the right strategy, none of it matters. Once you’ve checked off investing on your to-do list, you can move on with your life.

That’s what I love about index investing: Because it lets me invest with less time and effort, and I can then focus on doing things like slurping ramen and waving my Harry Potter wand at people and yelling “AVADA KEDAVRA!!”

And that, my friends, is true luxury.

Image credit: Stitch Out Loud

Great to find another Mark Manson fan in the Singapore blogosphere!