Do the most successful people work the hardest?

Do the most successful people work the hardest?

Think about your co-workers in your office – I’m willing to bet that the guy who stays late every day isn’t the guy who’s most likely to get promoted.

I’m not saying that it’s bad to work hard – it’s ok to obsess about your work sometimes – but I find it fascinating that those who produce the best results are often the same people who’re able to leave the office on time.

These people fascinated me. I was insanely curious: How do you become successful while having a life?

The 80/20 Rule

It’s easy to write these people off as just being born “smart” or “efficient”. But I suspect that it’s something a lot deeper than that.

Everyone has the same number of hours in a day, and has access to the same resources. But the key differentiator is what these people choose to focus on.

They don’t necessarily work harder than most people. Instead, out of the dozens of tasks they could do in any given day, they choose the ones that will produce the most results: The 80/20 Rule.

As Tim Ferriss writes in The 4-Hour Work Week:

Doing something unimportant well does not make it important. Requiring a lot of time does not make a task important.

From this moment forward, remember this: WHAT you do is infinitely more important than HOW you do it. Efficiency is still important, but it is useless unless applied to the right things.

In other words: More work doesn’t necessarily translate to better results.

How A Dumb 25-Year Old Got Better At Investing

I can attest to this advice from my personal investing experience.

When I first started investing, I believed I could conquer the world. I had a Masters degree in Finance, so I thought I could use my knowledge and apply all these statistical techniques to devise a perfect trading strategy.

I worked long hours – often way into the night. Once, I joined my family on a holiday to Perth, and I was so frustrated by my research that I stayed in the hotel to work while my family went out to enjoy themselves. It was a pretty crappy period in my life.

Then, I discovered index investing, and I never looked back.

For the past 4 years, I haven’t studied a single annual report or a single stock chart. I read the financial news about once every 3 months. If you ask me why the market went up and down yesterday, I’ll be like:

Yet, by following the 80/20 Rule and focusing on the right things, I’ve been investing way better than I ever have.

How?

80/20 Investing: The Evidence

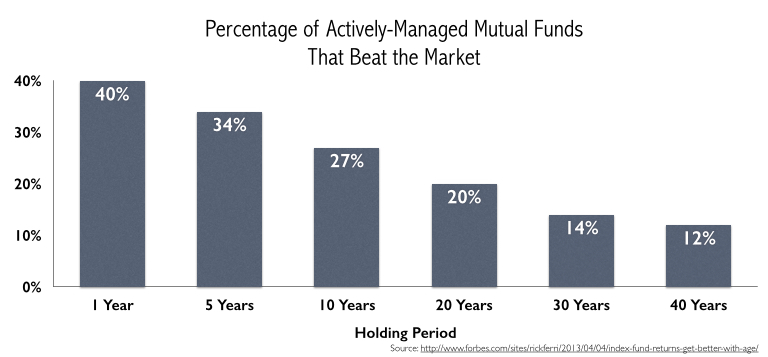

To answer that question, we need to turn to a study which looked at the performance of actively-managed mutual funds over a 40-year period.

Mutual funds are run by smart, hardworking people. Investing is their bread and butter, so obviously they need to do things like:

- Do research

- Keep up with economic news

- Speak the companies they invest in

- Attend earnings calls

- Analyse their performance

Ever see those fund management ads on the MRT bragging about how much they know their market? That’s them showing off how hard they work.

But does it translate to better results? Let’s see:

Source: Index Funds Get Better With Age by Rick Ferri, Forbes

Let me break this down for you. Despite all the work they do:

- Only 40% of them managed to beat the market over a 1 year period

- Only 27% of them managed to beat the market over a 10-year period

- Only 20% of them managed to beat the market over a 20-year period

In other words, if you had simply bought the market and went to sleep for 20 years, you would have beat at least 80% of them.

More Work Doesn’t Translate To Better Results

This is pretty counterintuitive: Most of us were taught that if we want to invest successfully, we need to put in hundreds of hours of work.

All the financial gurus tell us things like, “Make sure you study your stocks!” or “Make sure you know your market!”

Yet – how do you reconcile this advice with the fact that you can beat most PROFESSIONALS by simply buying the market?

No studying stock charts. No reading annual reports. Just a simple, buy-and-hold strategy.

Of course, some work is needed at the beginning.

- You need to figure out how to allocate your money between stocks and bonds.

- You need to research the indexes you wanna buy

- You need a strategy to add to your investments every month.

But after the initial work is done, it’s pretty much a breeze: Hold on to your investments, and add to it regularly.

So if you’re putting in hundreds of hours into your investments with no results (like I was), maybe it’s time to try a different strategy.

Maybe it’s time to be a little smarter about your investing: By applying the 80/20 Rule and investing in indexes.

Quick Reminder

I’ll be speaking about index investing at the inaugural Personal Finance Investment Seminar this Saturday (the 17th) along with several other amazing bloggers. I’m a little nervous (first time speaking on stage!), but I’m super psyched to meet you.

It’s already sold out, but if you have tickets, I’ll see you there! Remember to come give me a high five

Image credits: Cristolakis

Hi Lionel,

True and even very true what you are sharing here.

A clever person once said: “What is harder than finding a needle in a haystack? Finding a needle in a needle stack.” Nevertheless so many people are trying to find that needle (the 100% solution) in the stock market.

You and me do prefer to buy the entire needle stack right away with broad based and low fee Index Funds (ETFs).

By the way I have found out that the regular savings plan into ETFs is also a great way to overcome the Indecision Bias (once you have set it up).

Lionel, I wish you the best of times sharing your vast knowledge at the Personal Finance Seminar.

Unfortunately I was not able to get hold of a ticket. But I am sure you will tell us all about it in one of your next blogs.

Andy

Thanks so much Andy! I’m also speaking at Invest Carnival (investcarnival.com) in a couple of weeks, so feel free to come down and say hi if you’re free!

Love the quote about the haystack btw

hey lionel. Great post. any chance you have extra tickets which you can slip to me ? hehe