Last year, I wrote a post where I broke down the exact figures on how the average Singaporean could save $100K by 30.

Last year, I wrote a post where I broke down the exact figures on how the average Singaporean could save $100K by 30.

Over the next few months, I received dozens of responses on the post, and I found the insights super fascinating. Respondents generally fell into 2 camps:

- Group A: “I never thought that saving $100K by 30 was possible until I saw your numbers. I’ll increase my monthly savings to $X, and if I get promoted next year I should be able to hit $100K by the time I’m 32.”

- Group B: “This is so unrealistic. What about car expenses and holidays? What’s the point of having $100K by 30 if I give up my social life? Btw, I’m hoping to become a millionaire by 45. Please tell me how. Kthxbye!“

Guess which group is more likely to succeed?

The people who succeed aren’t obsessed about whether the study’s assumptions are “right” or not. Instead, they know how to tweak the assumptions to fit their lives, and take action to get closer to their goals.

That’s way further than what the keyboard warriors of Group B will ever achieve.

And so today, I’m writing this post for those in Group A.

We’re going to go beyond $100K and get into the big leagues. Today, I’m going to show you how you can retire with a $3 million-dollar portfolio.

Why $3 Million Dollars?

Let’s not get fixated on the figure of $3 million dollars. Some people need more, and others need less.

But I chose $3 million because it’ll be worth approximately $1.1 million by the time you retire, assuming you’re in your twenties. (I’m using Singapore’s long-term inflation rate, found here)

Together with your house, savings, CPF and all that jazz, you could probably give yourself a nice, cushy $5,000 monthly income (in today’s dollars), And retire very comfortably.

$3 Million By Retirement – Why It’s Totally Possible

Retiring with $3 million is way more than what 90% of people will ever save in their lifetimes. Yet, paradoxically, anyone can do this. You don’t need to be a graduate. You don’t need to be a fancy investment banker. You don’t need to come from a rich family.

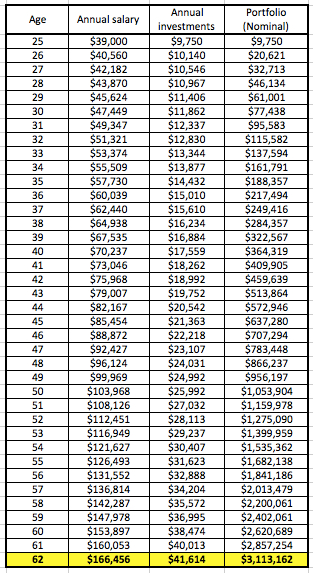

The average 25-year old Singaporean starting with the median salary of $3,250 can do this. Here’s how:

Assumptions:

- Starting median salary of $3,250, based on MOM’s figures

- Salary increases by 4% per year (based on MOM’s statistics on the average wage increase over the past 10 years)

- Investor invests 25% of his/her salary

- Investments rise by 7.5% a year

(Feel free to download my spreadsheet and play around with the numbers.)

The numbers are clear: If you want a $3 million portfolio by the time you retire, invest at least 25% of your salary.

Now, let’s work through some of the common objections that I know some of you might have:

“But I can’t invest 25% of my salary!”

Yes, 25% is a huge chunk of your salary. What do you want me to say? I’m not here to tell you bedtime stores. I’m here to tell you that if you want three million buckeroos, you’ve got to make some sacrifices.

Personally, I invest more than 25% of my salary and I’m perfectly happy with my lifestyle. I don’t own a car, I don’t shop much, but I love restaurants and take a 2-week vacation every year. It’s all about spending on what you love and cutting costs on the things you don’t.

Two other considerations:

- First, this is based on the median starting income. If you’re earning more, you can probably invest a lower proportion of your salary and still hit $3M by 62. Of course, the more you invest, the larger your long-term rewards.

- Next, your salary will rise as you become more experienced. It might be a little tight when you just start work, but as your salary increases, you’ll have more to play around with.

Besides, if you can’t invest 25%, can you do 20%? Or 15%? Any amount is better than doing nothing at all. Even if you invest just 10%, that still puts you way ahead of the Group Bs.

“Aren’t stock returns going to be lower going forward?”

I’ve always advocated investing in a global portfolio of stock and bond indexes.

Here, I’m assuming that a portfolio of 80% stocks and 20% bonds will give you a return of around 7.5%.

This was based on US stock and bond returns from 1802 to 2006, which were 8.3% and 5.0% respectively. (From the classic Stocks For the Long Run. This includes the period before the US was the world’s largest industrial superpower).

Also, for reference, the Singapore stock and bond markets returned around 10% and 3% a year for the past 10 years.

Are these reasonable assumptions? In my opinion, yes.

Are returns going to be lower in the future? Who knows? We can debate endlessly about what future returns will be, but here’s the thing: What’s the alternative? Trading forex? Small-caps? Gold? Bitcoin?

You could go for these sketchy options if you wanted to, if you’re willing to accept the huge risks involved. (Personally, I don’t want to run the risk of eating Maggi Mee and Khong Guan biscuits after I retire)

The truth is, a portfolio of stock and bond indexes are the most solid, robust and proven vehicles to grow your wealth. Nothing else even comes close. Stick with them for the long-term, and you’re almost certain to come out on top.

Side note: I’m putting the finishing touches on my revamped course that will teach you exactly how to create your own portfolio of indexes. If you’d like to get in on the early bird list, you can sign up here.

Nobody Said It Was Easy

I never said that retiring with $3 million dollars was going to be easy – Very few people would be willing to invest 25% of their salary (or more!).

But then again, very few people retire rich.

To the Group Bs reading this, it’s totally cool if you don’t agree with my study. Feel free to tear down my assumptions and say that I’m being unrealistic.

But remember that while most people are sitting around and complaining, the Group As out there are quietly making themselves richer.

Image credits: sheila_sund

Hi Lionel,

Great post! Love it. =)

“The people who succeed aren’t obsessed about whether the study’s assumptions are “right” or not. Instead, they know how to tweak the assumptions to fit their lives, and take action to get closer to their goals.”

The above probably sums up what all finance blog readers should do.

I understand everybody’s situation and preferences are different so seriously, there’s no point comparing and grumbling till the cows come home. What we can do is to always learn and take pointers from others to improve our processes to better attain the unique financial goals we set for ourselves.

Good spreadsheet, pretty realistic assumptions and I am looking forward to the launch of your revamped course. =)

Thanks 15HWW!

Anyone realize the sad truth that NOT all workers will have salary increment year and year and keep moving up with promotions with more salary adjustment?

Many workers will be stuck for years without any salary adjustment or increments until Government intervene the labour market.

The annual salary and annual investments put in have not taken into account any bonus payouts.

Assuming the worker would have at least a month’s bonus each year, would be able to supplement any salary incremental shortfall of the 4%.

Of course you can have the feedback that some workers do not have bonuses at all, in which the worker should either have a reflection on the company if it is worth working for, or on himself that he’s not performing.

Cheers.

Actually you did not reveal what portfolio of index stocks you advocate. because small caps funds can be rather nifty. you do not have to be expose to increase risk. its up to the portfolio manager to balance things up with an understanding of portfolio management.

what assumption did you make for the bond investment? I cant think of a low-cost way to invest monthly in bonds unless you RSP into a bond fund – but which bond fund would you recommend? They all seem to have high expenses compared to UK/US bond funds.

Hey Serendib! You can invest monthly into bonds using an RSP like you mentioned, or using bond ETFs.

Hi Lionel,

Thanks for the sharing. Just a note that the 4 per cent increment year-on-year till age 62 is a tad unrealistic.

There is an official/unofficial salary ceiling in most companies. A straight line extrapolation is too optimistic. You may want to consider a parabolic projection instead.

Great post! Looking forward to know more about your revamped course too