Imagine a world where nobody knows how to pick stocks.

Imagine a world where nobody knows how to pick stocks.

There are no investment books, no brokerages, and no annoying financial gurus trying to sell their stock-picking courses for $2,888.

Instead, people “invest” using a very simple method: Flipping a coin.

If your coin lands on Heads, you make money. If your coin lands on Tails, you lose money. Every year, you flip your coin and the outcome will determine whether you’re profitable or unprofitable. What would the results look like?

The Battle For The Top Half

Well, at the end of the first year, approximately half of the world’s investors would have flipped Heads and other half would have flipped Tails. So if we ranked all the investors by performance, around 50% of them would be in the top half at Year 1.

At the end of Year 2, everyone flips their coins again. Now, what’s the percentage of investors who remain in the top half after 2 consecutive years? The answer, of course, is 25%. The percentage of those who flipped Heads twice in a row would be 50% x 50% = 25%.

We repeat this in Year 3, Year 4, and Year 5. At the end of Year 5, how many of the coin-flipping investors managed to stay within the top half for 5 years straight? Taking the same logic, the answer is 50% x 50% x 50% x 50% x 50% = 3.13%.

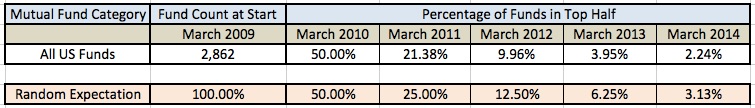

So if investing was completely random, we can expect 3.13% of investors to remain in the top half for 5 years straight:

But investing success isn’t random. Professionals pour millions of dollars researching the right stocks to invest in, so they should do better than just flipping coins… right?

How Investors Perform In the Real World

A huge chunk of invested money comes from mutual funds (we call them “unit trusts”in Singapore), who are run by smart professionals investing on behalf of people like you and me.

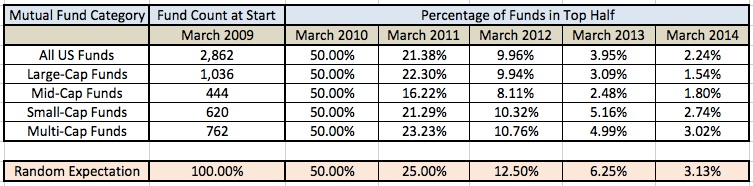

Standard & Poor’s did a study where they looked 2,862 US equity funds starting in March 2009 and studied how they performed over the next 5 years. Out of the original 2,862 funds, only 64 (2.24%) managed to stay in the top half for all 5 years.

Even if you break them down by investing style, there wasn’t a single instance when the industry managed to outperform random coin flips. D’oh!

By the way, I’m not even looking at the top funds here. We’re only studying those in the top half – a relatively lenient criteria. And yet, these so-called “professionals” disappoint.

What Should We Make Of This?

I’m not saying that it’s impossible to consistently outperform when it comes to investing. All I’m saying is that the probability of doing so is extremely, extremely low. As Keith Loggie, a senior executive at S&P Dow Jones Indices, said,

“The chance of any outperformance persisting for any extended period is very low. And it’s extremely unlikely that you can pick an outperformer based on past performance.”

So if someone comes to you with a strategy that has “beaten the market” for the past 5 years, I’d advise you to be very, very careful. It’s hard to determine if that performance was a matter of skill… or pure, dumb luck.

Let’s not forget that the professionals are supposedly more skilled at investing. If they have such a dismal track record, can you imagine what the results would look like for retail investors?

The lesson here is clear: Since investing is very close to a random walk (fancy academic speak for flipping a coin), you’d be better off investing in a sensible, low-cost, diversified index like the STI or the S&P 500. Singaporean investors can easily do this by building a portfolio of index-based ETFs.

When you invest in the index, you don’t try to beat the market. Instead, by simply matching the market, you can consistently beat the vast majority of stock-picking investors.

Food for thought.

Speaking of food, I’m off to get some breakfast and I’m undecided between prata or McDonald’s. Maybe I should flip a coin

Note: Inspiration for this post came from this NYT article. I crunched the numbers and altered the presentation in a way that hopefully gives you a better idea about what the stats are saying.

Image credit: nicubunu.photo

Well written, i am a “converter” into automatic investor by Andrew Hallam and you. Awaiting for your next project.

Totally honoured to be in mentioned in the same sentence as Andrew Hallam thanks Jaron!

thanks Jaron!