Don’t tell anyone because I’m embarrassed, but I used to be a HUGE Eminem fan. I’d come home from school, use my comb as a makeshift mic, and lip-sync to all the songs on The Marshall Mathers LP on full blast. (Since I’m such a huge nerd, that was about the most gangsta that I’ve ever been in my entire life).

Don’t tell anyone because I’m embarrassed, but I used to be a HUGE Eminem fan. I’d come home from school, use my comb as a makeshift mic, and lip-sync to all the songs on The Marshall Mathers LP on full blast. (Since I’m such a huge nerd, that was about the most gangsta that I’ve ever been in my entire life).

So when the movie 8 Mile came out, I went nuts. I loved that final rap battle between Eminem’s character and his arch-nemisis Papa Doc. Here’s a link to the clip – the final battle happens around 6.26, but watch the entire clip if you can because Eminem is a lyrical genius (Warning: It’s full of f-bombs so don’t watch it if you have kids around you).

You know why it was awesome? Because Eminem defeated Papa Doc not by bragging, but by highlighting all his weaknesses. By the time he was done, Papa Doc had nothing else to say and the battle was over.

And so 8 Mile inspired me to write a post all about the weaknesses of index investing. Two weeks ago, I wrote a completely biased review of different investing strategies, and if you read it you’ll know that I truly, absolutely, 100 percent sompah, believe in index investing.

But it wouldn’t be fair if I highlighted only its strengths. You see, scammy financial “gurus” will try to sell you a strategy by hiding all its weaknesses. But only true believers will be confident enough to come out in the open and be as transparent as possible.

And so in true Eminem style, I’m going to diss the strategy that I personally invest in, and highlight everything that could go wrong.

Mic check, 1, 2. Ay yo.

The Market Bucks Its Centuries-Old Trend of Rising

Let’s say the stock market suffers a dramatic crash, and stays dead in the water for 50 years. You wait, and wait, and wait, and on your 102nd birthday you refresh your brokerage account and see a profit of $2.67 before gasping your last breath.

I won’t deny that it’s totally possible, but it’s also extremely unlikely.

Stock market crashes happen all the time, but the market has always recovered if you were patient and held on. (Fun fact: If you held the stock market for at least 20 years anytime between 1871 to 2012, you never lost money even after inflation, no matter when you started!)

Is it possible that something crazy permanently prevents the stock market from rising ever again? Say, a cataclysmic war, a devastating asteroid, or robotic dinosaurs from space invade Earth and poop all over the place? Sure – anything’s possible.

But if that happens, your investments are probably the least of your concerns. In the 99.999% of all other possible future scenarios, it’s pretty safe to say that the stock market will rise over the long-term.

The Market Has Crappy Returns For Years and Years

Some pundits predict that stock returns could average as low as 2 to 5 percent in the next 10 years. When you read predictions like these, it’s easy to get discouraged, stare out at the sky, and feel sorry for yourself (Some of the more enthusiastic investors out there might feel compelled to do something extreme like… organise a protest at Hong Lim Park).

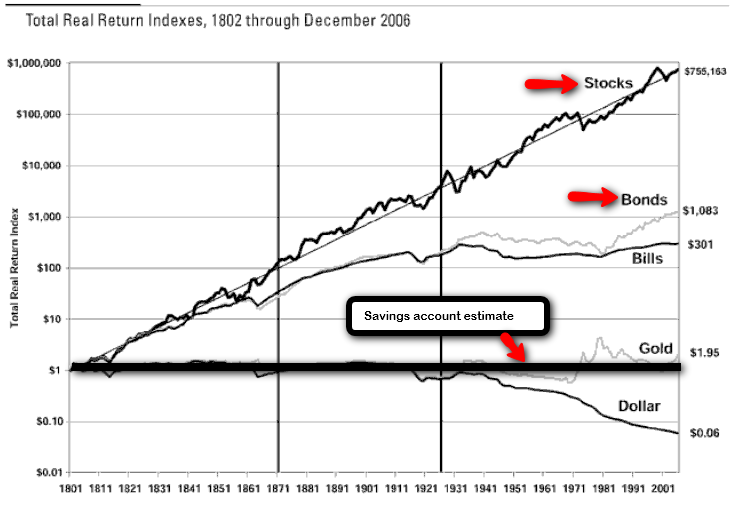

My response: What’s the alternative? Gold? Bonds? Bitcoin? None of these have long-run returns that come even close to that of the stock market. What about picking individual stocks or timing the market? Sure, you could do that – but good luck: hundreds of studies have shown that the vast majority professionals can’t beat the market consistently.

Pundits can argue until they’re blue in the face about whether the stock market’s future returns will be 2 percent, 5 percent, or 10 percent. At the end of the day, it doesn’t matter. Regardless of what the exact figure is, the fact remains that the stock market has beaten the crap out of any other asset or strategy over the long run, and will likely continue to do so.

Everyone Discovers the “Secret” of Index Investing

A funny thing happens when you try to talk to short-term investors about investing. They suddenly become one of those annoying smart alecs back in Primary School, covering up their homework and refusing to let you take a peek at their answers. (Gawd, I hated those guys.)

Why are they so paranoid? Because they’re afraid that if they tell you about their “secret” strategies, everyone will start copying them and they won’t make money anymore. So will that happen to index investors as well? As a reader writes,

What happens if literally everyone jumps on the bandwagon? Wouldn’t that change the macro-investing landscape somehow, and the people who started investing slowly and steadily lose their edge like the original value investors?

It’s a fear that’s totally understandable, but misguided. Unlike other types of investors, index investors are never afraid of losing our edge because we didn’t have one in the first place. Our strategy is simple: We track the market’s returns and don’t try to beat it. When you’re talking about a horizon of thirty years, terms like “alpha” and “edge” become irrelevant. Edges will come and go in the short term, but a sound strategy stands the test of time.

In fact, the more index investors there are, the better it is for us! A solid base of true long-term investors will help to support the market, keep it stable, and push it onwards in the long-term.

You Abandon It Altogether

Here’s the number one reason why an index investor might fail.

That reason has nothing to do with Wall Street, the economy, or what Ben Bernanke had for breakfast today. The most likely reason for an index investing strategy to fail is that the investor simply gives up on it. And there are plenty of ways that could happen:

- The investor panics during a recession and sells at the bottom

- The investor abandons it for a sexier strategy like investing in Hello Kitty currencies (ooh, pink!)

- The investor suddenly becomes convinced of his/ her ability to trade forex for a living. If this is you, stop reading this blog right now and sign up for a few scammy financial guru talks on Groupon. They might even have free food!

At its core, index investing is simple and sensible. The hardest part of it is sticking to it for the long-term. YOU are the biggest reason why it could go wrong.

Not Everyone Is Ready For Index Investing

Not everyone has what it takes to make a long-term commitment and hold on for the ride. Not everyone is disciplined enough to focus on the long-term and ignore the day-to-day movements of their portfolio. But if you’ve started index investing early and are in this for the long-haul, then great rewards await you.

If you’re not ready, no worries. I’d encourage you to research other investing strategies first. During your research, remember to always look out for what could go wrong. I’ve already helped you to do just that for index investing, because I believe in being completely honest with you.

Hey, that’s what Eminem would do.

P.S: For more honest thoughts on psychology, personal finance, and hatching a rich life, be sure to join my VIP List!

Whatever kind investing, it’s when you need to sell that counts.

Nice one!;)

“Is it possible that something crazy permanently prevents the stock market from rising ever again? Say, a cataclysmic war, a devastating asteroid, or robotic dinosaurs from space invade Earth and poop all over the place? Sure – anything’s possible.

But if that happens, your investments are probably the least of your concerns. In the 99.999% of all other possible future scenarios, it’s pretty safe to say that the stock market will rise over the long-term.”

It’s so true. IN the event something really bad occurs such as GFC 2 for eg, even our POSB and Temasek holdings might not save us, no matter they guarantee us for $50k per bank account. It’s meaningless by then because everything would have crashed.

Since… at the worst, everything should crash, then we might as well take a stride towards index investing.

(by the way, nice speech just now. I particularly like it when you said “chao xia (out of tune)” as you tried to say the word ‘dog’. Catches my wife’s attention and your graphs later too. felt blessed.”