Investing is controversial. It’s like health, religion, politics, CPF, or Chicken McNuggets sauce – Everyone has a strong opinion about which is the best. In fact, we will go to the ENDS OF THE EARTH to defend our opinions, which is why I think this post is gonna piss a lot of people off.A lot of people have been asking me for a comparison of different types of investments and strategies. I haven’t written one yet because I hate comparison lists – I mean, does anyone really wake up and say, “YES! I really need another pros and cons list!!“

Investment-Linked Plans

What they are:

When your friends graduated from university and became financial planners, you might’ve noticed how they suddenly became very interested to meet you for coffee. When you eventually answered their phone calls and met them, you were most likely subject to a convincing sales pitch around an Investment-Linked Plan (ILP).

ILPs were my very first foray into the world of investing, and buying one taught me a valuable lesson: Nothing is as shiny as what it says on the brochure.

ILPs work like this: You give your money to your annoying financial planner, he gives it to a unit trust, the unit trust buys some shares on your behalf, and you get some insurance coverage on the side.

What’s good about them:

For people who have ABSOLUTELY NO CLUE about investing, or who don’t want to take 2 hours to read a good investing book, then ILPs MAY be better than keeping money in a POSB savings account earning 0.05% per year. (Gee, thanks for the 25 cents in interest last year, POSB! You’re the best!)

It’s hassle-free: Your money is GIRO-ed out of your bank account, invested, and bam, you’re done. Hopefully, in 30 years time, you’ll get back more than what you put in.

What’s not so great:

For the vast majority of people, ILPs are a terrible idea. They do a horrible job at the two functions they’re supposed to perform: investing and insurance.

Let’s take investing. Before your money gets invested, a HUGE chunk gets wiped out for “administrative fees” (i.e: your financial planner’s downpayment on his new Mercedes). And when it does get invested, another huge chunk gets eaten up by the unit trust’s “expense ratio” – often as high as 1-3% of your investment amount every year. By then, so much of your premiums have been gobbled up that your net returns are often pretty pathetic – maybe even as low as 2% a year.

ILPs don’t help you in the insurance department either because you get a pretty crappy bang for your buck. You can get better insurance coverage at a much lower price by buying something called “term life” insurance. Google it, because your financial planner will probably discourage you from buying it. (Since he doesn’t get a great commission from selling it to you)

Technical Analysis

What it is:

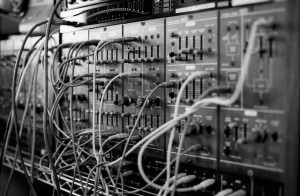

Ah, technical analysis – It’s all about the charts, charts, charts. Technical analysis (TA) involves looking at the price history of different investments, and using the patterns like “Support & Resistance”, “Head and Shoulders” (no, not the shampoo), “Death Cross”, or “Pink Money Howling At The Moon During A Solar Eclipse” (Ok, I made that last one up). Technical analysts use these patterns to discern market psychology, and then use that to predict whether the price is going up or down.

What’s good about it:

The good thing about TA is that it can be applied everywhere. Since any asset can be reduced to a price chart, you can apply it to anything you want: stocks, bonds, commodities, forex, etc. As long as you know the patterns, you can trade it. No deep analysis or financial news required!

Believers say that it works because it’s self-fulfilling. Since patterns like “Support & Resistance” are so widely-known, traders anticipate that other people will be following it, and so the “prediction” comes true.

What’s not so great:

Unfortunately, most of it is mumbo-jumbo. As humans, we’re naturally predisposed to see patterns in everything we come across, even if none exist. When I was a naive college kid, I’d see patterns and trading opportunities in everything. Why? Because deep down, I wanted action. I wanted to trade like Gordon Gecko, yell “Sell! Sell! Sell!” into a phone and make lotsa ca$$hh monehhhh. But most of the “patterns” I saw turned out to be duds.

It’s also subjective as hell. Give the same chart to two technical analysts, and they may come up with two completely different predictions. It’s almost like reading tea leaves – There’s just no precise way to determine which patterns on a chart are relevant. Sometimes, when I see some TA-wannabe staring at a chart on his iPad, I have an overwhelming urge to tap him on the shoulder and go, “Hey, if you stare really hard, it kinda looks like a unicorn, right?”.

And of course, a lot of research has shown that Technical Analysis just doesn’t work. Take this study, which looked at over 5,000 TA rules and found that most of them did no better than tossing a coin. Dang.

Systems Trading

What it is:

Systems trading entails coming up with a set of precise, hard-coded rules that help you to make buy or sell decisions, like “buy when the price exceeds the average of the past 20 days”. This was something that I tried, tested and pursued for years, convinced that if I could find the right algorithm, I’d become a master trader.

What’s good about it:

The great thing about systems trading is that it’s completely testable. You can buy trading software, code the strategy into it, and test it against price data. You can make it as simple or complex as you want, and get immediate feedback on how it would have performed in the past. There are even cool “machine learning” packages these days that can adapt your algorithm according to new information.

Unlike TA, systems trading is also completely objective. There’s no room for interpretation here – so if your algorithm triggers a buy signal, you buy! There’s no second-guessing, no wishy-washying, and no relying on unreliable indications like your “gut feel”.

What’s not so great:

The biggest problem with systems trading is that the future is never completely like the past. Markets are dynamic: They constantly adjust and evolve. A strategy that worked fantastically well when tested against your data may completely break down once you actually start trading it. This was my biggest folly: Since my algorithm had worked so well before, I had so much confidence in it that I never once questioned the rules. It was only when I lost 50% of my capital in a month that I was forced to confront the tough lesson that there is no single perfect market-beating strategy.

More dauntingly, you have to deal with competition. These days, hedge funds and high frequency traders can crunch thousands of models in a second and deploy them against you. Even if you did discover some secret algorithm, it’s likely that it’ll get picked apart by a hedge fund pretty fast, eliminating any edge that you might have had. The only way to get around this is to constantly develop new models, and who the heck has time for that?

Value Investing

What it is:

Oookiedokie, let’s get to the most controversial part of this post: Value investing. Unlike the above strategies, I actually believe in the idea of value investing – I just don’t think that the majority of investors (myself included) can do it successfully.

Value investing applies almost exclusively to stocks. First, it entails coming up with an estimate of a stock’s “value”: whether it’s earnings, book value, net asset value, dividends, etc. After that, a value investor will simply wait for a stock price to go below that value – often by a sufficient margin of safety – before swooping in to buy it. Once a value investor gets hold of a stock he wants at a cheap price, he can either hold onto it forever, or sell it once it becomes “overvalued”.

What’s good about it:

Value investing is easy to understand: Buy stocks only when they go on sale. It’s easy to see why it’s one of the most appealing strategies in the world. The success of investors like Warren Buffett have made it even more attractive in the past decade.

Buying stocks only when they’re “undervalued” and selling when they’re “overvalued”, is a nice contrarian strategy of buying low and selling high. You also limit your downside, since if a stock has fallen substantially it’s probably less likely to fall much further (though it’s always a possibility).

Research also shows that buying undervalued or high dividend stocks has managed to outperform the market for long periods in the past. (for mah fellow nerdy academic homies, this is also known as the “value premium”)

What’s not so great:

The thing is, “value” is notoriously hard to determine. Which metric do you use: P/E ratio? Book value? Earnings? And how sure can you be sure that you’re right? I’ve seen how up to 10 analysts can be COMPLETELY off in their estimates of the value of the same company. And these are professionals who do this full-time!

Personally, I’m not comfortable with concentrating my risk on a few individual stocks, no matter how valuable I think they are. After all, what happens if I’m wrong? RIM (the company behind Blackberry) is a great example of how the value investing model can break down when a company finds itself being upended by technology.

Being a value investor is a huge undertaking – you have to know the company inside out and study their financial statements. You have to constantly stay on top of developments that might alter your stock’s value, like an acquisition of a particular division, for example. You also have to constantly watch its price while waiting for it to become “undervalued”. And that’s just for one stock.

There’s also the problem of competition. Since value investing is so appealing, you’re competing against millions of other investors, many of them professionals. Don’t get me wrong – I think value investing works. I just think that with everyone chasing the same opportunities, it’ll become harder and harder to be successful at it.

Benjamin Graham – who literally wrote the book on value investing – had this to say about value investing towards the end of his career:

I am no longer and advocate of elaborate techniques of security analysis in order to find superior value opportunities. This was a rewarding activity, say, 40 years ago, when our textbook “Graham and Dodd” was first published; but the situation has changed a great deal since then. In the old days any well-trained security analyst could do a good professional job of selecting undervalued issues through detailed studies, but in the light of the enormous amount of research now being carried on, I doubt whether in most cases such extensive efforts will generate sufficiently superior selections to justify their cost.

If Graham was skeptical about the effectiveness of value investing back in 1976, I wonder what he would think about it today, when there is exponentially more research being done in value stocks?

In fact, there are already signs that the value premium – the “extra” return that comes from investing in value stocks – is disappearing.

Even Warren Buffett – arguably the world’s most successful value investor – feels that most retail investors should just forget about value investing and invest in index funds instead. Which brings us to….

Index Investing

What it is:

Instead of paying for your financial planner’s new car, discern chart patterns, formulate complex algorithms, or picking individual stocks, there’s this weirdo philosophy called “index investing”.

You don’t have to be a genius or have a PhD in Finance to understand it. Index investors like myself believe that the market may zig and zag in the short-term, but it always goes up over the long-term. (We’re talking about a time frame of 20-30 years here). In that case, then the only logical strategy would be to buy the market, hold it for the long-term, and move on with our lives.

Don’t waste your energy studying charts, algorithms or annual reports – they’re irrelevant over the long-term. If you believe that the global economy will be better 30 years from now than it is today (and I don’t see any reason why it wouldn’t), then index investing is the obvious choice.

What’s good about it:

Unlike any of the above strategies, you never have to worry about a “good time” to invest. When your timeframe is thirty years, the month-to-month movements of the stock market become mere trivialities.

You never have to worry about picking stocks because the market is more resilient than any individual stock. Individual companies will rise and fall – who knows where Google and Apple will be in 5 years? – but the stock market stands the test of time.

You never have to worry about competition because you ARE the competition. When you own the market, you own the actions of all the hedge funds, value investors, systems traders, and fundamental analysts within it. Let them fight it out over the short-term. We’ll sit back and wait for the market to rise in the long-term, as it has in the past 200 years.

What’s more, index investing takes way less time than any of the above strategies. When I come home exhausted from work, I wanna flop down on my couch and watch YouTube videos of Russell Peters and Louis CK. The last thing I want to see is some stock chart or annual report. The good thing is, index investing doesn’t require me to – I typically spend about 10 minutes a month on my investments, mainly limited to keying in my portfolio figures into Excel while leisurely eating a McDonalds Big Breakfast (mmmm.. hash browns).

What’s not so great:

The biggest problem I have with index investing is that it requires humility. As a young, cocky college kid, it took years before I could admit, “Okay, I’m not as smart as I thought I was. I can’t beat the market, so the best I can do is to simply own it and guarantee myself the market return.”

It’s also a challenge to accept that I won’t become a multimillionaire overnight – Index investing requires me to build my portfolio up for years. But with every passing year, I can see it compounding a little faster towards my goals. It’s gonna take some time, but I’d rather take it slow and steady than try 10 different risky strategies that don’t work.

This is my favourite strategy, and I know it’ll serve me well for the next few decades. It’s also why I wrote Automatic Investing, to help Singaporeans like you and I get invested, move on with our lives, and achieve something awesome.

Now, I’d love to hear from you. Have you had any experiences with the above strategies? How did it feel to invest in any of the above? Lemme know by leaving a comment or sending me an email. I read every one.

*Okay, I know some of you will get really worked up that I lumped trading strategies under the category of “investing”, but let’s not get caught up in the semantics here. These are simply options that will confront newbies who’re looking to grow their money.

Nice paper. Thanks!

For TA, I want to add that though total hit rate could be 50%, key point is to hold if are correct and cut loss quickly if not. That is even more important than have a more accurate chart analysis method.

Hi Lionel,

A very long write-up and agree with most of your points. I would probably have just stuck with index investing all the way if I wasn’t curious about picking stocks or I was satisfied with the “projected” returns.

Regarding “projected” returns, do you think the numbers 8-10% would hold, considering it’s largely based on the past 100 years of US history, when it was helmed by an unprecedented event of the US economy growing rapidly to became the sole global power?

Would love to hear your thoughts on this. =)

The short answer is that I never worry about projected returns Investors can quibble all day about whether it’s 5% or 7% or 9.2%, but at the end of the day, we have to ask: What’s the alternative? The fact is that stock market returns have tremendously outpaced the returns of every single asset class over the long-term. This applies in most developed markets, not just the US (I think there are several studies on global markets – google it).

Investors can quibble all day about whether it’s 5% or 7% or 9.2%, but at the end of the day, we have to ask: What’s the alternative? The fact is that stock market returns have tremendously outpaced the returns of every single asset class over the long-term. This applies in most developed markets, not just the US (I think there are several studies on global markets – google it).

Hi, in William Bernstein’s new book, he wrote that expected returns on indexes could average as low as 2-5%. What’re your thoughts on that and if it’s at these levels, would it be enough for you? http://www.bogleheads.org/wiki/Historical_and_expected_returns

I never worry about expected returns Investors can quibble all day about whether it’s 2% or 5% or 9.2%, but at the end of the day, we have to ask: What’s the alternative? If you’re not invested in indexes, what will you invest in? Bonds? Gold? Bitcoin? None of them have been proven to be able to beat the market over the long-term. No matter what the expected future returns are, the fact remains that stock market returns have tremendously outpaced the returns of every single asset class over the long-term.

Investors can quibble all day about whether it’s 2% or 5% or 9.2%, but at the end of the day, we have to ask: What’s the alternative? If you’re not invested in indexes, what will you invest in? Bonds? Gold? Bitcoin? None of them have been proven to be able to beat the market over the long-term. No matter what the expected future returns are, the fact remains that stock market returns have tremendously outpaced the returns of every single asset class over the long-term.

I guess there is no harm applying multiple strategies in investing. Personally, I’ve not started investing into the indexes, do you recommend dollar-cost averaging for index investing?

Yep – I think that’s way better than trying to time the market.