I used to hate opening my wallet. Every time I pulled out my wallet to pay for something, I’d feel this mild wave of stress wash over me. The source of my stress was the perennial question that stumps us all: Now, which credit card should I use?

I used to hate opening my wallet. Every time I pulled out my wallet to pay for something, I’d feel this mild wave of stress wash over me. The source of my stress was the perennial question that stumps us all: Now, which credit card should I use?

You might think that this is totally weird, but admit it – you’ve probably felt it at some point. I know, because I’m a weirdo and I love watching people pay for stuff. I’d see them take out their wallet, open it up, and pause awkwardly as they peruse the twenty credit cards in their humongous wallet.

Why do we do this? Why do we subject ourselves to this tiny piece of stress every day, sometimes multiple times a day? It’s partly because of the credit card companies: They love sending us multiple card offers, because the more cards we own, the easier it is for them to screw us over. But we can also blame ourselves: Most of us are so petrified of “missing out” on benefits and offers that we choose to accumulate as many cards as we can. But as most financial advisors will tell you, this is often a bad, bad idea.

Don’t get me wrong – I love credit cards. I think they’re excellent tools that can help us track our spending and give us crazy awesome benefits to boot. But the one thing that bugs me is that tiny wave of stress when I’m deciding which one to use.

For the past few years, I’ve tried to fight this by limiting myself to just three cards – one for transport, one for dining, and one for “just in case” situations. But I found that even having just three cards was still a tiny bit stressful.

So for the past two months, I went to the extreme – I switched to using just one credit card for everything. One. Uno. I even went so far as to cancel my other cards until I was left with one single, solitary card.

Here’s How I Did It

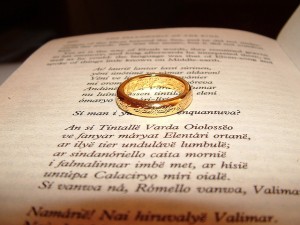

Essentially, I treated my one credit card like the One Ring from Lord of the Rings. Sure, the Elven-kings and Dwarf-lords and Mortal Men all had their own bling-bling, but Sauron’s ONE ring still kicked more ass than all of ‘em combined.

Three Rings for the Elven-kings under the sky,

Seven for the Dwarf-lords in their halls of stone,

Nine for Mortal Men doomed to die,

One for the Dark Lord on his dark throne,

In the Land of Mordor where the Shadows lie.

One Ring to rule them all, One Ring to find them,

One Ring to bring them all and in the darkness bind them.

(Yeah, sometimes I have these fantasies where I’m like the Dark Lord of Personal Finance. If I ever get superpowers, that’ll be my supervillain hero name)

I picked the ONE benefit that I wanted to accrue: In my case, it was cashback. So I picked the FRANK credit card from OCBC, which gives me some pretty good cashback rates, and did all my spending on that. (Yes, everyone has a different opinion of supposed “better” cashback cards out there, but I picked OCBC because it also helps me to accrue an awesome interest rate on my OCBC 360 account)

So what advantages did I discover from using just one card? Let me count the ways:

1. Easier tracking

I use my credit card statements to track my spending every month, so limiting my spending to just one card made my life wayyyy easier. I only had to check one statement a month (instead of three statements that arrived at different times). This, coupled with the fact that OCBC has a spiffy online spending tracker, helped to reduce my expense-tracking time from 20 minutes to just 5 minutes a month

It was also way easier to stay on top of the benefits I was eligible for. When I owned multiple credit cards, I received like 5 brochures with different dining/shopping/travel/spa offers every month. This was way too overwhelming for a busy person like me, so I found myself throwing most of them away without even looking at them.

Now that I have a much smaller array of choices, it’s a lot easier to actually take advantage of the offers I have. See this TED talk on why limiting your choices can actually help you to take action. It’s counterintuitive, but it works.

A further benefit of having just one credit card is that it’s also easier to catch the annual fee when the card companies secretly sneak it into your bill. I love that feeling of going “Ah-ha! GOTCHA you sonofabitch!”, and then calling them gleefully to waive my annual fee. (Yes, I need to get a life).

2. Concentrated Firepower

Let’s say the Godzilla of Spending is attacking Singapore. Which weapon would be more effective at stopping it: 1. A singular, huge bazooka blast, or 2. Five puny catapult shots?

Like using a catapult, splattering your spending across different credit cards is a terrible way to earn benefits. If you spend $100 on one card, $240 on another, and $83.30 on the third, you’re not going to get any rewards from any one of ‘em.

But when you concentrate on a singular weapon and spend everything on one card, it becomes super easy to hit the spending thresholds you need to accrue some real benefits.

For example, it’s an almost no-brainer for me to hit the $400-$500 spending threshold to enjoy the additional 1% interest in my OCBC 360 account and enjoy better cashback rates on my card. The same applies if your card gives you rewards or miles: It’s definitely a better idea to concentrate your spending on it to accelerate your accumulation of freebies and flights.

3. Cognitive Benefits

However, the real benefit of using just one card is psychological.

Management guru Peter Drucker once wrote that the most effective executives make the least number of decisions in a day. Why? Because whenever they encounter a new situation, they decide straightaway on how they’re going to deal with it from now on. That way, when they stumble upon that situation again, the decision has already been made. Instead of making hundreds of small decisions a day, they free up their mental capacity on the few big, strategic decisions that will truly make a difference.

Similarly, the less you have to worry about your spending, saving, and investing, the more capacity you have left over to focus on the BIG things in life – things like your family, career, launching a side business, or finding your dream job. Simplifying your credit card decisions becomes almost a zen-like decision. In fact, I wanted to call this the “Zen Credit Card Technique For People Who Hate Making Decisions”, but it was too long to fit into the title.

Don’t waste your energies tracking your benefits and deciding which card to use. Instead, make a decision early on, stick to it, and move on to other, more important things in life.

But What If I Miss Out On Discounts?

Will you miss out on certain discounts and offers if you use just one card? Probably. Is that such a bad thing? Nope.

First, most credit card discounts aren’t that great of a deal anyway. Most of them are designed to make you spend more, not less. For example, “get a free dessert for every $50 spent at Xin Wang”. Are you really going to spend 50 bucks eating luncheon meat instant noodles at Xin Wang just to get that free dessert? Probably not. Take an honest look at how many credit card discounts you actually took advantage of in the past 6 months. Chances are, it’s not that many. In my case, it was exactly zero.

Also, discounts and offers change every other week. Even if you did use one, it’s pretty likely that by next month, it would have been replaced with some lame offer that you don’t want, like a $250 Aloe Vera Miracle Mud Full Body Scrub. (Wtf?)

If you pick the right card, chances are you’ll be eligible for plenty of offers and discounts from this one card alone – probably more than you can keep track of. Stop worrying about the things you’re missing out on, and start seeing how you can take advantage of the one card you already have.

Try It Out

If you haven’t tried focusing your spending on just one card, I’d recommend trying it out for a month or two. You don’t have to be crazy like me and cancel all your other cards – just stop spending on them for now. If you don’t like it, you can always switch back to your old system.

It sounds like a crazy experiment, but you never know – it might actually rock your world (like it did for me). Notice how you feel while you’re on your one-card spending journey. Do you find yourself getting less stressed? Does it feel great knowing that you only have to check one statement and pay one bill this month?

If it does, awesome! You’re well on your way to becoming a Credit Card Zen Master. You can then focus your energies on the bigger, more important things in life – like becoming a Dark Lord of Personal Finance.

Have you tried reducing the number of credit cards you use? What was your experience and how did it feel?

Images: Zanastardust, RA_ul, Salfalko, Dunechaser, najeebkhan2009

I used to have quite a number of cards (but not humongous wallet) but find that it is really a trouble to keep track with all the bills and payment. I’ve since reduced to one debit card and one credit card nowadays.

I like to use debit card more so that I feel the pinch when spending on those “good to have” stuff

Nice! I totally agree with you that it’s hassle to keep track of all the bills and payment. Though I try to consolidate it all on my credit card to get the benefits. I still make myself feel the “pinch” by recording my transactions on my spending app though

Hi Lionel,

Can I clarify with you on how did you get to waive your annual fee for your credit card? Very interested to know even though I do not have any credit cards yet.

Most credit card companies will usually waive the annual fees if you spend a reasonable amount on their cards. You just have to call in and ask