Most Singaporeans (including myself) have incredibly high expectations for everything we do.

Most Singaporeans (including myself) have incredibly high expectations for everything we do.

For example, I found myself getting pissed because I missed the MRT by 2 seconds last night and I had to wait SEVEN WHOLE MINUTES for the next one. Seven minutes!! (Never mind that in other countries, waiting ten minutes for the subway is pretty uhm, normal.)

It’s the same when it comes to investments. I blog a lot about investing for the long-term – and I’m talking about twenty to thirty years here – but that’s often too slow for many people.

Check out an excerpt from this email that I got from one of my readers:

Everyone wants to have their 1st million in the shortest time. If I hold (my investments) for more than 20 – 30 years, I think my energy would be too depleted to enjoy the wealth that I’ve built over the years.

Can I shorten the number of years to reach that magical 1M without pumping more cash into the account? Can you tell me if I can short ETFs?

In summary: I don’t want to wait that long. I want to get rich NOW.

Dumb Ways To Invest

It doesn’t help when more experts are telling us that the days of 10%+ average annual returns in the stock market are behind us. “Don’t expect high returns!” they’ll say while wagging their fingers, “Your investments aren’t going to perform all that great in the future!”

So we’ve got a combination of people wanting to get rich in the shortest time possible, and gloom-and-doom experts telling us that the market might return 4-8% instead of 10% a year.

This makes people do dumb things to boost their returns, like trading in and out of the market, shorting ETFs, buying “warrants” or “Bull-Bear Contracts”, and investing in Ponzi schemes. It’s ironic, because this is the very behavior that will prevent them from growing their long-run wealth in the first place.

There’s a better, far simpler way to get to your financial goals. And it’s got nothing to do with your portfolio’s return.

How Much You Contribute Matters Far More Than What Your Return Is

I love it when someones takes “conventional” wisdom, and then systematically destroys it using plain, simple math.

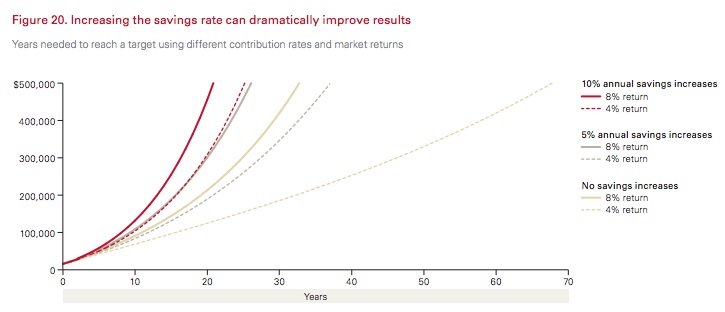

Investment giant Vanguard lays it all out in their principles for investing success. They used the example of an investor who’s trying to grow his portfolio to a pretty ambitious goal of $500,000. He starts off by investing $10,000, and contributes an additional $5,000 every year.

Vanguard simulated 3 scenarios:

- No increase in his yearly $5,000 contribution

- A 5% increase in his yearly $5,000 contribution

- A 10% increase in his yearly $5,000 contribution

For each of these scenarios, they simulated how fast he’d get to his goal assuming his investments earned either 4% or 8% a year. Here’s what they found:

First, check out the two dotted lines on the right. Notice that if our investor simply increased his contributions by 5% a year (i.e: $5,000 in year 1, $5,250 in year 2, $5,512 in year 3, etc…) he could get to his $500K goal way faster than if he didn’t increase his contributions – in fact, more than three decades faster.

Next, notice that getting an 8% return while increasing contributions by 5% a year (the solid grey line) produces almost the same result as getting a 4% return while boosting contributions by 10% a year (the dashed red line). Yet, the investor who got the 8% return likely took on a whole lot more risk than the investor who got the 4% return. By simply increasing your contribution rate, you can get the same results with lower risk, even with a lower overall return.

The lesson here is that how much you contribute matters far more than what your portfolio’s return is. It doesn’t matter whether the pundits predict that the stock market will return 4% or 8% annually over the next 10 years – that’s something you can’t control anyway. Instead, focus on what you can control, which is shoveling as much money as you can into your investments.

Three Easy Ways To Boost Your Investment Contributions

The solution is so simple, it’s enough to make you go “d’oh!”: Work hard, spend less than you earn, and direct the difference into your investments. While there are a gagillion tips out there on how you can do this more effectively, here are three that have worked really well for me:

- Automate your investments. Arrange to have a portion of your salary automatically transferred into your investment account before you even get to see it. If you don’t see it, you won’t miss it.

- Invest your salary increases. What do most people do when they get a raise? They buy cars, more expensive clothes, go on more vacations, etc – resulting in a net gain of zero to their wealth. Yet, if you keep your expenses at roughly the same levels as before, you can easily boost your investments by 10% or more every year by investing the difference. As you can tell from the chart above, that tiny 10% increase can dramatically accelerate your investments in the long-run.

- Target your 2 biggest expenses. Don’t bother trying to scrimp in all aspects of your life. Do you honestly think that forgoing that $2 cup of bubble tea is going to make a huge difference to your portfolio? Instead, you’ll get far better results by optimizing your spending in your 2 largest spending categories, for example, dining out and taking cabs. Eat in once a week and take two cabs less a month – and your savings will add up significantly.

If you haven’t already done so, check out my free ebook Small Tweaks for the details on how you can implement the above three strategies immediately. Give it a try. Next month, you might just end up with an extra couple of hundred dollars, which you can use to give your investments a boost.

I get it – most of us don’t want to wait 50 years to get rich. But that doesn’t mean that we need to resort to dumb things like trading or shorting ETFs in order to get there.

A far better solution would be to work hard, spend less, and invest more. You’ll do way better in the long run.

Images: DanDeChiaro, Vanguard

Hi Lionel,

i have a quick question. assuming that i am planning to invest $1000 per month into the STI, should i be making

1) 1 transaction of $1000 every month?

or

2) 1 transaction of $12000 every year?

Thanks for your help!

Regards,

Kenneth

If you’re doing it for the long-term, then both are pretty much the same. The advantage of $1000 a month is that you get to invest more frequently, so you spread your risk out over more intervals. But if you’re using a traditional broker, the commissions you incur by investing every month might not make sense. In that case, you’re better off doing $12,000 a year.

hey lionel, great article there. just wanted to get your opinion regarding existing ILPs which i believe most people would have often been persuaded to take up in their early days. having better financial literacy, my consideration would be to terminate my ILP (which is only yielding a meagre 2% annualised return!) and go for a term insurance and use those additional funds for my long term investment nest.

would like to hear your views regarding the pros and cons of doing so. thanks!

Hey Mark, great question and it’s definitely something a lot of people (myself included) have struggled with. I actually wrote some articles on ILPs vs term insurance last year – check out the “insurance” category in the sidebar – so I won’t repeat the arguments here. I’m no expert at insurance, so I’d recommend that you supplement your research by Googling around (Tan Kin Lian has some great advice on this topic, though it’s a little biased). I really detest ILPs (If you read my Automatic Investing ebook you’ll know exactly why), so my preference would be to go for the term insurance. But that’s just me 🙂