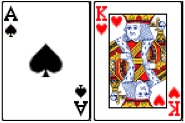

Let’s say you were playing poker and you were dealt the following cards:

Everyone else calls the big blind of $0.20, until the player next to you raises her bet to $0.50. How much would you bet?

****************

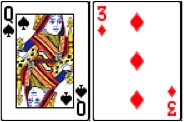

Now let’s switch the game to In-Between (Click here if you need a refresher on the rules). You’re dealt the following two cards:

Your friends have been betting an average of $2-$5 in previous rounds. How much would you bet?

How Games Affect Betting Behavior

A couple of weeks ago, a few friends and I gathered for our usual Chinese New Year gambling card-playing session. We spent a couple of hours playing Texas Hold ‘Em, before moving on to In-Between.

I observed something interesting when we transitioned between the two games.

My friends and I usually bet in pretty small amounts for poker: A $0.50 raise here, a $1 raise there, and that was it. A $2 bet was considered daring; a $10 bet was unthinkable.

But when we switched to In-Between, everyone suddenly started betting at least $2 per hand. Whenever we were dealt good cards (like a 3 and a Q), we’d bet as high as $5 or even $10, hoping for a quick win.

I found it interesting that we could be so careful with our money in one game, only to be crazily reckless with it in another! We could win or lose more money in a single hand of In-Between than in hours of playing poker.

For example, while we were playing poker, one of my friends spent five minutes deliberating whether to call a $2 raise. But when he got favorable cards in In-Between, that same friend plopped down $10 without hesitation.

So what was causing our change in behavior?

A Devious Psychological Trick

It wasn’t just about the strategy. If we go back to the two hands of cards that we highlighted at the beginning, we’ll find that statistically, both hands are pretty strong in their respective games:

- AK is the 8th strongest pre-flop pair in terms of expected value in poker

- Q3 has a spread of 8 points, which gives you favorable odds in the game of In-Between

Instead, there was something else at work here: the psychological phenomenon known as mental accounting. This refers to our tendency to handle money differently in different contexts. It explains why we feel more pain when we lose $2 in one game vs. another.

But here’s the thing: Money doesn’t care which game you’re spending it on. A $2 bet in poker is the same amount as a $2 bet in In-Between. I blogged about this concept on a theoretical level previously, but I only realized how much it affected us in real life after my little gaming session.

Then I started thinking about how it applies to the rest of our lives:

- We get angry if the supermarket raises the price of a 1.5L bottle of Coke by 50 cents, but think nothing about upsizing our meal at McDonald’s for a couple more sips and a few fries.

- We spend hours deliberating over whether we should buy a good book for $25, but hardly bat an eyelid paying $25 at Fish and Co for a (let’s face it) mediocre meal.

- We balk at spending $200 for a self-improvement course that could make us richer for life, but happily take out our wallets for a 3-day Phuket getaway that sets us back by $300.

How To Make Good Self-Improvement Decisions

Whenever we’re faced with a decision on whether we should make an investment in a book or a course, it’s useful to compare it against what we would ordinarily spend at a restaurant or on holiday.

If we’re more than happy to fork out cash for a relatively fleeting experience, shouldn’t we be more willing to invest in books or courses that could make us richer for life?

That’s why I allocate a budget of $1,000 a year for books and courses, although Li Ka-Shing would argue that it’s not enough. Mr Li says that ideally, we should invest as much as 15 percent of our income on self-improvement if we want an edge:

“Third set of funds: To learn… Because you don’t have a lot of money, you should pay attention to learning. When you buy books, read them carefully and learn the lessons and strategies that are being taught in the book. Each book, after reading them, put them into your own language to tell the stories.”

Now, watch me seamlessly tie this to my soon-to-be-launched ebook.

An Update On My Upcoming Ebook

Speaking of self-improvement, my book on Automatic Investing will be launching soon. I’ve gotten feedback from dozens of people over the past few weeks, added even more useful content, and I’m currently in the process of finalizing it. I’ll be releasing it soon, but I’ll first need to take care of all the various administrative tasks (e.g formatting, design, extras, etc), so watch this space.

This book is packed with premium material which I’ve never released before, and I believe it’ll be especially useful for those who’re just starting out in investing in Singapore.

When it comes out, you’ll have a choice: Would you rather spend the money on a fleeting experience, or on something that could make you richer for life?

Image credits: jfitz, goodnewsday, e-27

Great article as always Lionel. Looking forward to getting and reading your book.

-Conor

Thanks Conor! Looking as good as you were from our English House days haha

yay another ebook! looking forward.

looking forward.

Excellent article. Just beaware decision that affects outside, social norm may not give us too much room. Buying a book is well within !

Looking forward to your book, Lionel!