As you know, I love making fun of people who get overly stressed about tiny things. Don’t we all know someone like that? For example: the student who obsesses about the half-point that he lost on a test, or the co-worker who stays late in the office to churn out a report that nobody reads.

As you know, I love making fun of people who get overly stressed about tiny things. Don’t we all know someone like that? For example: the student who obsesses about the half-point that he lost on a test, or the co-worker who stays late in the office to churn out a report that nobody reads.

And when it comes to investments, I’m talking about the traders, the economists, the talking heads on CNBC, most retail investors, and pretty much anyone clueless about behavioral finance.

How Clueless People React to the Market

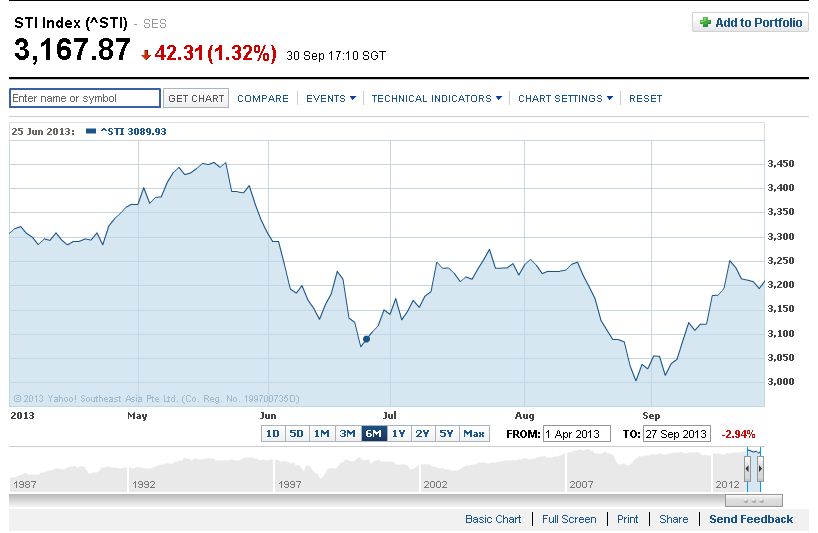

The past couple of months have been crazy for the stock market. Everyone speculated if the Federal Reserve was going to “taper” its bond purchases. The NASDAQ suffered a technical glitch that halted trading for three hours. The US Government shut down this week. Back home, the Straits Times Index (STI) dropped steadily for months, zoomed up, and went into a freefall again.

Check out this chart of the STI, which shows how the market fell from a high of 3,450 in late May to as low as 3,000 in just slightly more than 3 months. That’s a loss of thirteen frickin percent! Aragh! Sell all your stocks now!!!

Traders were in an uproar. Investors were panicking. Ben Bernanke tried to calm everybody down.

And passive investors went back to sleep. The 13% drop didn’t bother me. In fact, I wasn’t even aware that it happened in the first place.

Why Don’t Passive Investors Care About Market Drops?

To passive investors, a huge drop in the stock market is like a baby ant challenging us to a fight – it simply doesn’t scare us.

Two reasons why:

1. Asset Allocation

Ok, I know “asset allocation” sounds like some B.S phrase, like “synergy” or “terms of reference”, but hear me out for a second here. Asset allocation simply means holding a bunch of different assets, so that when one tanks, the others help to shore it up.

Here’s the thing: Investing isn’t only about stocks! (You’d be surprised by the number of people who think that this is news)

As a passive investor, I’m not just invested in the Straits Times Index. I’m also invested in the global stock market, REITs, and bonds from all around the world. The other parts of my portfolio – especially bonds – act as a counterweight to the riskier components. So a l3% loss in the local stock markets hardly even registers when you look at it from an overall portfolio perspective.

2. A long-term perspective

Again, “long-term” sounds like another B.S excuse that companies or failing entrepreneurs make when things aren’t going well for them.

But for passive investors, “long-term” isn’t some random platitude that we give – it’s built into the very definition of how we invest. We know that it’s a fool’s game to play in the short-term sandbox of high-frequency traders and professional money managers. That’s why we take a long-term perspective – often as long as 30-40 years. (See a past post I’ve written on this)

When you look at it from a long-term view, short-term drops in the market hardly matter. Check out this long-term chart of the US stock market – you’ll notice that the 2008 credit crisis, the 2000 internet bubble crash, and even the 1929 Great Depression, are just tiny blips in the overall scheme of things.

(Credit: Visualizing Economics. If you’re a huge nerd like me and are curious why we use a logarithmic scale to graph the stock market, you can check out the reason here)

In fact, passive investors skilled at behavioral finance will know that drops like these in the market represent excellent buying opportunities. That’s right – a stock market drop gets me as excited as a bunch of aunties at an OG sale. After all, who wouldn’t say no to cheaper prices?

When you adopt a long-term perspective, you get to see the opportunities when everyone else is fearful.

In Short…

Don’t get fazed by market dips. In the grand scheme of things, they hardly even matter. So while the rest of the world is panicking, go for a leisurely breakfast, read a few pages of a book, and go back to sleep.

Thanks for the link on Linear and Log Logic. I learn something very useful today.