So I was having a coffee after lunch, telling lame jokes and showing my colleagues stupid movie trailer parodies on YouTube. A friend and I started talking about investing (I super appreciate this, because HARDLY ANYONE likes to talk about investing when you’re Asian and young. My friends usually just call me a weirdo and run away).

So I was having a coffee after lunch, telling lame jokes and showing my colleagues stupid movie trailer parodies on YouTube. A friend and I started talking about investing (I super appreciate this, because HARDLY ANYONE likes to talk about investing when you’re Asian and young. My friends usually just call me a weirdo and run away).

We started chatting about the usual stuff like what assets to invest in, how to invest with limited capital, etc, when my colleague said something that I found really interesting: “I’m willing to accept a lower rate of return, but I just don’t want to lose money.”

The academic, know-it-all douchebag within me would’ve corrected him in an instant, lecturing him about how his money will be eroded by inflation, that stocks have proven to be even safer than bonds over the very long run, etc, but it probably wouldn’t be of any use. At this point, some other guy who’d been burnt by investing in tech stocks in 2001 would’ve jumped up, pointed at me, and yelled, “BLASPHEMY! STOP SPREADING YOUR TRECHEROUS LIES, SNAKE!”

Everyone has deeply-entrenched beliefs that are really, really, really hard to change. A fear of “losing money” is one of them.

Let me show you why:

Let’s Play A Game

Let’s pretend that you have $1,000 and you have two options:

- Option A: I give you $500.

- Option B: We flip a coin. I’ll give you $1,000 if it lands on Heads and nothing if it lands on Tails.

Which option would you choose?

Now let’s play a different game. Let’s pretend that you now have $2,000. Choose one of these options:

- Option A: You give me $500.

- Option B: We flip a coin. You give me $1,000 if it lands on Heads and nothing if it lands on Tails.

Which option would you choose?

Here’s Proof That You’re Completely Irrational

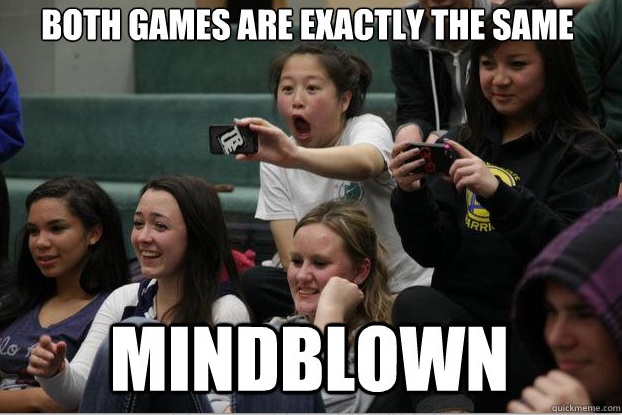

If you’re like most people, you probably chose Option A in the first game and Option B in the second. But here’s the unbelievably weird part:

(Think about it: In both games, Option A gives you a sure $1,500 while Option B gives you a 50% chance of getting $1,000 and a 50% chance of getting $2,000.)

So what caused you to act differently in the exact same scenario? The answer lies in the second enemy in our behavioral finance series: Loss aversion. In English, it means that people really hate losing money.

In the first game, you picked Option A because you’d rather lock in a sure gain rather than risk losing it. In the second game, you picked Option B because you’d rather gamble with a potential loss than suffer the pain of losing money for sure.

We hate losing money, so we tend to be overly cautious when it comes to gains.

Why You Need To Lose Money If You Want To Be Rich

I get it. Losing money in the short-term sucks ass. The stock market dropped last week and everyone was running in circles screaming, “The bull market is over! The bull market is over!”

But things look very different when you look at it from a longer perspective. Over the very long run, “risking” your money in the global stock market is ALWAYS better than investing it in supposedly “safer” assets like bonds.

Source: Wikipedia

Source: Wikipedia

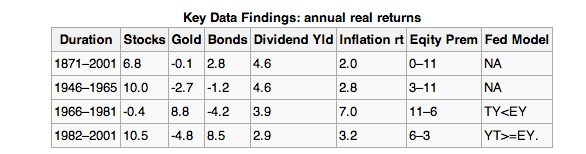

Compare the returns between stocks and bonds:

- There wasn’t a single long-term subperiod (at least 15 years) where stock returns lost out to bonds, and

- The ABSOLUTE WORST that stocks have done was in 1966-1981: when stocks more or less kept pace with inflation. That’s way better than bonds, which got absolutely decimated by the 7% inflation rate.

People who let their loss aversion get to them are blindsided by their losses in the short-term. But these losses are totally expected, just as if you were playing a game of chess. Sometimes you have to sacrifice a few pawns if you want to take your opponent’s King.

If you invest in the stock market, you WILL encounter some short-term losses, but that’s okay. Because, as you can see from the table above, you’ll come out on top in the long-run if you stick with the plan.

Three Strategies To Hack Your Loss Aversion

If you want to get those sexy returns by sticking with the stock market for the long-run, you’re gonna have to get really comfy with loss aversion. Here’s how:

1. Ooch In

When I first started investing, I was freakin’ terrified of losing money. I’d only invested like $200, but I kept obsessively checking my brokerage account to see how my pathetic 3 stocks were doing. Almost on cue, the market dropped like 5% the week after I made my first investment, everyone was panicking, newspaper headlines were screaming THE NEXT BEAR MARKET, and I realized that I lost a grand total of… $10.

When you’re first starting out, it’s always a good idea to ooch into investing. Don’t throw your entire life savings in, but invest just a tiny amount every month. My initial investment of $200 helped me to get comfortable with losing money in the short-term, which helped me to handle short-term losses a lot better when my account got larger.

2. Have a Balanced Investment Diet

The best way to avoid the pain of losing money is to avoid losing money in the first place. Unfortunately, that isn’t possible.

You can, however, limit your losses by diversifying as much as possible. And by diversifying, I don’t mean buying like 10 different stocks. That’s like eating only McDonald’s, Burger King and KFC and claiming that you have a balanced diet. D’oh!

Instead, you should be investing in as many asset classes as possible. The more asset classes you invest in, the more likely one will perform well when the others tank, saving your portfolio from those scary rollercoaster drops. Personally, I invest in stocks, REITs, bonds, and time deposits, which have given me a pretty good level of diversification.

This great post from Canadian Couch Potato talks a lot more about diversification if you wanna dive deeper.

3. Use The Vacation Technique to Check Your Portfolio

Imagine that you went on vacation for two weeks, and while you were gone, your colleagues experienced the worst crisis ever and had to work nonstop for 10 days straight to handle it. Everything was resolved when you returned, allowing you to get back to your usual, peaceful routine.

Not checking your portfolio is exactly like going on vacation and completely missing the crisis. Contrary to what most scammy trading books will tell you, the less you know, the better. When you check your portfolio every day, it becomes way too easy to feel anxious whenever your investments go down by just a tiny bit, even if it’s just because of the market’s usual fluctuations.

Why subject yourself to all that anxiety? Check your portfolio no more than once a month, and even better if it’s once a quarter or annually. In all likelihood, you’ll be blissfully unaware of the crazy gyrations that went on while you were gone.

You can’t feel the pain of a loss when you don’t even know that you had a loss in the first place.

In short…

This is a long post – it’s pretty scary what a cup of kopi-O kosong does to me sometimes – but loss aversion is particularly interesting to me because I believe it’s the number 1 reason why most people don’t get rich.

I’m hoping that the above strategies will help you to get a little more comfy with losses, and feel free to leave a comment below or send me an email if you have questions. Or if you just wanna share some dumb YouTube videos, that works too

This post is the second in my behavioral finance series – the psychological influences that affect our finances. I’ll be basing it off the book Why Smart People Make Dumb Money Mistakes by Gary Belsky and Thomas Gilovich – which is an awesome read even if you’re not a psychology nerd like I am.

Check out my previous post: “How To Hack Your Mental Accounting“

Great post. It is indeed rare to find someone to talk to regarding investing and the stock market, especially among female friends.